Question: Unit 10 Lab Final Project (i Saved Help Save & Exit Submit Check my work 3 Required information Chinson Wayland Peppinico Cooper Hissop Success WCW

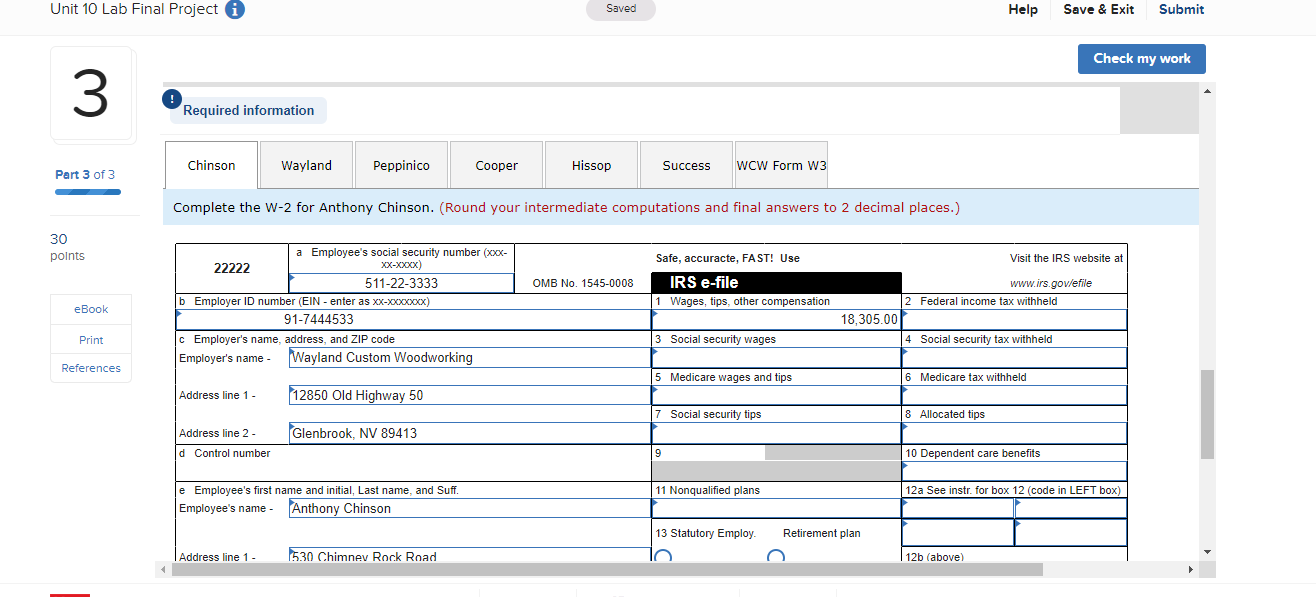

Unit 10 Lab Final Project (i Saved Help Save & Exit Submit Check my work 3 Required information Chinson Wayland Peppinico Cooper Hissop Success WCW Form W3 Part 3 of 3 Complete the W-2 for Anthony Chinson. (Round your intermediate computations and final answers to 2 decimal places.) 30 points a Employee's social security number (xxx- Safe, accurace, FAST! Use Visit the IRS website at 22222 XX-XXXX) 511-22-3333 OMB No. 1545-0008 RS e-file www.irs.gowefile b Employer ID number (EIN - enter as xx-)oxoooox() 1 Wages, tips, other compensation 2 Federal income tax withheld eBook 91-7444533 18,305.00 Print c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld Employer's name - Wayland Custom Woodworking References 5 Medicare wages and tips 6 Medicare tax withheld Address line 1 - 12850 Old Highway 50 7 Social security tips 8 Allocated tips Address line 2 - Glenbrook, NV 89413 d Control number 9 10 Dependent care benefits e Employee's first name and initial, Last name, and Suff. 11 Nonqualified plans 12a See instr. for box 12 (code in LEFT box) Employee's name - Anthony Chinson 13 Statutory Employ. Retirement plan Address line 1 - 530 Chimney Rock Road 12b (above)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts