Question: ( underline { text { Use below information for Questions } 5 text { to 7 : } } )

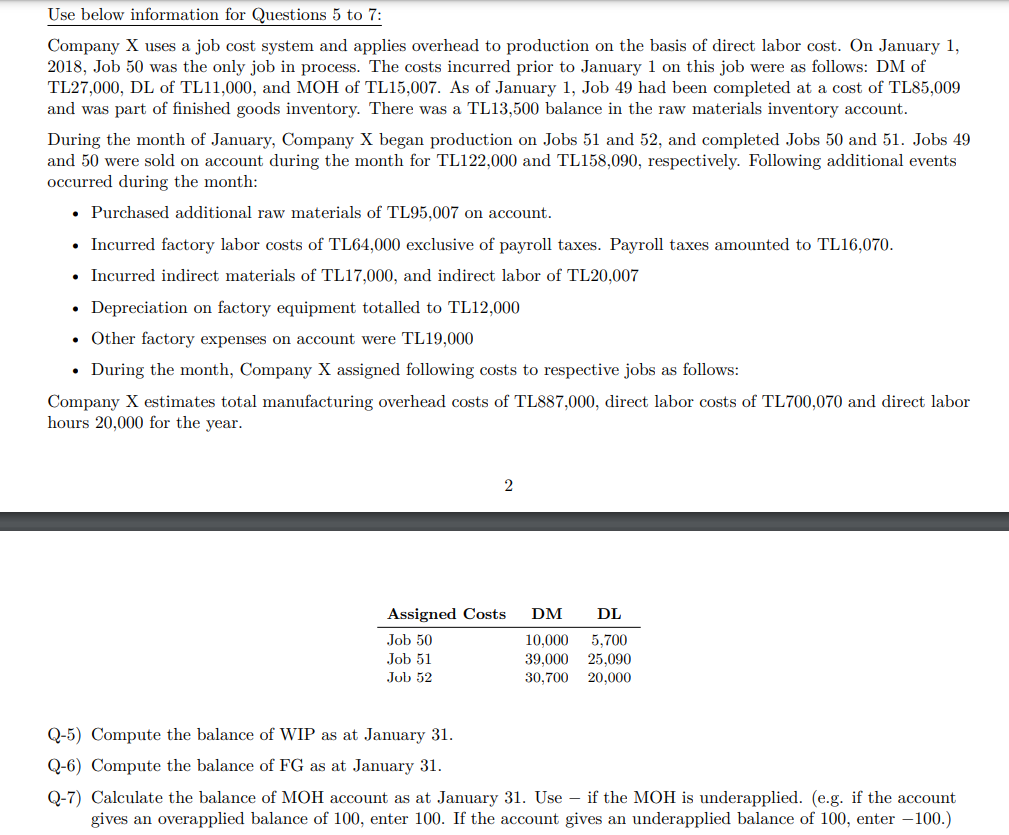

underlinetext Use below information for Questions text to : Company X uses a job cost system and applies overhead to production on the basis of direct labor cost. On January Job was the only job in process. The costs incurred prior to January on this job were as follows: DM of TL DL of TL and MOH of TL As of January Job had been completed at a cost of TL and was part of finished goods inventory. There was a TL balance in the raw materials inventory account. During the month of January, Company X began production on Jobs and and completed Jobs and Jobs and were sold on account during the month for TL and TL respectively. Following additional events occurred during the month: Purchased additional raw materials of TL on account. Incurred factory labor costs of TL exclusive of payroll taxes. Payroll taxes amounted to TL Incurred indirect materials of TL and indirect labor of TL Depreciation on factory equipment totalled to TL Other factory expenses on account were TL During the month, Company X assigned following costs to respective jobs as follows: Company X estimates total manufacturing overhead costs of TL direct labor costs of TL and direct labor hours for the year. Q Compute the balance of WIP as at January Q Compute the balance of FG as at January Q Calculate the balance of MOH account as at January Use if the MOH is underapplied. eg if the account gives an overapplied balance of enter If the account gives an underapplied balance of enter

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock