Question: Uniform Supply accepted a $ 16, 800. 90-day. 7% note from Tracy on October 1? What entry should Uniform Supply make on January 15 or

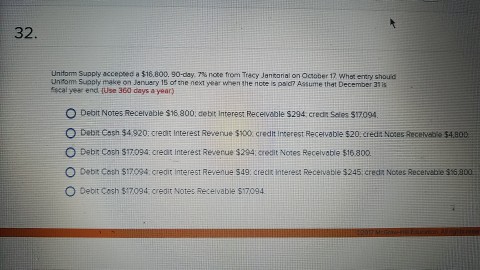

Uniform Supply accepted a $ 16, 800. 90-day. 7% note from Tracy on October 1? What entry should Uniform Supply make on January 15 or the next year when the note is paid? Assume that December 31 is year end. (Use 360 days a year) Debit Notes Receivable $16, 800 debit interest Receivable $294 credit $17, 094. Debit Cash $4, 920: credit Interest Revenue $100 credit Interest Receivable $20, credit Notes Receivable $4, 800 Debit Cash $17, 094: credit interest Revenue $294: credit Notes Receivable $16, 800 Debit Cash $17, 094 credit interest Revenue $49: credit interest Receivable $245 credit Notes Receivable $16, 800 Debit Cash $17, 094 credit Notes Receivable $17, 094

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts