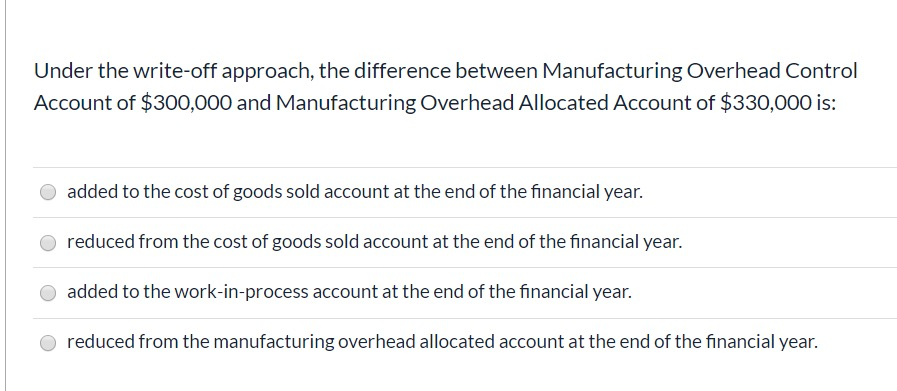

Question: Under the write-off approach, the difference between Manufacturing Overhead Control Account of $300,000 and Manufacturing Overhead Allocated Account of $330,000 is: added to the cost

Under the write-off approach, the difference between Manufacturing Overhead Control Account of $300,000 and Manufacturing Overhead Allocated Account of $330,000 is: added to the cost of goods sold account at the end of the financial year. reduced from the cost of goods sold account at the end of the financial year. added to the work-in-process account at the end of the financial year. reduced from the manufacturing overhead allocated account at the end of the financial year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts