Question: Under the internal assessment section you should start with the size up of the company's financial performance in current situation. Are there any especially good

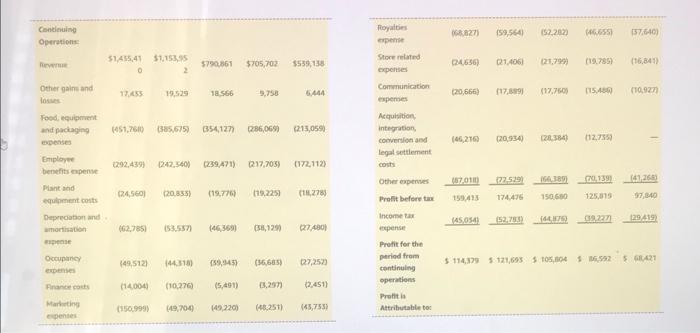

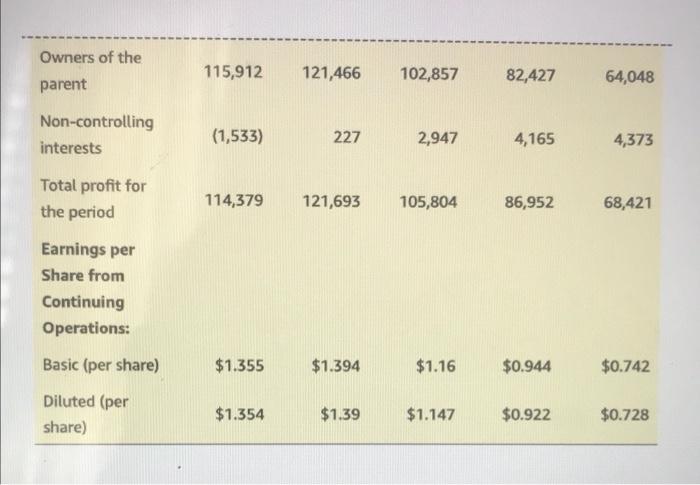

EXHIBIT 2 Domino's Pizza Consolidated Statement of Profit or Loss (Dollars in thousands) 2019 2018 2017 2016 2015 68.827) 159,5641 Continuing Operations 152.202 157.640) Royalties expen Store related expenses 51,455,41 $115395 2 5790,861 $705,702 $539,135 24656) 021.406 121.799 (19.795) (16,841 Communication 17.455 19.529 18 566 5444 (20,666) 117,6891 119.750 1154 (10927 4451,760 1585,675) 354127 286,069 (215,059 Acquisition integration conversion and legal settlement (46,216 020954) 120.541 112.7551 Other gain and los Food equipment and packaging expenses Employee benefits expense Plant and equipment costs Deprecation and mortation 1242.540) (239,471) 2217,705) 0172,112) 15701 122.539 19 (41,265 12456 (20.335) (19.776 (19.2251 (1278) Other expenses Profit before 159413 1740 150 600 125,019 97,840 Income 45,054) (64) 129419 12,785 ) 153.537 638,129 027430 Occupancy expenses 149.5121 144.3130 159,945) (56,685) 27,2523 Profit for the period from continuing operations $ 114,379 5 121,6955105,045 16.592561421 Francos 114,004 (10.276 (5.491) 13,297 12.451) Marie penses (150.999) Prati Attributable to 9,700 149.220) 65,7531 Owners of the parent 115,912 121,466 102,857 82,427 64,048 Non-controlling interests (1,533) 227 2,947 4,165 4,373 Total profit for the period 114,379 121,693 105,804 86,952 68,421 Earnings per Share from Continuing Operations: Basic (per share) $1.355 $1.394 $1.16 $0.944 $0.742 Diluted (per share) $1.354 $1.39 $1.147 $0.922 $0.728 EXHIBIT 2 Domino's Pizza Consolidated Statement of Profit or Loss (Dollars in thousands) 2019 2018 2017 2016 2015 68.827) 159,5641 Continuing Operations 152.202 157.640) Royalties expen Store related expenses 51,455,41 $115395 2 5790,861 $705,702 $539,135 24656) 021.406 121.799 (19.795) (16,841 Communication 17.455 19.529 18 566 5444 (20,666) 117,6891 119.750 1154 (10927 4451,760 1585,675) 354127 286,069 (215,059 Acquisition integration conversion and legal settlement (46,216 020954) 120.541 112.7551 Other gain and los Food equipment and packaging expenses Employee benefits expense Plant and equipment costs Deprecation and mortation 1242.540) (239,471) 2217,705) 0172,112) 15701 122.539 19 (41,265 12456 (20.335) (19.776 (19.2251 (1278) Other expenses Profit before 159413 1740 150 600 125,019 97,840 Income 45,054) (64) 129419 12,785 ) 153.537 638,129 027430 Occupancy expenses 149.5121 144.3130 159,945) (56,685) 27,2523 Profit for the period from continuing operations $ 114,379 5 121,6955105,045 16.592561421 Francos 114,004 (10.276 (5.491) 13,297 12.451) Marie penses (150.999) Prati Attributable to 9,700 149.220) 65,7531 Owners of the parent 115,912 121,466 102,857 82,427 64,048 Non-controlling interests (1,533) 227 2,947 4,165 4,373 Total profit for the period 114,379 121,693 105,804 86,952 68,421 Earnings per Share from Continuing Operations: Basic (per share) $1.355 $1.394 $1.16 $0.944 $0.742 Diluted (per share) $1.354 $1.39 $1.147 $0.922 $0.728

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts