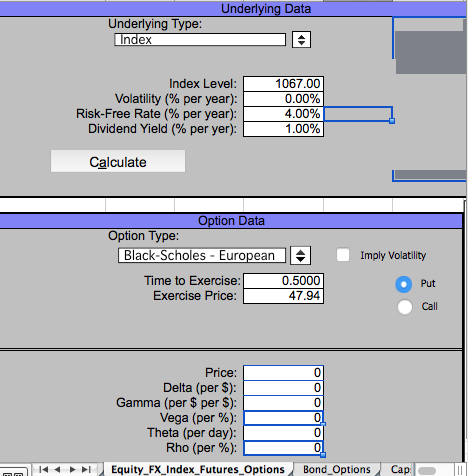

Question: Underlying Data Underlying Type: Index Index Level: 1067.00 Volatility (% per year): 0.00% Risk-Free Rate (% per year): 4.00% Dividend Yield (% per yer):

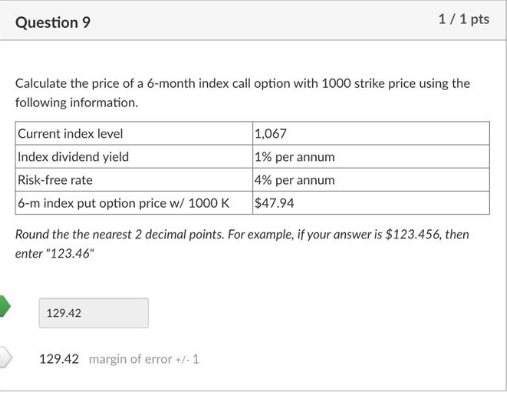

Underlying Data Underlying Type: Index Index Level: 1067.00 Volatility (% per year): 0.00% Risk-Free Rate (% per year): 4.00% Dividend Yield (% per yer): 1.00% Calculate Option Data Option Type: Black-Scholes - European Imply Volatility Time to Exercise: 0.5000 Put Exercise Price: 47.94 Call Price: 0 Delta (per $): 0 Gamma (per $ per $): Vega (per %): Theta (per day): Rho (per %): 0 0 0 0 14 Equity FX Index Futures Options Bond Options Cap Question 9 1/1 pts Calculate the price of a 6-month index call option with 1000 strike price using the following information. Current index level Index dividend yield 1,067 1% per annum 4% per annum 6-m index put option price w/ 1000 K $47.94 Risk-free rate Round the the nearest 2 decimal points. For example, if your answer is $123.456, then enter "123.46" 129.42 129.42 margin of error +/-1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts