Question: under the lifo method is A correct? what's the second step? is D correct ? is C correct? general ledger? nothing? T the LIFO method,

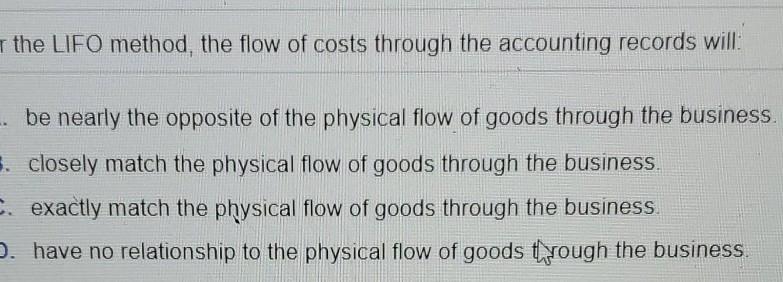

under the lifo method is A correct?

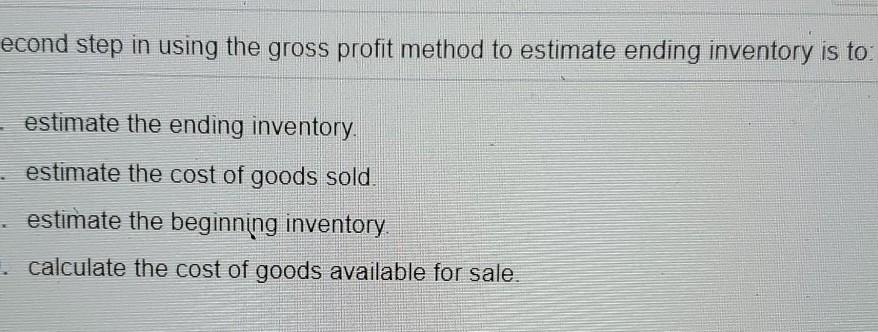

what's the second step? is D correct ?

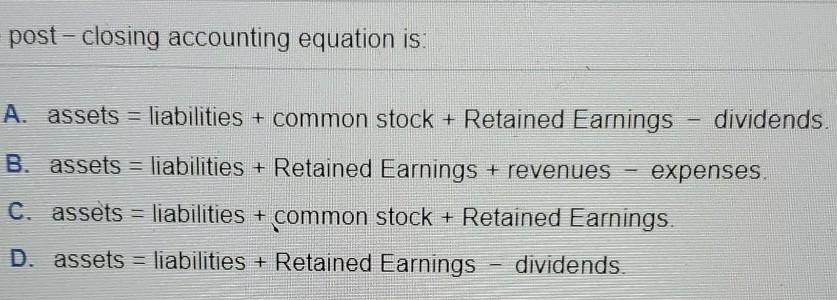

is C correct?

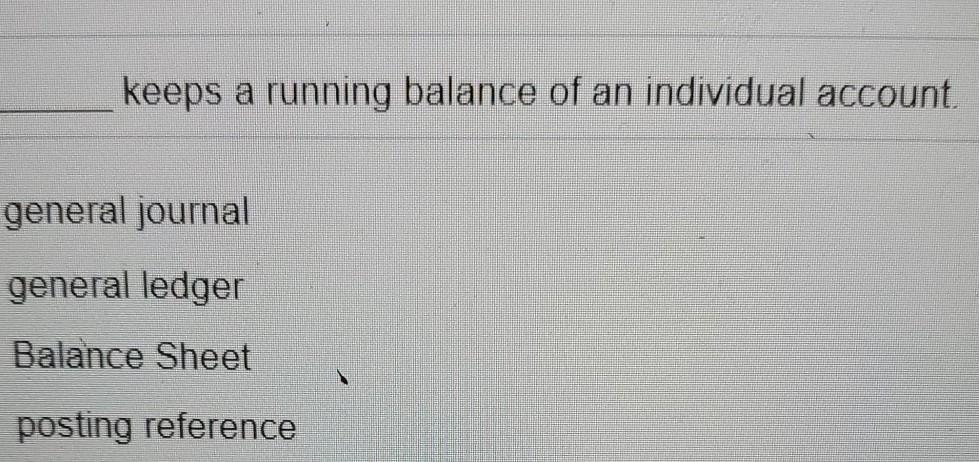

general ledger?

nothing?

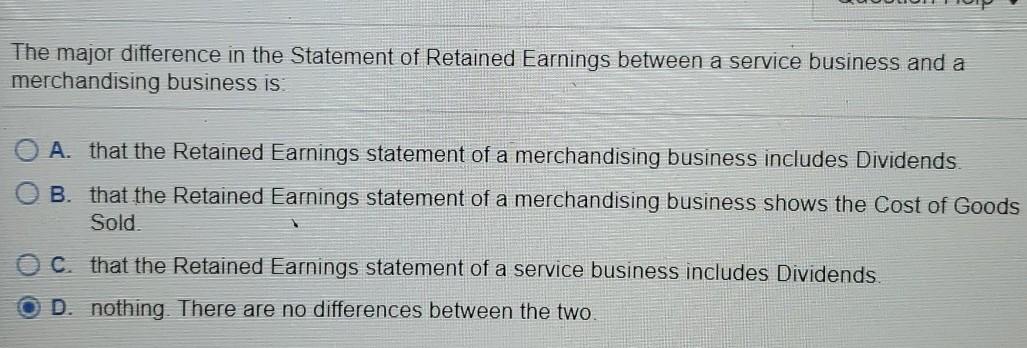

T the LIFO method, the flow of costs through the accounting records will: -. be nearly the opposite of the physical flow of goods through the business. closely match the physical flow of goods through the business exactly match the physical flow of goods through the business. B. have no relationship to the physical flow of goods tyough the business econd step in using the gross profit method to estimate ending inventory is to estimate the ending inventory. estimate the cost of goods sold estimate the beginning inventory calculate the cost of goods available for sale. post closing accounting equation is: A. assets = liabilities + common stock + Retained Earnings dividends. B. assets = liabilities + Retained Earnings + revenues expenses C. assets = liabilities + common stock + Retained Earnings. D. assets = liabilities + Retained Earnings dividends. keeps a running balance of an individual account. general journal general ledger Balance Sheet posting reference The major difference in the Statement of Retained Earnings between a service business and a merchandising business is A. that the Retained Earnings statement of a merchandising business includes Dividends. B. that the Retained Earnings statement of a merchandising business shows the Cost of Goods Sold. C. that the Retained Earnings statement of a service business includes Dividends. D. nothing. There are no differences between the two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts