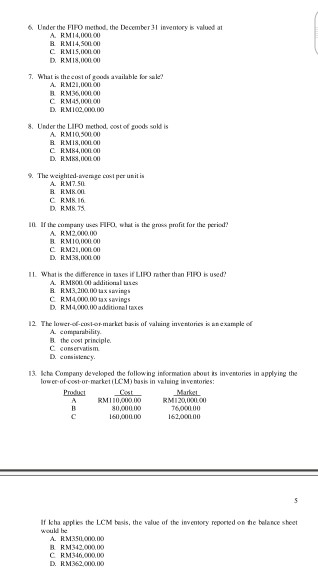

Question: & Under the FIFO method. the December 31 Inventory is valued at A RM14,000.00 BRM14, sono CAMIS, 00 D. RM18.00 7. What is the cost

& Under the FIFO method. the December 31 Inventory is valued at A RM14,000.00 BRM14, sono CAMIS, 00 D. RM18.00 7. What is the cost of goods available kesak? A. RM21.00 BRM.MIKELOO CRMS,COLLO D. RM100.000,00 8. Under the LIFO method. cost of goods soklis A. RMIO.500.00 B RM18,00 CRM4,00 D. RMK,00000 9. The weight lavere per unitis A. RM7.50 BRMO CRM16 D. RMS In the company es FIRO, what is the greaprofit for the period? A. RM2.000,00 BRMIQ,000.00 CRM21,00 D. RM4,00 IL What is the difference in taxes i LIFO rather than FIFO is used! A. RMSO00 additional anes B RM20.00 ux saving CRMA.COM ax savings D. RM4.000,00 additional taxes 12 The lower-d-ander market basis of valuing investering is an example of A comparability the cost principle. conservatism D. consistency 13 khe Company developed the following information about is investories in applying the Tower of cost or market LCM basis invaluing inventories: Muhe A RM110.000,00 RM120,000.00 80.000.00 76,000.00 C 160,000.00 162,000.00 if kha applies the LCM bess, the value of the inventory reported on the belance sheet would A. RMSL.000.00 BRM342.000,00 C RM346.000,00 D. RM2.000 & Under the FIFO method. the December 31 Inventory is valued at A RM14,000.00 BRM14, sono CAMIS, 00 D. RM18.00 7. What is the cost of goods available kesak? A. RM21.00 BRM.MIKELOO CRMS,COLLO D. RM100.000,00 8. Under the LIFO method. cost of goods soklis A. RMIO.500.00 B RM18,00 CRM4,00 D. RMK,00000 9. The weight lavere per unitis A. RM7.50 BRMO CRM16 D. RMS In the company es FIRO, what is the greaprofit for the period? A. RM2.000,00 BRMIQ,000.00 CRM21,00 D. RM4,00 IL What is the difference in taxes i LIFO rather than FIFO is used! A. RMSO00 additional anes B RM20.00 ux saving CRMA.COM ax savings D. RM4.000,00 additional taxes 12 The lower-d-ander market basis of valuing investering is an example of A comparability the cost principle. conservatism D. consistency 13 khe Company developed the following information about is investories in applying the Tower of cost or market LCM basis invaluing inventories: Muhe A RM110.000,00 RM120,000.00 80.000.00 76,000.00 C 160,000.00 162,000.00 if kha applies the LCM bess, the value of the inventory reported on the belance sheet would A. RMSL.000.00 BRM342.000,00 C RM346.000,00 D. RM2.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts