Question: Under U . S . GAAP, what is the proper treatment of unrealized foreign exchange gains? Multiple Choice 1 2 8 : 4 2 They

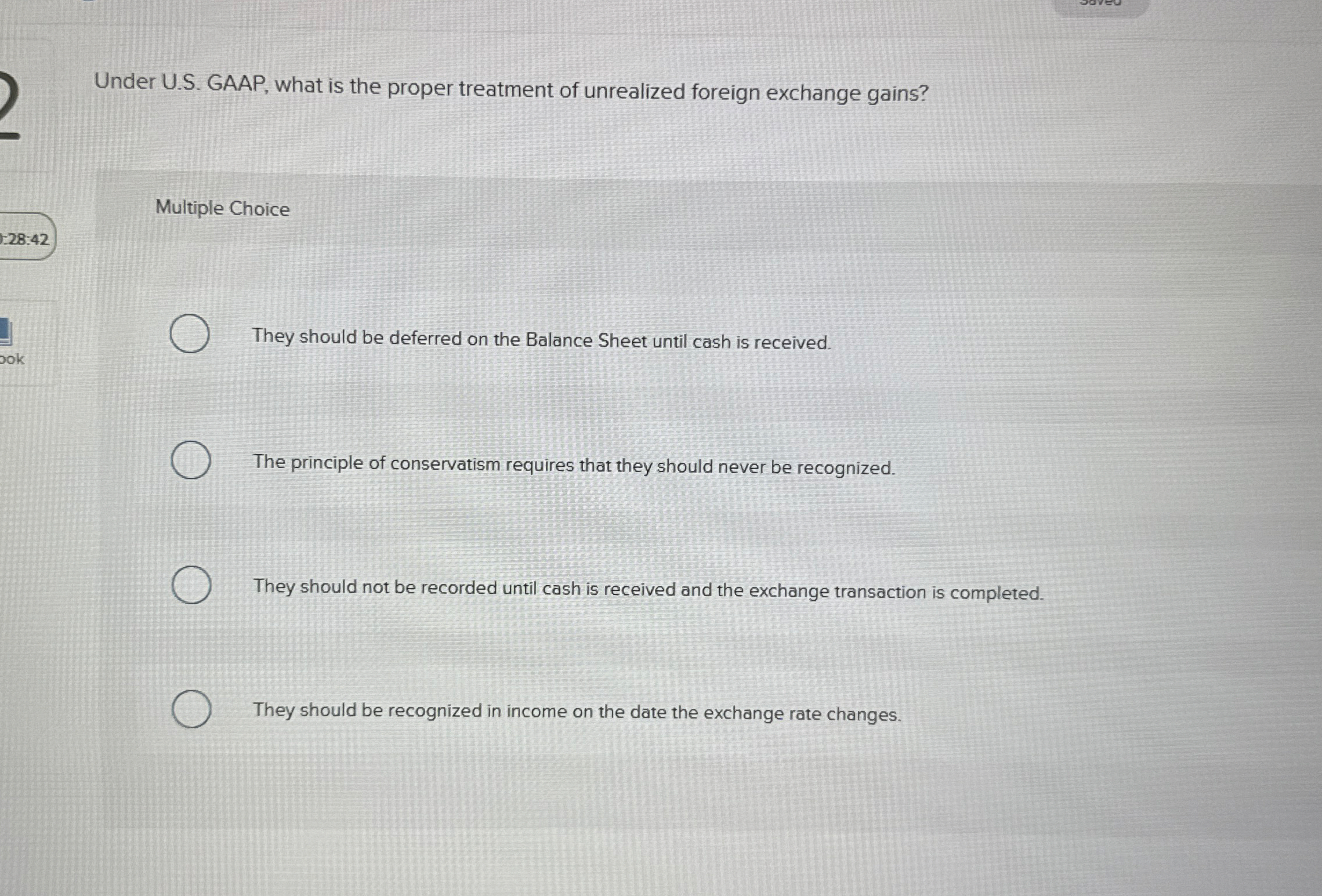

Under US GAAP, what is the proper treatment of unrealized foreign exchange gains?

Multiple Choice

:

They should be deferred on the Balance Sheet until cash is received.

The principle of conservatism requires that they should never be recognized.

They should not be recorded until cash is received and the exchange transaction is completed.

They should be recognized in income on the date the exchange rate changes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock