Question: . Understanding the NPV profile If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of

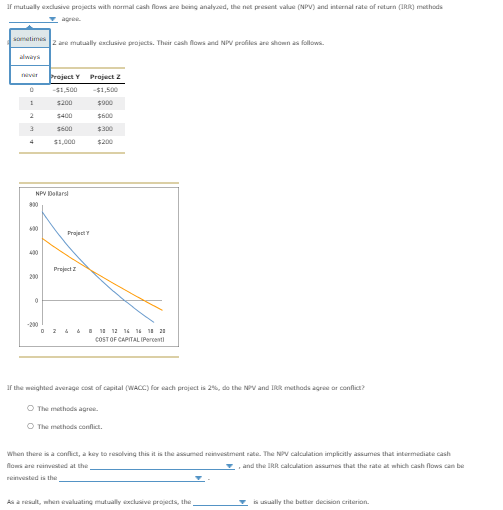

. Understanding the NPV profile If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of return (IRR) methods (???) agree.

blue lines=

1) RRR, IRR, MIRR

2) RRR, IRR, MIRR

3) NPV METHOD, IRR METHOD

adrek 2 ar mulually esclusiv projocte. Thoir cash flows ard NFe profiles are shown as follows. alwirys Thw mothads agree. The mothads cenfict. When there is a cenflict, a key to resolving this it is the asoutred reibisitmont rate. The Niv calculationt implicitly assumes that intiomodiate cash flome are raitwisend at the , and the lRR calculationt assumist that the tate at which cash flewsi cant be reinvested is the Ast a rkult, mhin valuating mutually exchusive projects, the be chally the botser docibian criterian

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts