Question: Understanding Present Value - End of Appendix Problem The drug company Pizer is considering whether to irrest in the development of a new cancer drug,

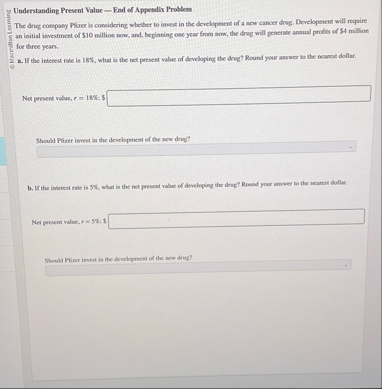

Understanding Present Value End of Appendix Problem

The drug company Pizer is considering whether to irrest in the development of a new cancer drug, Development will require an initial investment of $ millios now, and, beginning ooe year from now, the drug will generate annual profise of $ million for three years.

If the interest rate is what in the net present value of developing the drug? Round your answer to the nowest dollar.

Net present value, if

Should Plizer invest in the developenest of the new drug?

b If the inderest rate is what is the net present value of developing the drug? Rousd your amoer to the nearest dollar.

Net present value, :

Should Pluer invest in the developenent of the new drug?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock