Question: Unit 1. 1-1.4 Quiz - Form A (24 points) - Review Multiple Choice (1 point each) 1. What are some common payroll deductions? List as

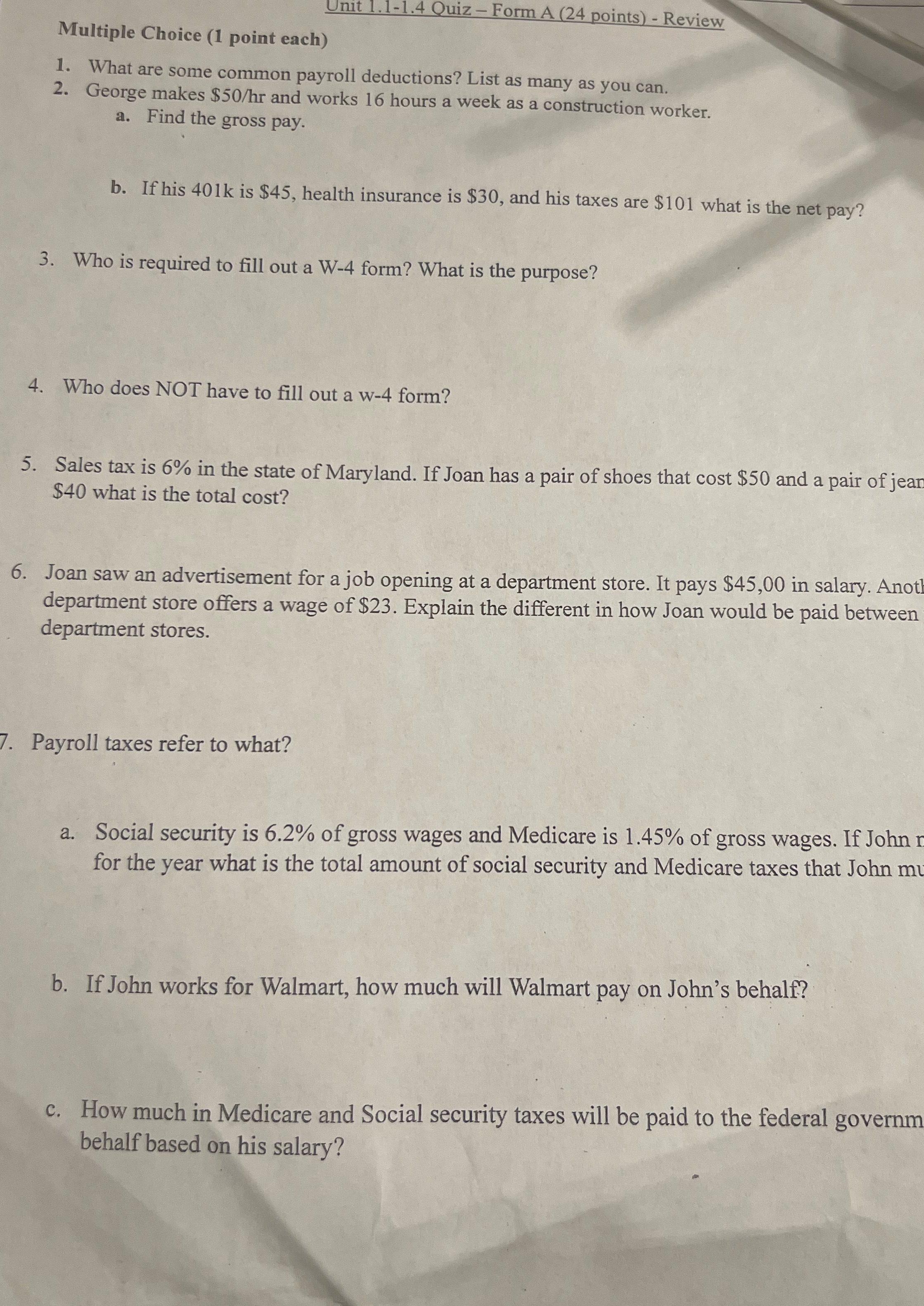

Unit 1. 1-1.4 Quiz - Form A (24 points) - Review Multiple Choice (1 point each) 1. What are some common payroll deductions? List as many as you can. 2. George makes $50/hr and works 16 hours a week as a construction worker. a. Find the gross pay. b. If his 401k is $45, health insurance is $30, and his taxes are $101 what is the net pay? 3. Who is required to fill out a W-4 form? What is the purpose? 4. Who does NOT have to fill out a w-4 form? 5. Sales tax is 6% in the state of Maryland. If Joan has a pair of shoes that cost $50 and a pair of jean $40 what is the total cost? 6. Joan saw an advertisement for a job opening at a department store. It pays $45,00 in salary. Anot department store offers a wage of $23. Explain the different in how Joan would be paid between department stores. Payroll taxes refer to what? a. Social security is 6.2% of gross wages and Medicare is 1.45% of gross wages. If John for the year what is the total amount of social security and Medicare taxes that John mu b. If John works for Walmart, how much will Walmart pay on John's behalf? c. How much in Medicare and Social security taxes will be paid to the federal governm behalf based on his salary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts