Question: UNE (20 MARKS) 1 2 3 4 5 6 7 8 9 10 1. Cultural attitudes toward risk are critical in credit granting organization. Credit

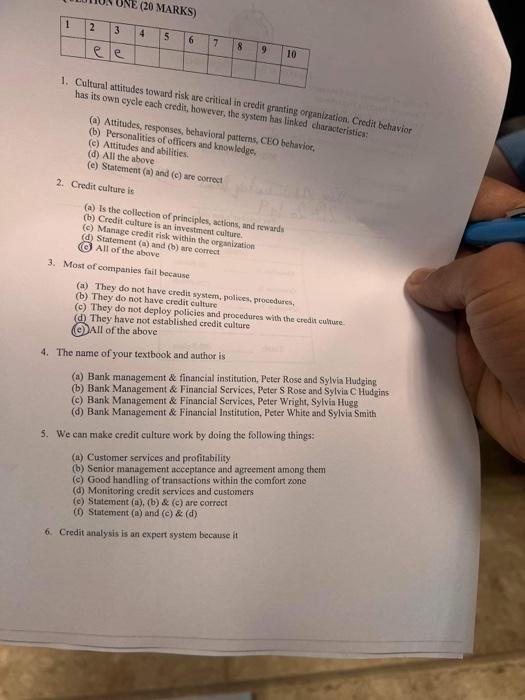

UNE (20 MARKS) 1 2 3 4 5 6 7 8 9 10 1. Cultural attitudes toward risk are critical in credit granting organization. Credit behavior has its own cycle each credit, however, the system has linked characteristics: (a) Attitudes, responses, behavioral patterns, CEO behavior, (b) Personalities of officers and knowledge, (c) Attitudes and abilities. (d) All the above (c) Statement(a) and (e) are correct 2. Credit culture is (a) is the collection of principles, actions, and rewards (b) Credit culture is an investment culture (c) Manage credit risk within the organization d) Statement (a) and (b) are correct All of the above 3. Most of companies fail because (a) They do not have credit system, polices, procedures (b) They do not have credit culture (c) They do not deploy policies and procedures with the credit culture (d) They have not established credit culture All of the above 4. The name of your textbook and author is (a) Bank management & financial institution, Peter Rose and Sylvia Hudging (b) Bank Management & Financial Services, Peter S Rose and Sylvia Hudgins (c) Bank Management & Financial Services, Peter Wright, Sylvia Hugg (d) Bank Management & Financial Institution, Peter White and Sylvia Smith 5. We can make credit culture work by doing the following things: (a) Customer services and profitability (b) Senior management acceptance and agreement among them () Good handling of transactions within the comfort zone (d) Monitoring credit services and customers (e) Statement (a), (b) & (c) are correct (1) Statement (a) and (c) & (d) 6. Credit analysis is an expert system because it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts