Question: Unit 2 Assignment: Time Value Money in Everyday Life Due Date: 11:59 pm EST Sunday of Unit 2 Points: 100 Overview: This assignment will give

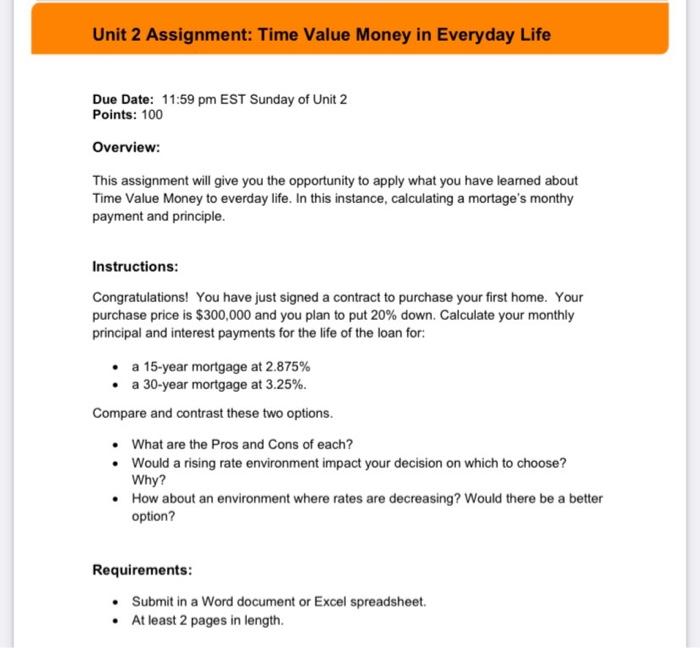

Unit 2 Assignment: Time Value Money in Everyday Life Due Date: 11:59 pm EST Sunday of Unit 2 Points: 100 Overview: This assignment will give you the opportunity to apply what you have leamed about Time Value Money to everday life. In this instance, calculating a mortage's monthy payment and principle. Instructions: Congratulations! You have just signed a contract to purchase your first home. Your purchase price is $300,000 and you plan to put 20% down. Calculate your monthly principal and interest payments for the life of the loan for: - a 15-year mortgage at 2.875% - a 30-year mortgage at 3.25%. Compare and contrast these two options. - What are the Pros and Cons of each? - Would a rising rate environment impact your decision on which to choose? Why? - How about an environment where rates are decreasing? Would there be a better option? Requirements: - Submit in a Word document or Excel spreadsheet. - At least 2 pages in length

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts