Question: Understanding the Approximate Expected Return Equation The foemula for the opproxarnate expected ceturn of an imvestment can look intimidoting, but it's really just a function

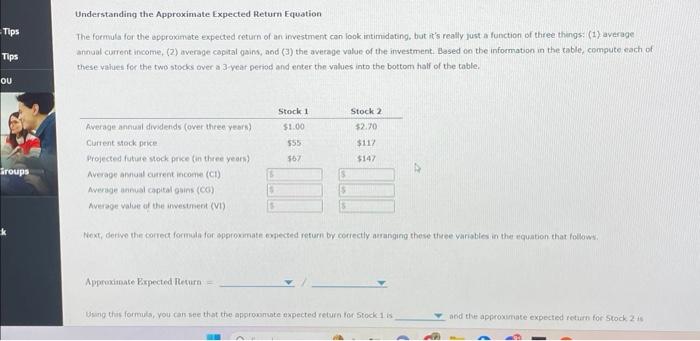

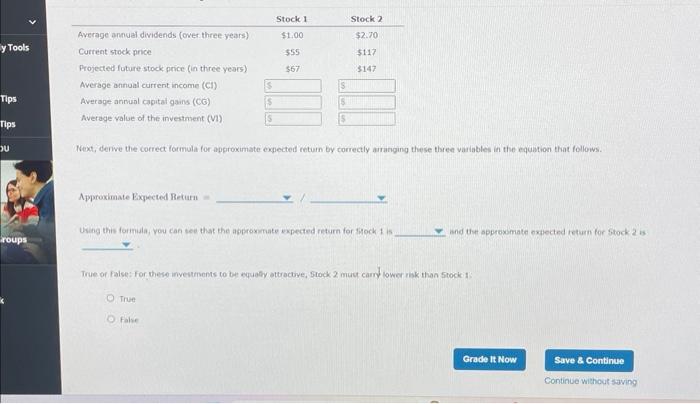

Understanding the Approximate Expected Return Equation The foemula for the opproxarnate expected ceturn of an imvestment can look intimidoting, but it's really just a function of three thengs: ( 1 ) average annual current income, (2) average captal gain, aod (3) the average value of the investment. Based on the informatson in the table, compute each of these yahues for the two stocks over a 3 year period and enter the values into the bottom half of the table. Noxt, derwe the correct formuln for epproxmate expected return by correctly amanging these thee variables in the equation that follows. Approxianase Expected Rtecura: = Using this formuls, vou cansee that the apprownste expected retuin for Stock-1 is abd the approximate expected retiath for stock 2 is Using this formula, vou can see that the approxmate expected return for finock 1 is and the spproxmate extected teturn for Stock 2 is True of false: for these investments to be equaly ettractive, Ftock 2 must carr 1 lower rak than 5 tock 1: True Palse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts