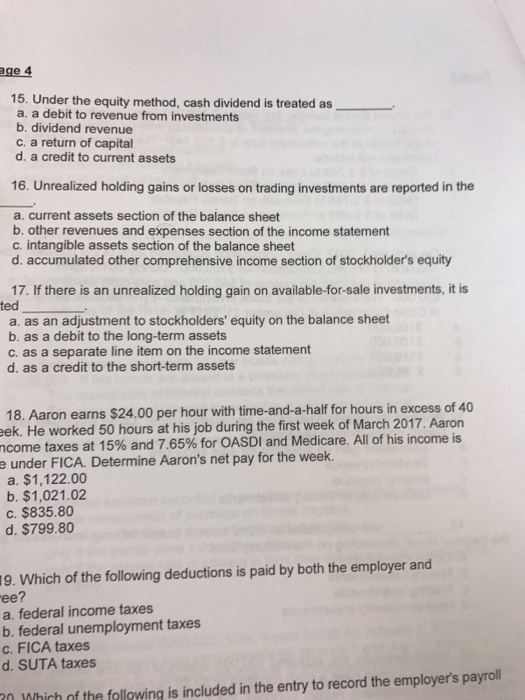

Question: Under the equity method, cash dividend is treated as _____ a. a debit to revenue from investments b. dividend revenue c. a return of capital

Under the equity method, cash dividend is treated as _____ a. a debit to revenue from investments b. dividend revenue c. a return of capital d. a credit to current assets Unrealized holding gains or losses on trading investments are reported in the a. current assets section of the balance sheet b. other revenues and expenses section of the income statement c. intangible assets section of the balance sheet d. accumulated other comprehensive income section of stockholder's equity If there is an unrealized holding gain on available-for-sale investments, it is _____ a. as an adjustment to stockholders' equity on the balance sheet b. as a debit to the long-term assets c. as a separate line item on the income statement d. as a credit to the short-term assets Aaron earns $24.00 per hour with for in excess of 40 He worked 50 hours at his during the first week of March 2017. Aaron income taxes at 15% and 7.65% for OASDI and Medicare. All of his income is under FICA. Determine Aaron's net pay for the week. a. $1, 122.00 b. $1, 021.02 c. $835.80 d. $799.80 Which of the following deductions is paid by both the employer and ? a. federal income taxes b. federal unemployment taxes c. FICA taxes d. SUTA taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts