Question: Union Pacific Case Study 2020 Bare with me please I appreciate it so much if yall can figure this out! Sand Company Inc. Contract Structure

Union Pacific Case Study 2020

Bare with me please I appreciate it so much if yall can figure this out!

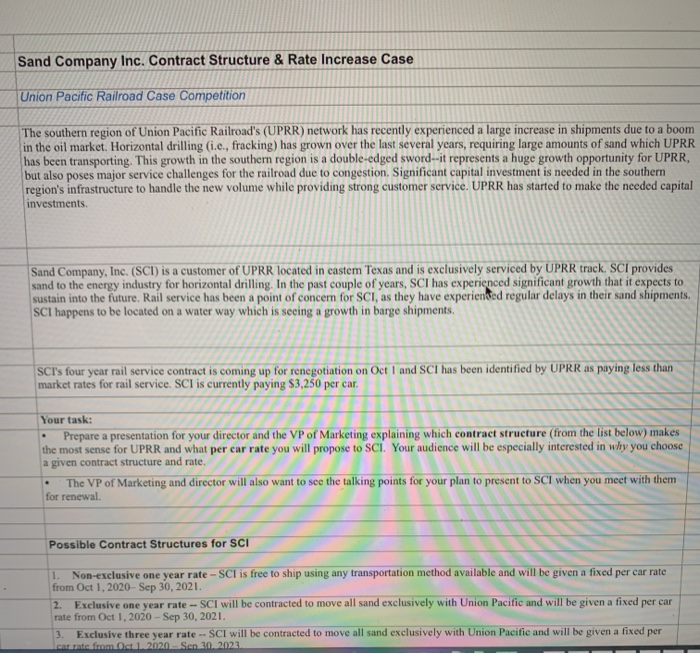

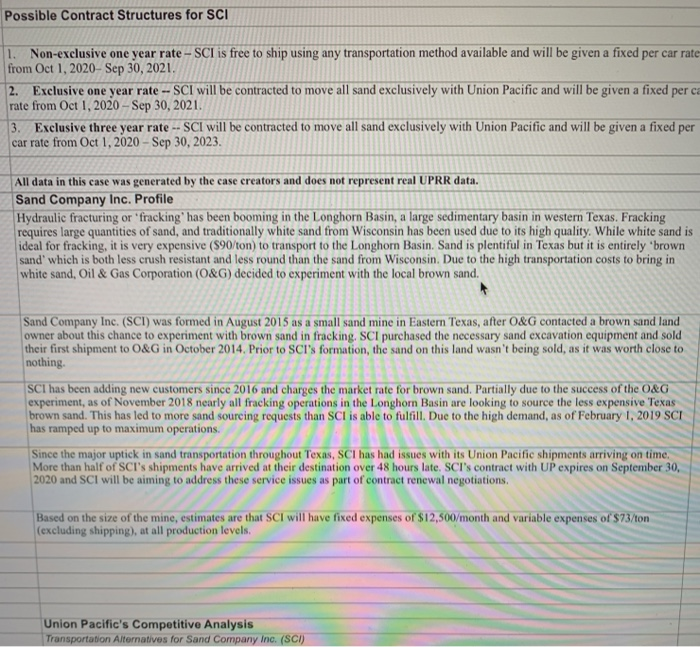

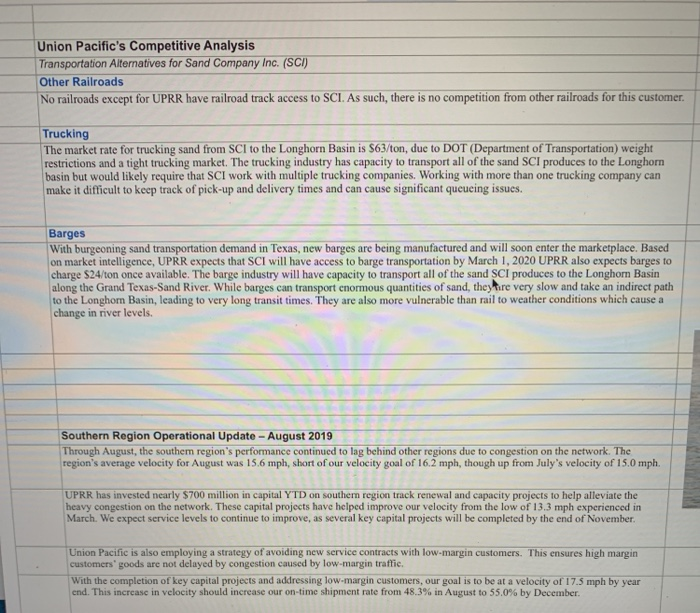

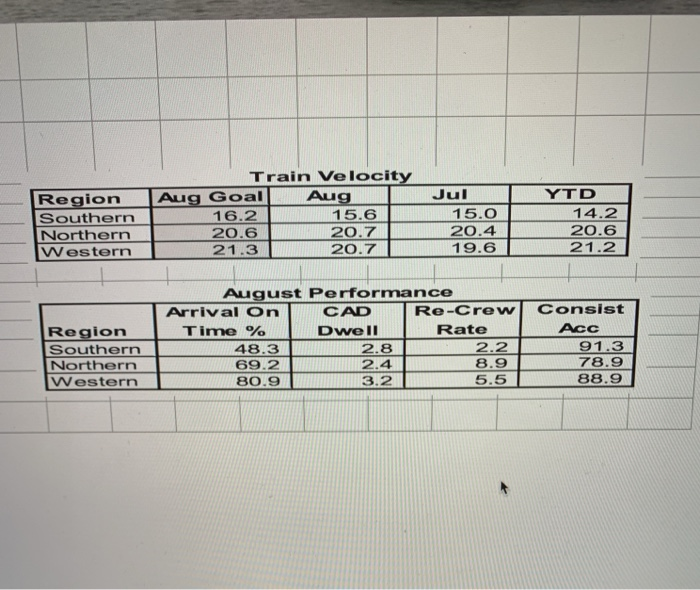

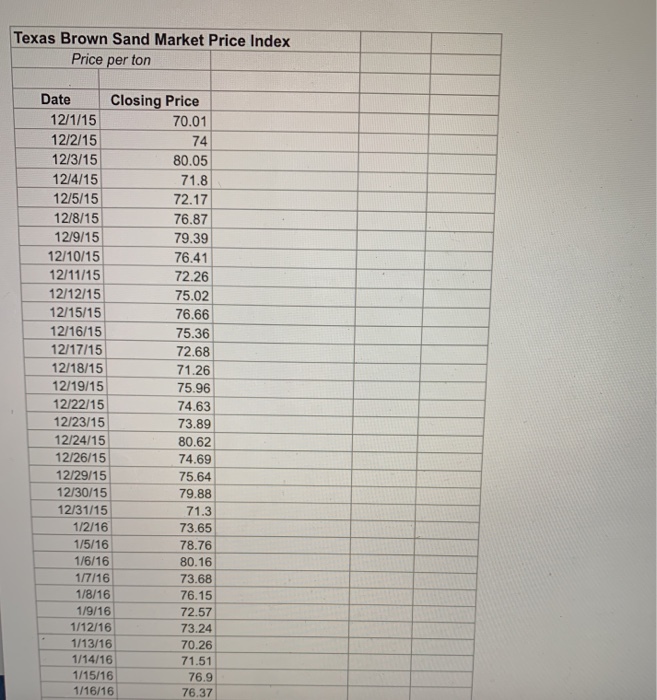

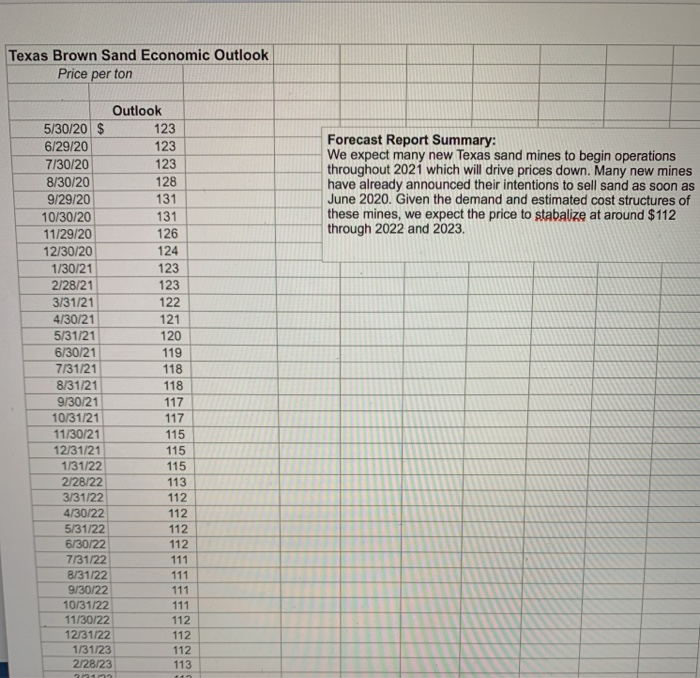

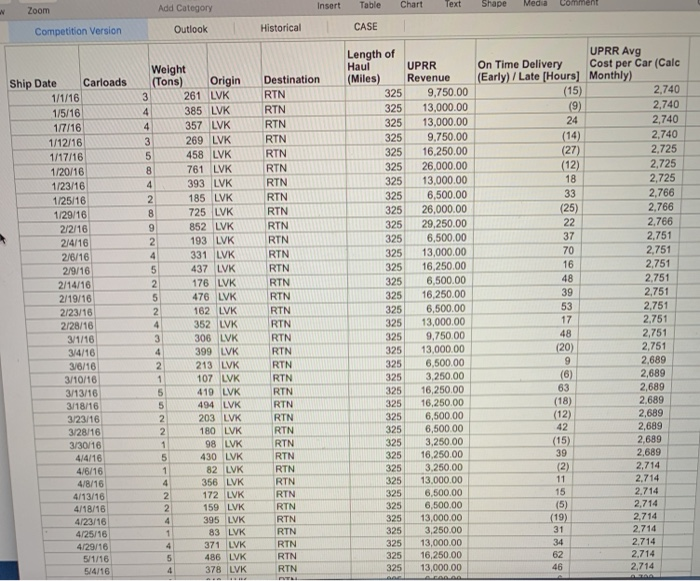

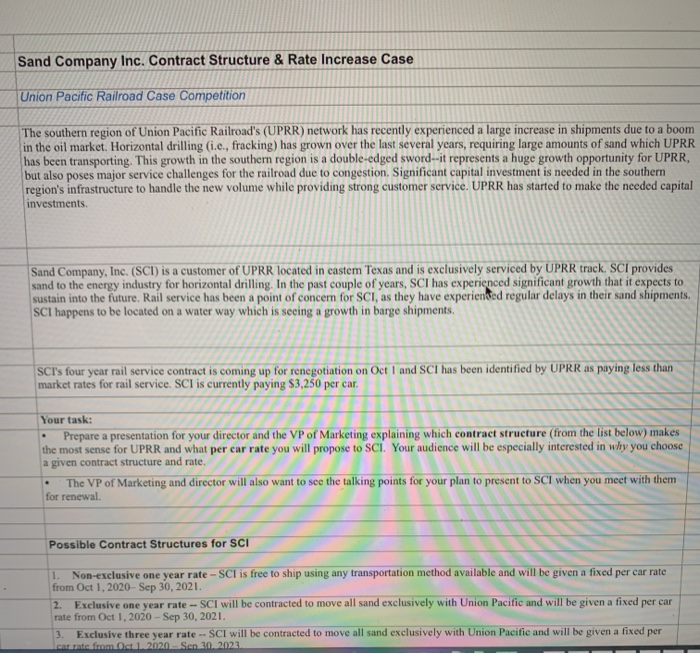

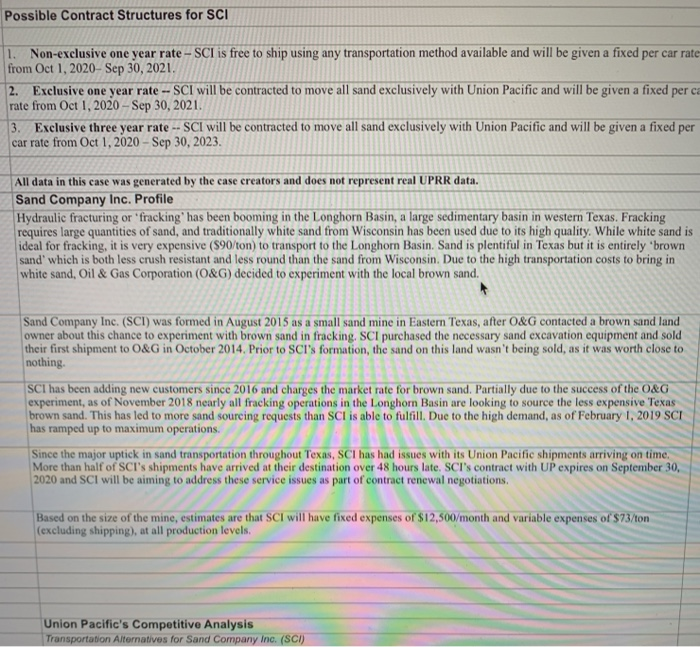

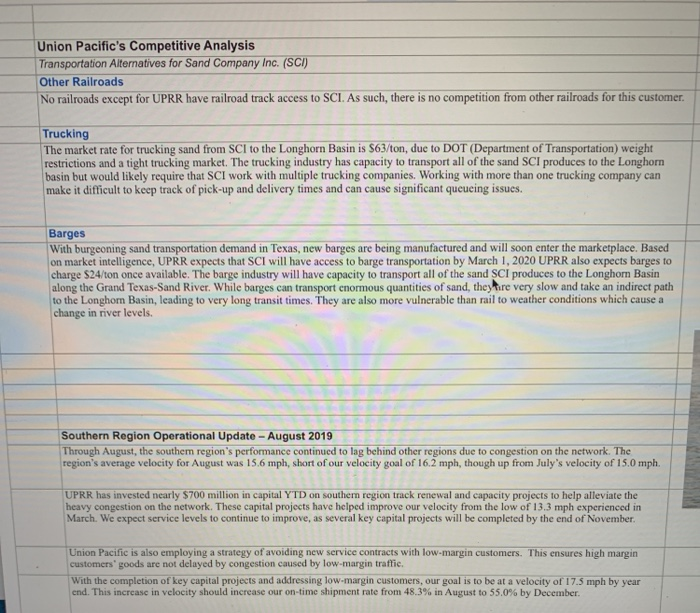

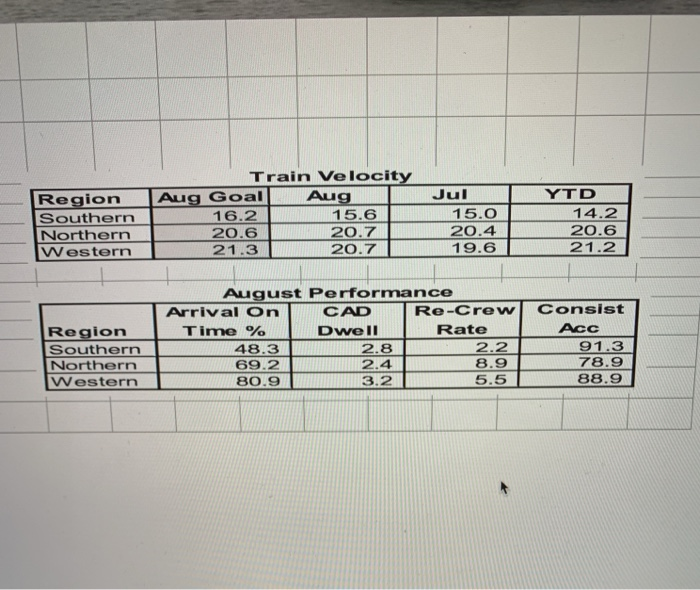

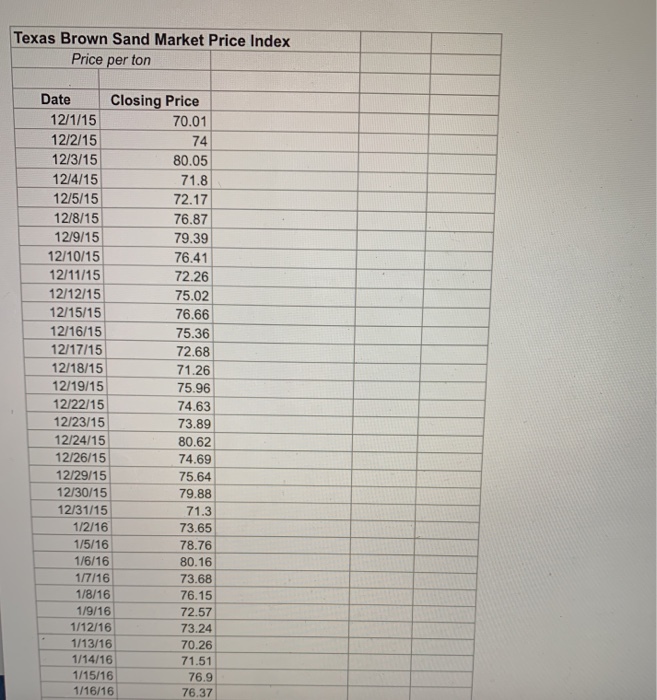

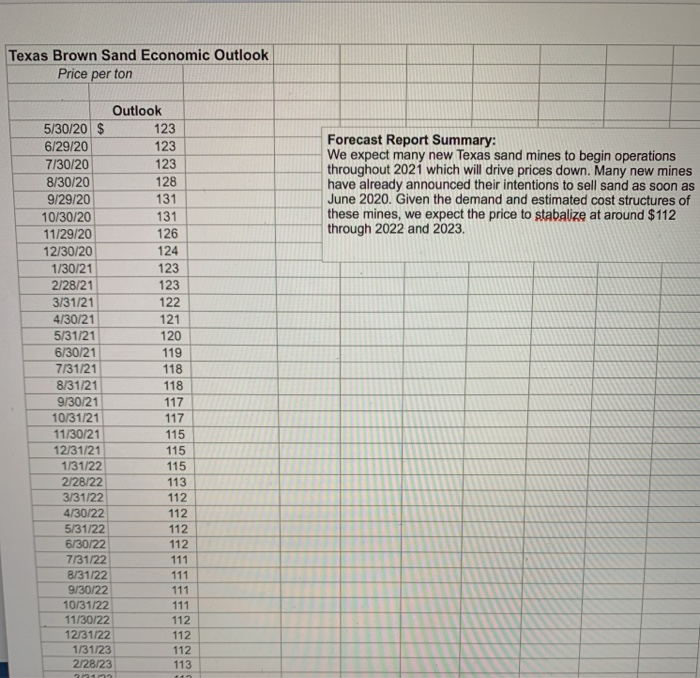

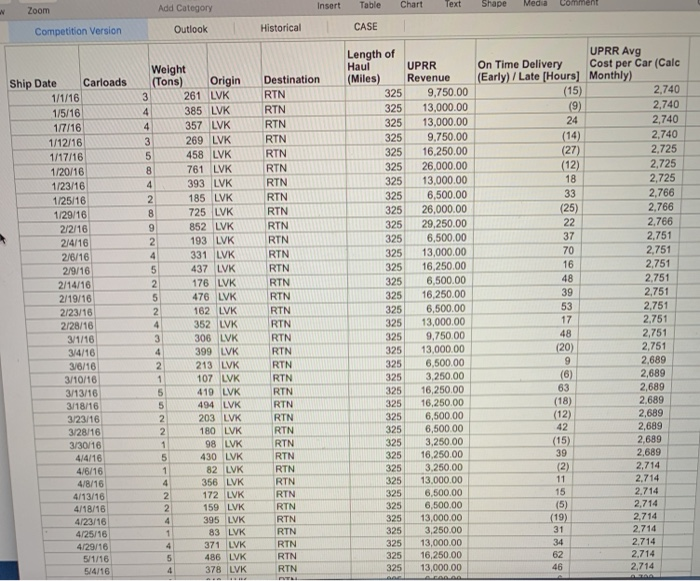

Sand Company Inc. Contract Structure & Rate Increase Case Union Pacific Railroad Case Competition The southern region of Union Pacific Railroad's (UPRR) network has recently experienced a large increase in shipments due to a boom in the oil market. Horizontal drilling (i.e., fracking) has grown over the last several years, requiring large amounts of sand which UPRR has been transporting. This growth in the southern region is a double-edged sword--it represents a huge growth opportunity for UPRR, but also poses major service challenges for the railroad due to congestion. Significant capital investment is needed in the southern region's infrastructure to handle the new volume while providing strong customer service. UPRR has started to make the needed capital investments Sand Company, Inc. (SCI) is a customer of UPRR located in castem Texas and is exclusively serviced by UPRR track. SCI provides sand to the energy industry for horizontal drilling. In the past couple of years, SCI has experienced significant growth that it expects to sustain into the future. Rail service has been a point of concern for SCI, as they have experienced regular delays in their sand shipments. SCI happens to be located on a water way which is seeing a growth in barge shipments. SCI's four year rail service contract is coming up for renegotiation on Oct 1 and SCI has been identified by UPRR as paying less than market rates for rail service. SCI is currently paying $3,250 per car. Your task: Prepare a presentation for your director and the VP of Marketing explaining which contract structure (from the list below) makes the most sense for UPRR and what per ear rate you will propose to SCI. Your audience will be especially interested in why you choose a given contract structure and rate. The VP of Marketing and director will also want to see the talking points for your plan to present to SCI when you meet with them for renewal. . Possible Contract Structures for SCI 1. Non-exclusive one year rate - SCI is free to ship using any transportation method available and will be given a fixed per car rate from Oct 1, 2020-Sep 30, 2021. 2. Exclusive one year rate -- SCI will be contracted to move all sand exclusively with Union Pacific and will be given a fixed per car rate from Oct 1, 2020 - Sep 30, 2021. 3 Exclusive three year rate -- SCI will be contracted to move all sand exclusively with Union Pacific and will be given a fixed per team...2020-Sen 30.2023 Possible Contract Structures for SCI 1. Non-exclusive one year rate - SCI is free to ship using any transportation method available and will be given a fixed per car rate from Oct 1, 2020-Sep 30, 2021. 2. Exclusive one year rate -- SCI will be contracted to move all sand exclusively with Union Pacific and will be given a fixed per ca rate from Oct 1, 2020 - Sep 30, 2021. 3. Exclusive three year rate -- SCI will be contracted to move all sand exclusively with Union Pacific and will be given a fixed per car rate from Oct 1, 2020 - Sep 30, 2023. All data in this case was generated by the case creators and does not represent real UPRR data. Sand Company Inc. Profile Hydraulic fracturing or 'fracking' has been booming in the Longhorn Basin, a large sedimentary basin in western Texas. Fracking requires large quantities of sand, and traditionally white sand from Wisconsin has been used due to its high quality. While white sand ideal for fracking, it is very expensive (890/ton) to transport to the Longhorn Basin. Sand is plentiful in Texas but it is entirely brown sand' which is both less crush resistant and less round than the sand from Wisconsin. Due to the high transportation costs to bring in white sand, Oil & Gas Corporation (O&G) decided to experiment with the local brown sand. Sand Company Inc. (SCI) was formed in August 2015 as a small sand mine in Eastern Texas, after O&G contacted a brown sand land owner about this chance to experiment with brown sand in fracking. SCI purchased the necessary sand excavation equipment and sold their first shipment to O&G in October 2014. Prior to SCI's formation, the sand on this land wasn't being sold, as it was worth close to nothing SCI has been adding new customers since 2016 and charges the market rate for brown sand. Partially due to the success of the O&G experiment, as of November 2018 nearly all fracking operations in the Longhorn Basin are looking to source the less expensive Texas brown sand. This has led to more sand sourcing requests than SCI is able to fulfill. Due to the high demand, as of February 1, 2019 SCI has ramped up to maximum operations. Since the major uptick in sand transportation throughout Texas, SCI has had issues with its Union Pacific shipments arriving on time, More than half of SCI's shipments have arrived at their destination over 48 hours late. SCI's contract with UP expires on September 30, 2020 and SCI will be aiming to address these service issues as part of contract renewal negotiations. Based on the size of the mine, estimates are that SCI will have fixed expenses of $12,500/month and variable expenses of $73/ton (excluding shipping), at all production levels. Union Pacific's Competitive Analysis Transportation Alternatives for Sand Company Inc. (SCI) Union Pacific's Competitive Analysis Transportation Alternatives for Sand Company Inc. (SCI) Other Railroads No railroads except for UPRR have railroad track access to SCI. As such, there is no competition from other railroads for this customer. Trucking The market rate for trucking sand from SCI to the Longhorn Basin is $63/ton, due to DOT (Department of Transportation) weight restrictions and a tight trucking market. The trucking industry has capacity to transport all of the sand SCI produces to the Longhorn basin but would likely require that SCI work with multiple trucking companies. Working with more than one trucking company can make it difficult to keep track of pick-up and delivery times and can cause significant queueing issues. Barges With burgeoning sand transportation demand in Texas, new barges are being manufactured and will soon enter the marketplace. Based on market intelligence, UPRR expects that SCI will have access to barge transportation by March 1, 2020 UPRR also expects barges to charge $24/ton once available. The barge industry will have capacity to transport all of the sand SCI produces to the Longhorn Basin along the Grand Texas-Sand River. While barges can transport enormous quantities of sand, they fire very slow and take an indirect path to the Longhorn Basin, leading to very long transit times. They are also more vulnerable than rail to weather conditions which cause a change in river levels Southern Region Operational Update - August 2019 Through August, the southem region's performance continued to lag behind other regions due to congestion on the network. The region's average velocity for August was 15.6 mph, short of our velocity goal of 16.2 mph, though up from July's velocity of 15.0 mph. UPRR has invested nearly $700 million in capital YTD on southern region track renewal and capacity projects to help alleviate the heavy congestion on the network. These capital projects have helped improve our velocity from the low of 13.3 mph experienced in March. We expect service levels to continue to improve, as several key capital projects will be completed by the end of November Union Pacific is also employing a strategy of avoiding new service contracts with low-margin customers. This ensures high margin customers' goods are not delayed by congestion caused by low-margin traffic. With the completion of key capital projects and addressing low-margin customers, our goal is to be at a velocity of 17.5 mph by year end. This increase in velocity should increase our on-time shipment rate from 48.3% in August to 55.0% by December Region Southern Northern Western Train Velocity Aug Goal Aug 16.2 15.6 20.6 20.7 21.3 20.7 Jul 15.0 20.4 19.6 YTD 14.2 20.6 21.2 Region Southern Northern Western August Performance Arrival on CAD Re-Crew Consist Time % Dwell Rate 48.3 2.8 2.2 91.3 69.2 2.4 8.9 78.9 80.9 3.2 5.5 88.9 Texas Brown Sand Market Price Index Price per ton Date Closing Price 12/1/15 70.01 12/2/15 74 12/3/15 80.05 12/4/15 71.8 12/5/15 72.17 12/8/15 76.87 12/9/15 79.39 12/10/15 76.41 12/11/15 72.26 12/12/15 75.02 12/15/15 76.66 12/16/15 75.36 12/17/15 72.68 12/18/15 71.26 12/19/15 75.96 12/22/15 74.63 12/23/15 73.89 12/24/15 80.62 12/26/15 74.69 12/29/15 75.64 12/30/15 79.88 12/31/15 71.3 1/2/16 73.65 1/5/16 78.76 1/6/16 80.16 1/7/16 73.68 1/8/16 76.15 1/9/16 72.57 1/12/16 73.24 1/13/16 70.26 1/14/16 71.51 1/15/16 76.9 1/16/16 76.37 Texas Brown Sand Economic Outlook Price per ton Forecast Report Summary: We expect many new Texas sand mines to begin operations throughout 2021 which will drive prices down. Many new mines have already announced their intentions to sell sand as soon as June 2020. Given the demand and estimated cost structures of these mines, we expect the price to stabalize at around $112 through 2022 and 2023. Outlook 5/30/20 $ 123 6/29/20 123 7/30/20 123 8/30/20 128 9/29/20 131 10/30/20 131 11/29/20 126 12/30/20 124 1/30/21 123 2/28/21 123 3/31/21 122 4/30/21 121 5/31/21 120 6/30/21 119 7/31/21 118 8/31/21 118 9/30/21 117 10/31/21 117 11/30/21 115 12/31/21 115 1/31/22 115 2/28/22 113 3/31/22 112 4/30/22 112 5/31/22 112 6/30/22 112 7/31/22 111 8/31/22 111 9/30/22 111 10/31/22 111 11/30/22 112 12/31/22 112 1/31/23 112 2/28/23 113 2021 1 Insert Table Add Category Chart Text Shape Meda Comment Zoom Outlook Competition Version Historical CASE (25) Ship Date Carloads 1/1/16 1/5/16 1/7/16 1/12/16 1/17/16 1/20/16 1/23/16 1/25/16 1/29/16 2/2/16 2/4/16 2/6/16 2/9/16 2/14/16 2/19/16 2/23/16 2/28/16 3/1/16 3/4/16 3/6/16 3/10/16 3/13/16 3/18/16 3/23/16 3/28/16 3/30/16 4/4/16 4/6/16 4/8/16 4/13/16 4/18/16 4/23/16 4/25/16 4/29/16 5/1/16 5/4/16 Weight (Tons) Origin 3 261 LVK 4 385 LVK 4 357 LVK 3 269 LVK 5 458 LVK 8 761 LVK 4 393 LVK 2 185 LVK 8 725 LVK 9 852 LVK 2 193 LVK 4 331 LVK 5 437 LVK 2 176 LVK 5 476 LVK 2 162 LVK 4 352 LVK 3 306 LVK 4 399 LVK 2 213 LVK 1 107 LVK 5 419 LVK 5 494 LVK 2 203 LVK 2 180 LVK 1 98 LVK 5 430 LVK 1 82 LVK 4 356 LVK 2 172 LVK 2 159 LVK 4 395 LVK 1 83 LVK 4 371 LVK 5 486 LVK 4 378 LVK Destination RTN RTN RIN RTN RTN RTN RTN RTN RTN RIN RTN RIN RTN RTN RTN RTN RIN RTN RTN RTN RTN RIN RTN RIN RTN RTN RTN RTN RTN RIN RTN RTN RTN RIN RIN RIN Length of Haul UPRR (Miles) Revenue 325 9,750.00 325 13,000.00 325 13,000.00 325 9,750.00 325 16.250.00 325 26,000.00 325 13,000.00 325 6,500.00 325 26,000.00 325 29,250.00 325 6,500.00 325 13,000.00 325 16,250.00 325 6,500.00 325 16.250.00 325 6,500.00 325 13,000.00 325 9,750.00 325 13,000.00 325 6,500.00 325 3,250.00 325 16,250.00 325 16,250.00 325 6,500.00 325 6,500.00 325 3,250.00 325 16.250.00 325 3.250.00 325 13,000.00 325 6,500.00 325 6,500.00 325 13,000.00 325 3,250.00 325 13,000.00 325 16,250.00 325 13,000.00 UPRR Avg On Time Delivery Cost per Car (Calc (Early) / Late (Hours) Monthly) (15) 2,740 (9) 2,740 24 2,740 (14) 2.740 (27) 2,725 (12) 2,725 18 2,725 33 2,766 2,766 22 2.766 37 2.751 70 2,751 16 2.751 48 2,751 39 2.751 53 2,751 17 2.751 48 2,751 (20) 2,751 9 2,689 (6) 2,689 63 2,689 (18) 2.689 (12) 2,689 42 2,689 (15) 2,689 39 2,689 (2) 2,714 11 2,714 15 2,714 (5) 2,714 (19) 2,714 31 2,714 34 2,714 62 2.714 46 2,714 Sand Company Inc. Contract Structure & Rate Increase Case Union Pacific Railroad Case Competition The southern region of Union Pacific Railroad's (UPRR) network has recently experienced a large increase in shipments due to a boom in the oil market. Horizontal drilling (i.e., fracking) has grown over the last several years, requiring large amounts of sand which UPRR has been transporting. This growth in the southern region is a double-edged sword--it represents a huge growth opportunity for UPRR, but also poses major service challenges for the railroad due to congestion. Significant capital investment is needed in the southern region's infrastructure to handle the new volume while providing strong customer service. UPRR has started to make the needed capital investments Sand Company, Inc. (SCI) is a customer of UPRR located in castem Texas and is exclusively serviced by UPRR track. SCI provides sand to the energy industry for horizontal drilling. In the past couple of years, SCI has experienced significant growth that it expects to sustain into the future. Rail service has been a point of concern for SCI, as they have experienced regular delays in their sand shipments. SCI happens to be located on a water way which is seeing a growth in barge shipments. SCI's four year rail service contract is coming up for renegotiation on Oct 1 and SCI has been identified by UPRR as paying less than market rates for rail service. SCI is currently paying $3,250 per car. Your task: Prepare a presentation for your director and the VP of Marketing explaining which contract structure (from the list below) makes the most sense for UPRR and what per ear rate you will propose to SCI. Your audience will be especially interested in why you choose a given contract structure and rate. The VP of Marketing and director will also want to see the talking points for your plan to present to SCI when you meet with them for renewal. . Possible Contract Structures for SCI 1. Non-exclusive one year rate - SCI is free to ship using any transportation method available and will be given a fixed per car rate from Oct 1, 2020-Sep 30, 2021. 2. Exclusive one year rate -- SCI will be contracted to move all sand exclusively with Union Pacific and will be given a fixed per car rate from Oct 1, 2020 - Sep 30, 2021. 3 Exclusive three year rate -- SCI will be contracted to move all sand exclusively with Union Pacific and will be given a fixed per team...2020-Sen 30.2023 Possible Contract Structures for SCI 1. Non-exclusive one year rate - SCI is free to ship using any transportation method available and will be given a fixed per car rate from Oct 1, 2020-Sep 30, 2021. 2. Exclusive one year rate -- SCI will be contracted to move all sand exclusively with Union Pacific and will be given a fixed per ca rate from Oct 1, 2020 - Sep 30, 2021. 3. Exclusive three year rate -- SCI will be contracted to move all sand exclusively with Union Pacific and will be given a fixed per car rate from Oct 1, 2020 - Sep 30, 2023. All data in this case was generated by the case creators and does not represent real UPRR data. Sand Company Inc. Profile Hydraulic fracturing or 'fracking' has been booming in the Longhorn Basin, a large sedimentary basin in western Texas. Fracking requires large quantities of sand, and traditionally white sand from Wisconsin has been used due to its high quality. While white sand ideal for fracking, it is very expensive (890/ton) to transport to the Longhorn Basin. Sand is plentiful in Texas but it is entirely brown sand' which is both less crush resistant and less round than the sand from Wisconsin. Due to the high transportation costs to bring in white sand, Oil & Gas Corporation (O&G) decided to experiment with the local brown sand. Sand Company Inc. (SCI) was formed in August 2015 as a small sand mine in Eastern Texas, after O&G contacted a brown sand land owner about this chance to experiment with brown sand in fracking. SCI purchased the necessary sand excavation equipment and sold their first shipment to O&G in October 2014. Prior to SCI's formation, the sand on this land wasn't being sold, as it was worth close to nothing SCI has been adding new customers since 2016 and charges the market rate for brown sand. Partially due to the success of the O&G experiment, as of November 2018 nearly all fracking operations in the Longhorn Basin are looking to source the less expensive Texas brown sand. This has led to more sand sourcing requests than SCI is able to fulfill. Due to the high demand, as of February 1, 2019 SCI has ramped up to maximum operations. Since the major uptick in sand transportation throughout Texas, SCI has had issues with its Union Pacific shipments arriving on time, More than half of SCI's shipments have arrived at their destination over 48 hours late. SCI's contract with UP expires on September 30, 2020 and SCI will be aiming to address these service issues as part of contract renewal negotiations. Based on the size of the mine, estimates are that SCI will have fixed expenses of $12,500/month and variable expenses of $73/ton (excluding shipping), at all production levels. Union Pacific's Competitive Analysis Transportation Alternatives for Sand Company Inc. (SCI) Union Pacific's Competitive Analysis Transportation Alternatives for Sand Company Inc. (SCI) Other Railroads No railroads except for UPRR have railroad track access to SCI. As such, there is no competition from other railroads for this customer. Trucking The market rate for trucking sand from SCI to the Longhorn Basin is $63/ton, due to DOT (Department of Transportation) weight restrictions and a tight trucking market. The trucking industry has capacity to transport all of the sand SCI produces to the Longhorn basin but would likely require that SCI work with multiple trucking companies. Working with more than one trucking company can make it difficult to keep track of pick-up and delivery times and can cause significant queueing issues. Barges With burgeoning sand transportation demand in Texas, new barges are being manufactured and will soon enter the marketplace. Based on market intelligence, UPRR expects that SCI will have access to barge transportation by March 1, 2020 UPRR also expects barges to charge $24/ton once available. The barge industry will have capacity to transport all of the sand SCI produces to the Longhorn Basin along the Grand Texas-Sand River. While barges can transport enormous quantities of sand, they fire very slow and take an indirect path to the Longhorn Basin, leading to very long transit times. They are also more vulnerable than rail to weather conditions which cause a change in river levels Southern Region Operational Update - August 2019 Through August, the southem region's performance continued to lag behind other regions due to congestion on the network. The region's average velocity for August was 15.6 mph, short of our velocity goal of 16.2 mph, though up from July's velocity of 15.0 mph. UPRR has invested nearly $700 million in capital YTD on southern region track renewal and capacity projects to help alleviate the heavy congestion on the network. These capital projects have helped improve our velocity from the low of 13.3 mph experienced in March. We expect service levels to continue to improve, as several key capital projects will be completed by the end of November Union Pacific is also employing a strategy of avoiding new service contracts with low-margin customers. This ensures high margin customers' goods are not delayed by congestion caused by low-margin traffic. With the completion of key capital projects and addressing low-margin customers, our goal is to be at a velocity of 17.5 mph by year end. This increase in velocity should increase our on-time shipment rate from 48.3% in August to 55.0% by December Region Southern Northern Western Train Velocity Aug Goal Aug 16.2 15.6 20.6 20.7 21.3 20.7 Jul 15.0 20.4 19.6 YTD 14.2 20.6 21.2 Region Southern Northern Western August Performance Arrival on CAD Re-Crew Consist Time % Dwell Rate 48.3 2.8 2.2 91.3 69.2 2.4 8.9 78.9 80.9 3.2 5.5 88.9 Texas Brown Sand Market Price Index Price per ton Date Closing Price 12/1/15 70.01 12/2/15 74 12/3/15 80.05 12/4/15 71.8 12/5/15 72.17 12/8/15 76.87 12/9/15 79.39 12/10/15 76.41 12/11/15 72.26 12/12/15 75.02 12/15/15 76.66 12/16/15 75.36 12/17/15 72.68 12/18/15 71.26 12/19/15 75.96 12/22/15 74.63 12/23/15 73.89 12/24/15 80.62 12/26/15 74.69 12/29/15 75.64 12/30/15 79.88 12/31/15 71.3 1/2/16 73.65 1/5/16 78.76 1/6/16 80.16 1/7/16 73.68 1/8/16 76.15 1/9/16 72.57 1/12/16 73.24 1/13/16 70.26 1/14/16 71.51 1/15/16 76.9 1/16/16 76.37 Texas Brown Sand Economic Outlook Price per ton Forecast Report Summary: We expect many new Texas sand mines to begin operations throughout 2021 which will drive prices down. Many new mines have already announced their intentions to sell sand as soon as June 2020. Given the demand and estimated cost structures of these mines, we expect the price to stabalize at around $112 through 2022 and 2023. Outlook 5/30/20 $ 123 6/29/20 123 7/30/20 123 8/30/20 128 9/29/20 131 10/30/20 131 11/29/20 126 12/30/20 124 1/30/21 123 2/28/21 123 3/31/21 122 4/30/21 121 5/31/21 120 6/30/21 119 7/31/21 118 8/31/21 118 9/30/21 117 10/31/21 117 11/30/21 115 12/31/21 115 1/31/22 115 2/28/22 113 3/31/22 112 4/30/22 112 5/31/22 112 6/30/22 112 7/31/22 111 8/31/22 111 9/30/22 111 10/31/22 111 11/30/22 112 12/31/22 112 1/31/23 112 2/28/23 113 2021 1 Insert Table Add Category Chart Text Shape Meda Comment Zoom Outlook Competition Version Historical CASE (25) Ship Date Carloads 1/1/16 1/5/16 1/7/16 1/12/16 1/17/16 1/20/16 1/23/16 1/25/16 1/29/16 2/2/16 2/4/16 2/6/16 2/9/16 2/14/16 2/19/16 2/23/16 2/28/16 3/1/16 3/4/16 3/6/16 3/10/16 3/13/16 3/18/16 3/23/16 3/28/16 3/30/16 4/4/16 4/6/16 4/8/16 4/13/16 4/18/16 4/23/16 4/25/16 4/29/16 5/1/16 5/4/16 Weight (Tons) Origin 3 261 LVK 4 385 LVK 4 357 LVK 3 269 LVK 5 458 LVK 8 761 LVK 4 393 LVK 2 185 LVK 8 725 LVK 9 852 LVK 2 193 LVK 4 331 LVK 5 437 LVK 2 176 LVK 5 476 LVK 2 162 LVK 4 352 LVK 3 306 LVK 4 399 LVK 2 213 LVK 1 107 LVK 5 419 LVK 5 494 LVK 2 203 LVK 2 180 LVK 1 98 LVK 5 430 LVK 1 82 LVK 4 356 LVK 2 172 LVK 2 159 LVK 4 395 LVK 1 83 LVK 4 371 LVK 5 486 LVK 4 378 LVK Destination RTN RTN RIN RTN RTN RTN RTN RTN RTN RIN RTN RIN RTN RTN RTN RTN RIN RTN RTN RTN RTN RIN RTN RIN RTN RTN RTN RTN RTN RIN RTN RTN RTN RIN RIN RIN Length of Haul UPRR (Miles) Revenue 325 9,750.00 325 13,000.00 325 13,000.00 325 9,750.00 325 16.250.00 325 26,000.00 325 13,000.00 325 6,500.00 325 26,000.00 325 29,250.00 325 6,500.00 325 13,000.00 325 16,250.00 325 6,500.00 325 16.250.00 325 6,500.00 325 13,000.00 325 9,750.00 325 13,000.00 325 6,500.00 325 3,250.00 325 16,250.00 325 16,250.00 325 6,500.00 325 6,500.00 325 3,250.00 325 16.250.00 325 3.250.00 325 13,000.00 325 6,500.00 325 6,500.00 325 13,000.00 325 3,250.00 325 13,000.00 325 16,250.00 325 13,000.00 UPRR Avg On Time Delivery Cost per Car (Calc (Early) / Late (Hours) Monthly) (15) 2,740 (9) 2,740 24 2,740 (14) 2.740 (27) 2,725 (12) 2,725 18 2,725 33 2,766 2,766 22 2.766 37 2.751 70 2,751 16 2.751 48 2,751 39 2.751 53 2,751 17 2.751 48 2,751 (20) 2,751 9 2,689 (6) 2,689 63 2,689 (18) 2.689 (12) 2,689 42 2,689 (15) 2,689 39 2,689 (2) 2,714 11 2,714 15 2,714 (5) 2,714 (19) 2,714 31 2,714 34 2,714 62 2.714 46 2,714

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock