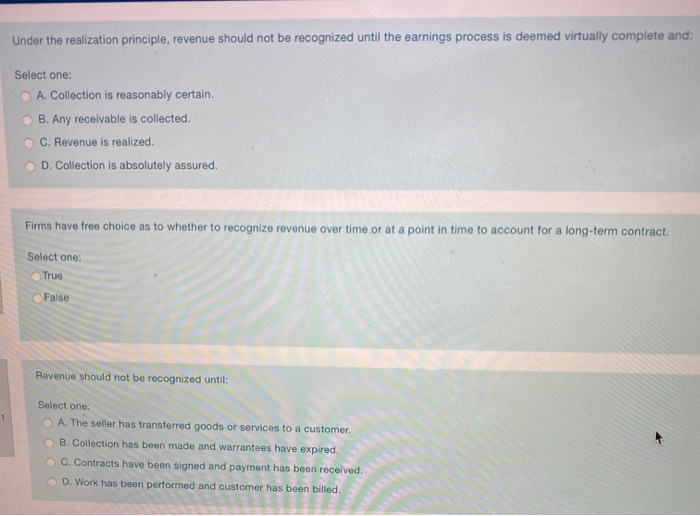

Question: Under the realization principle, revenue should not be recognized until the earnings process is deemed virtually complete and: Select one: A. Collection is reasonably certain

Under the realization principle, revenue should not be recognized until the earnings process is deemed virtually complete and: Select one: A. Collection is reasonably certain B. Any receivable is collected. C. Revenue is realized D. Collection is absolutely assured. Firms have free choice as to whether to recognize revenue over time or at a point in time to account for a long-term contract. Select one: True False Revenue should not be recognized until: 1 Select one: A. The seller has transferred goods or services to a customer. B. Collection has been made and warrantees have expired. C. Contracts have been signed and payment has been received D. Work has been performed and customer has been billed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts