Question: Under the double-entry accounting system, when a financial transaction occurs, it affects at least two accounts. This is demonstrated by looking at the basic accounting

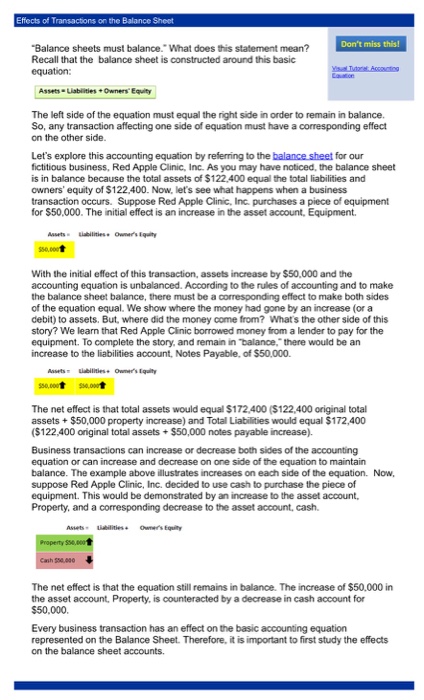

Effects of Transactions on the Balance Sheet Balance sheets must balance.-What does this statement mean? Don't miss this! Balance sheets must balance. What does this statement mean? Recall that the balance sheet is constructed around this basic equation: Cavaton Assets- Liablities +Owners Equity The left side of the equation must equal the right side in order to remain in balance. So, any transaction affecting one side of equation must have a corresponding effect on the other side Let's explore this accounting equation by referring to the balance sheet for our fictitious business, Red Apple Clinic, Inc. As you may have noticed, the balance sheet is in balance because the total assets of $122,400 equal the total liabilities and owners' equity of $122,400. Now, let's see what happens when a business transaction occurs. Suppose Red Apple Clinic, Inc. purchases a piece of equipment for $50,000. The initial effect is an increase in the asset account, Equipment. Assets. ?abilities* 0wwr's Equity With the initial effect of this transaction, assets increase by $50,000 and the accounting equation is unbalanced. According to the rules of accounting and to make the balance sheet balance, there must be a corresponding effect to make both sides of the equation equal. We show where the money had gone by an increase (or a debit) to assets. But, where did the money come from? Whats the other side of this story? We learn that Red Apple Clinic borrowed money from a lender to pay for the equipment. To complete the story, and remain in balance, there would be an increase to the liabilities account, Notes Payable, of $50,000. AssetsisbilitiesOwner's Equity The net effect is that total assets would equal $172.400 ($122,400 original total assets $50,000 property increase) and Total Liabilities would equal $172,400 ($122,400 original totalasets $50,000 notes payable increase). Business transactions can increase or decrease both sides of the accounting equation or can increase and decrease on one side of the equation to maintain balance. The example above illustrates increases on each side of the equation. Now suppose Red Apple Clinic, Inc. decided to use cash to purchase the piece of equipment. This would be demonstrated by an increase to the asset account, Property, and a corresponding decrease to the asset account, cash. $0,000, accoutoeaon Every business transaction has an effect on the basic accounting equation represented on the Balance Sheet. Therefore, it is important to first study the effects on the balance sheet accounts. The net effect is that the equation still remains in balance. The increase of $50,000 in the asset account, Property, is counteracted by a decrease in cash account for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts