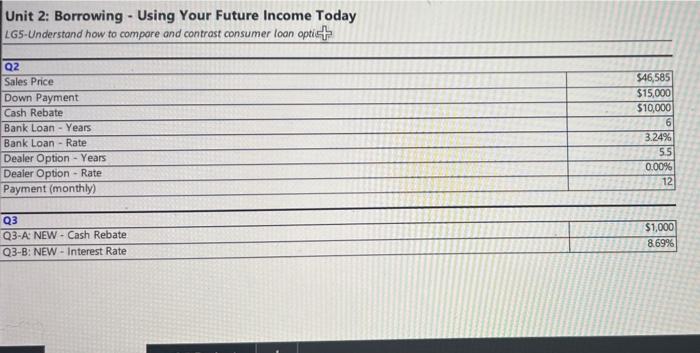

Question: Unit 2: Borrowing - Using Your Future Income Today LG5-Understand how to compore and controst consumer loan opti } Application Timel jessica would like to

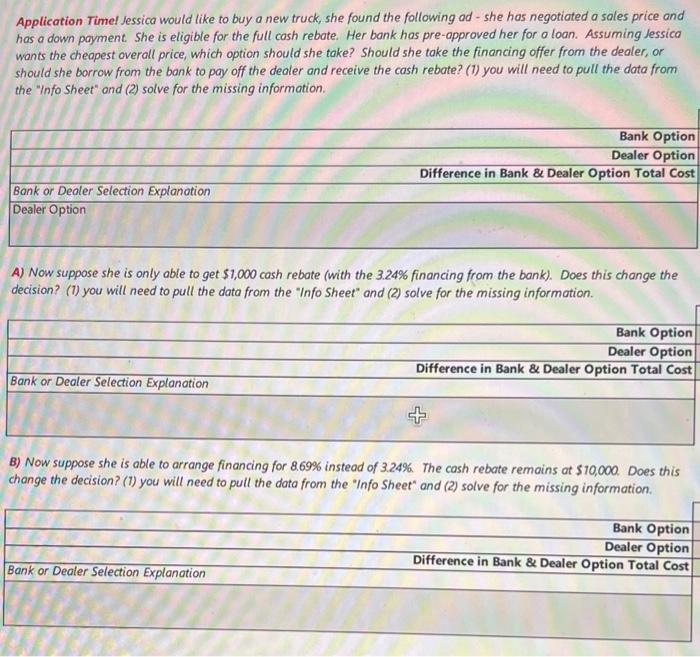

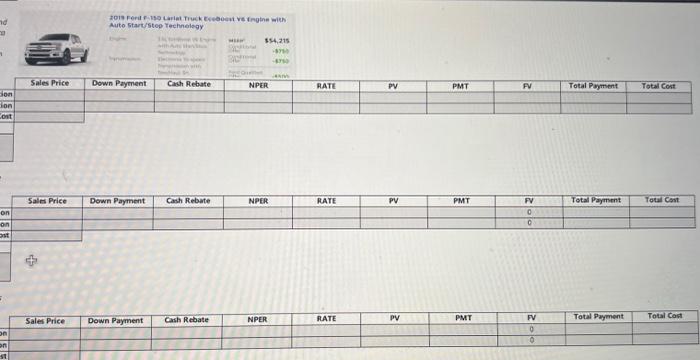

Unit 2: Borrowing - Using Your Future Income Today LG5-Understand how to compore and controst consumer loan opti } Application Timel jessica would like to buy a new truck, she found the following ad - she has negotiated a sales price and hos a down payment. She is eligible for the full cash rebate. Her bank has pre-approved her for a loan. Assuming lessica wants the cheopest overall price, which option should she take? Should she take the financing offer from the dealer, or should she borrow from the bank to pay off the dealer and receive the cash rebate? (1) you will need to pull the data from the "Info Sheet" and (2) solve for the missing information. A) Now suppose she is only able to get $1,000 cash rebate (with the 3.24% financing from the bank). Does this change the decision? (1) you will need to pull the data from the "Info Sheet" and (2) solve for the missing information. B) Now suppose she is able to arrange financing for 8.69% instead of 3.24%. The cash rebate remains at $10,000. Does this change the decision? (1) you will need to pull the data from the "Info Sheet" and (2) solve for the missing information. tois Forit risis Lariet Thuck Eweooent ve fingtie ath Muto Startisteo Technelegy Unit 2: Borrowing - Using Your Future Income Today LG5-Understand how to compore and controst consumer loan opti } Application Timel jessica would like to buy a new truck, she found the following ad - she has negotiated a sales price and hos a down payment. She is eligible for the full cash rebate. Her bank has pre-approved her for a loan. Assuming lessica wants the cheopest overall price, which option should she take? Should she take the financing offer from the dealer, or should she borrow from the bank to pay off the dealer and receive the cash rebate? (1) you will need to pull the data from the "Info Sheet" and (2) solve for the missing information. A) Now suppose she is only able to get $1,000 cash rebate (with the 3.24% financing from the bank). Does this change the decision? (1) you will need to pull the data from the "Info Sheet" and (2) solve for the missing information. B) Now suppose she is able to arrange financing for 8.69% instead of 3.24%. The cash rebate remains at $10,000. Does this change the decision? (1) you will need to pull the data from the "Info Sheet" and (2) solve for the missing information. tois Forit risis Lariet Thuck Eweooent ve fingtie ath Muto Startisteo Technelegy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts