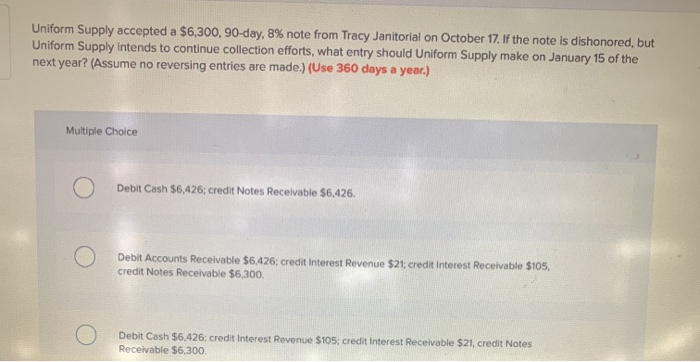

Question: Uniform Supply accepted a $6,300, 90-day, 8% note from Tracy Janitorial on October 17. If the note is dishonored, but Uniform Supply intends to continue

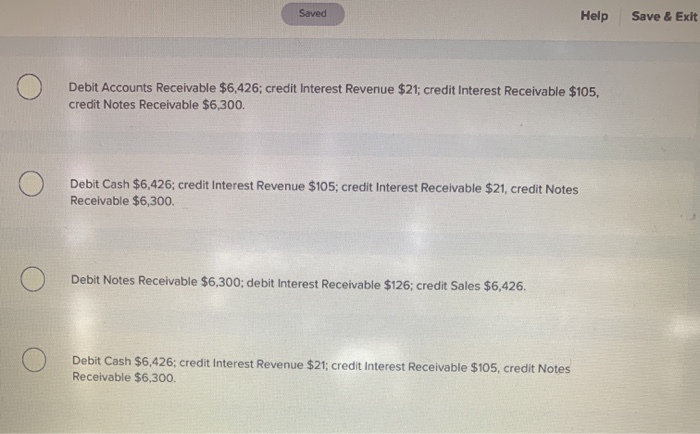

Uniform Supply accepted a $6,300, 90-day, 8% note from Tracy Janitorial on October 17. If the note is dishonored, but Uniform Supply intends to continue collection efforts, what entry should Uniform Supply make on January 15 of the next year? (Assume no reversing entries are made.) (Use 360 days a year.) Multiple Choice Debit Cash $6,426; credit Notes Receivable $6,426. Debit Accounts Receivable $6,426; credit Interest Revenue $21; credit Interest Receivable $105, credit Notes Receivable $6,300. Debit Cash $6,426; credit Interest Revenue S105; credit Interest Receivable $21, credit Notes Receivable $6,300 Saved Help Save & Exit Debit Accounts Receivable $6,426; credit Interest Revenue $21; credit Interest Receivable $105, credit Notes Receivable $6,300. O Debit Cash $6,426; credit Interest Revenue $105; credit Interest Receivable $21, credit Notes Receivable $6,300. O Debit Notes Receivable $6,300; debit Interest Receivable $126; credit Sales $6,426. O O Debit Cash $6,426; credit Interest Revenue $21; credit Interest Receivable $105, credit Notes Receivable $6,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts