Question: Unit 2 Test - Chapters 4-5 i Saved Help Save & Exit Submit 3 Cortez Company sells chairs that are used at computer stations. Its

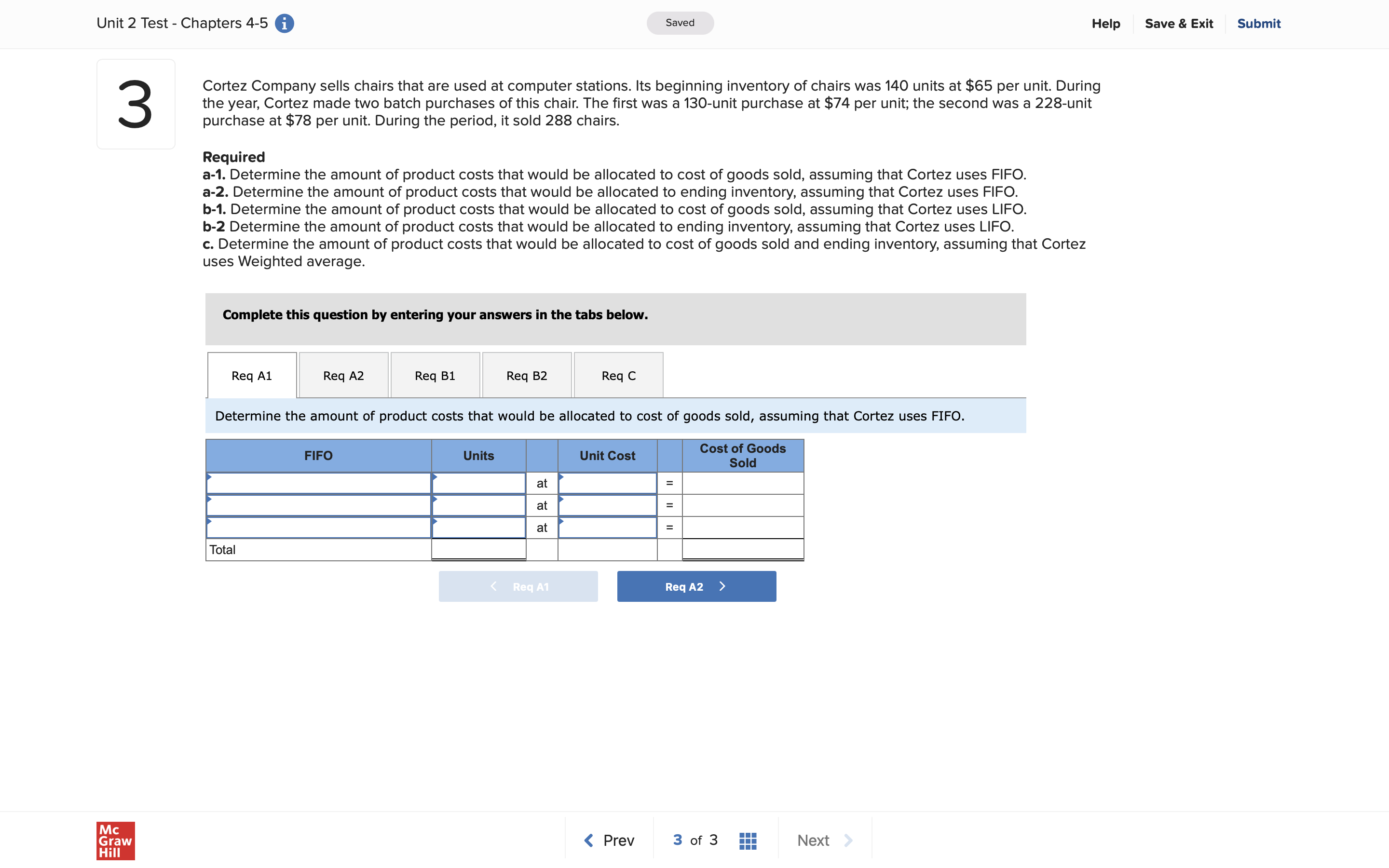

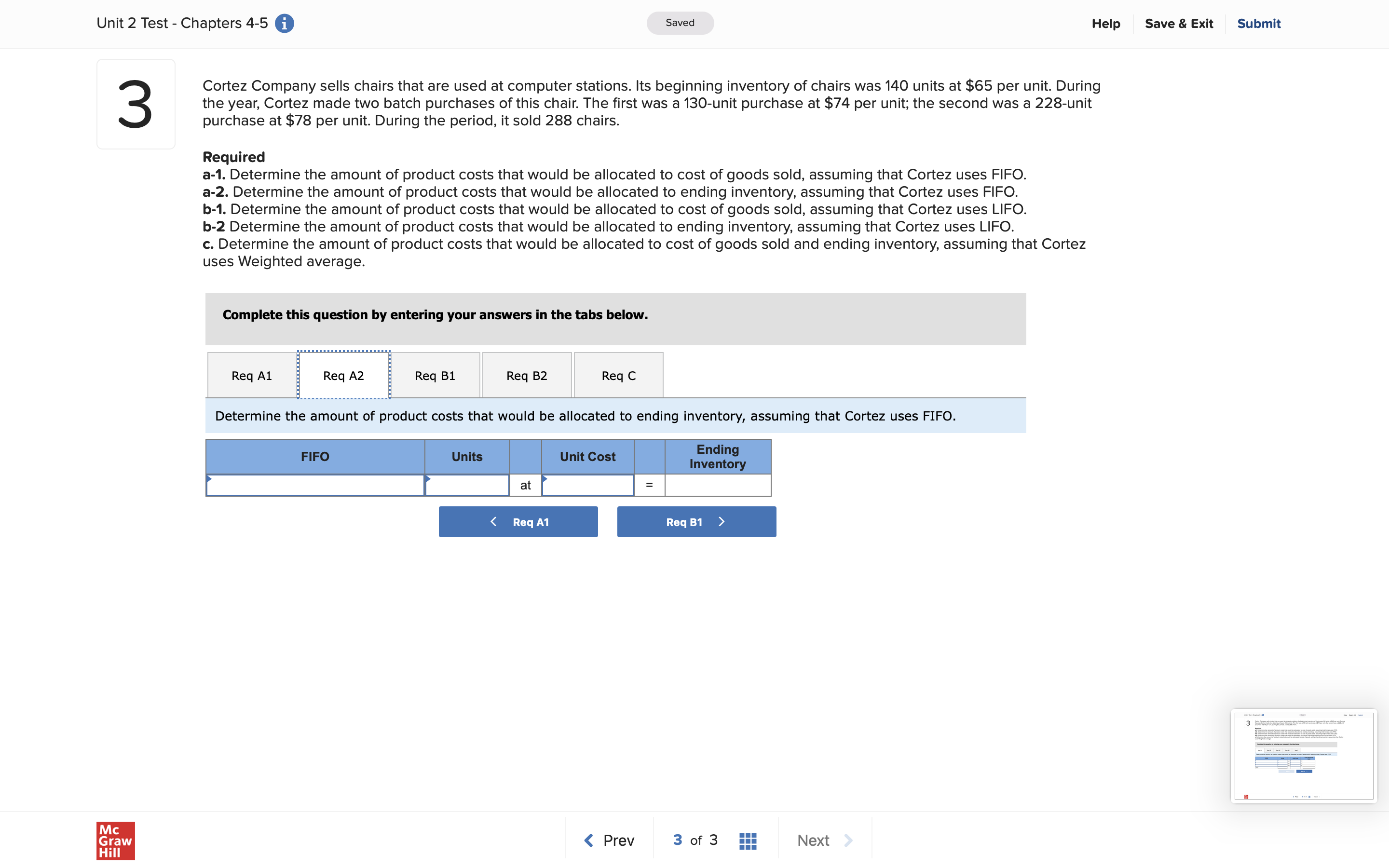

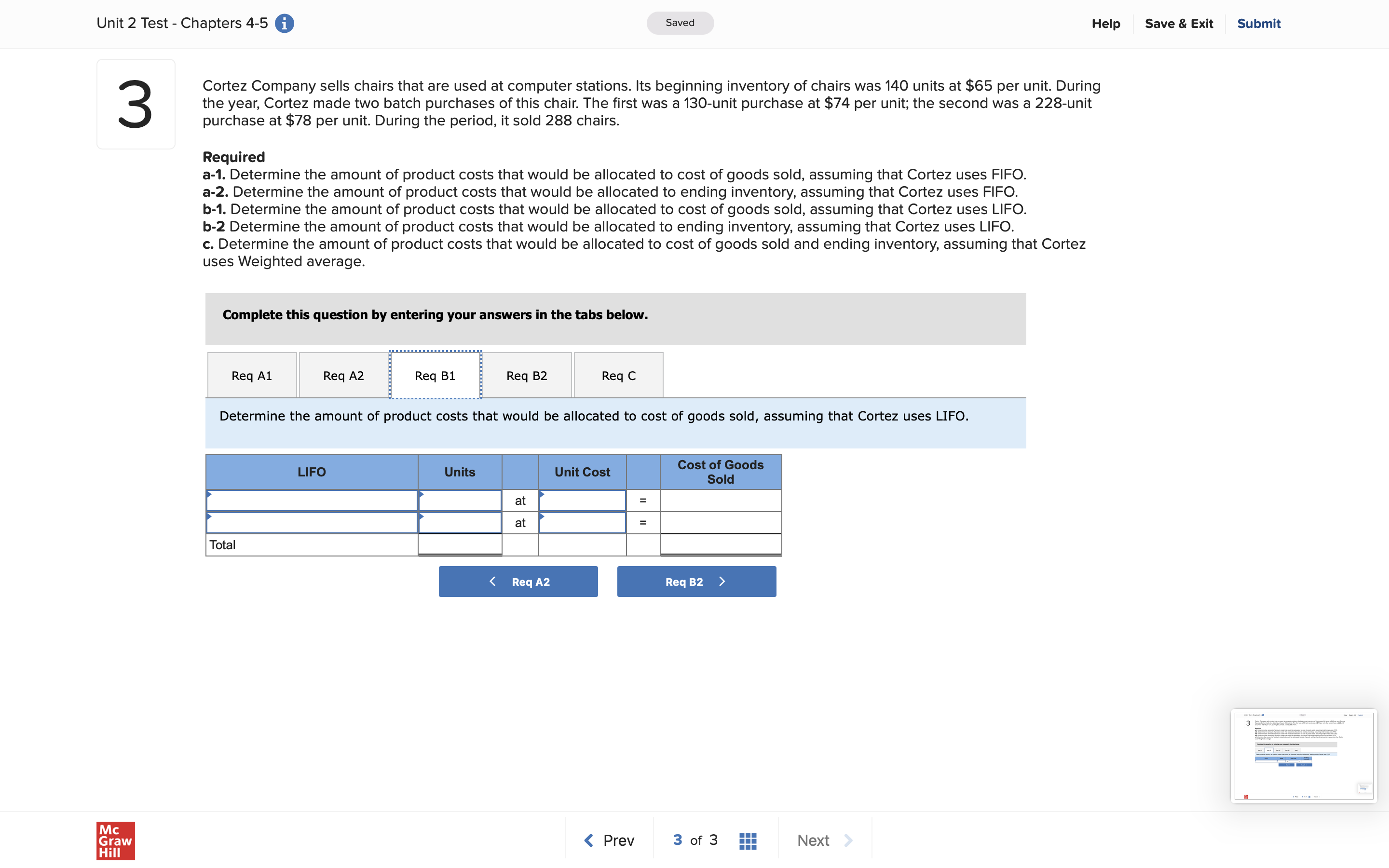

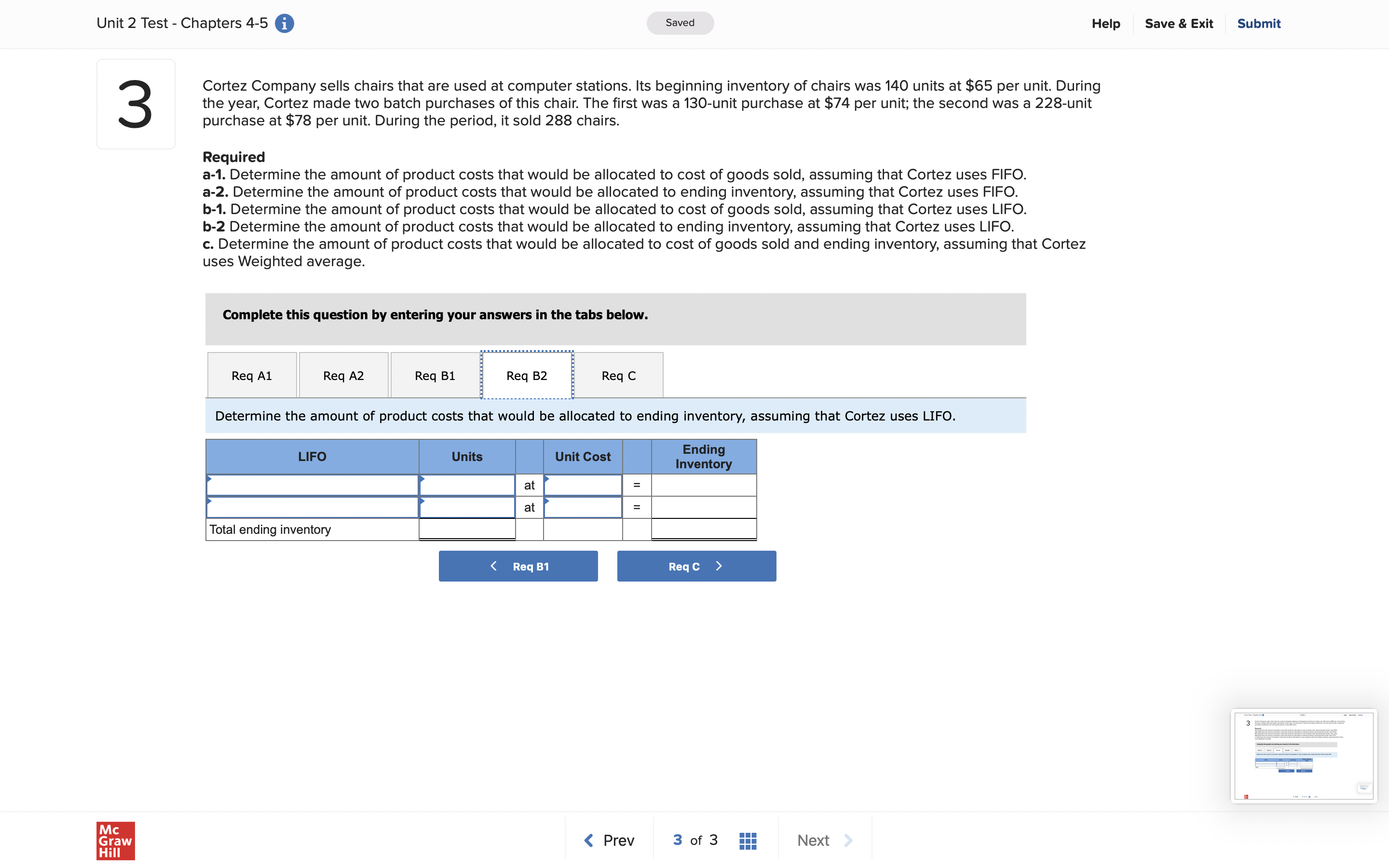

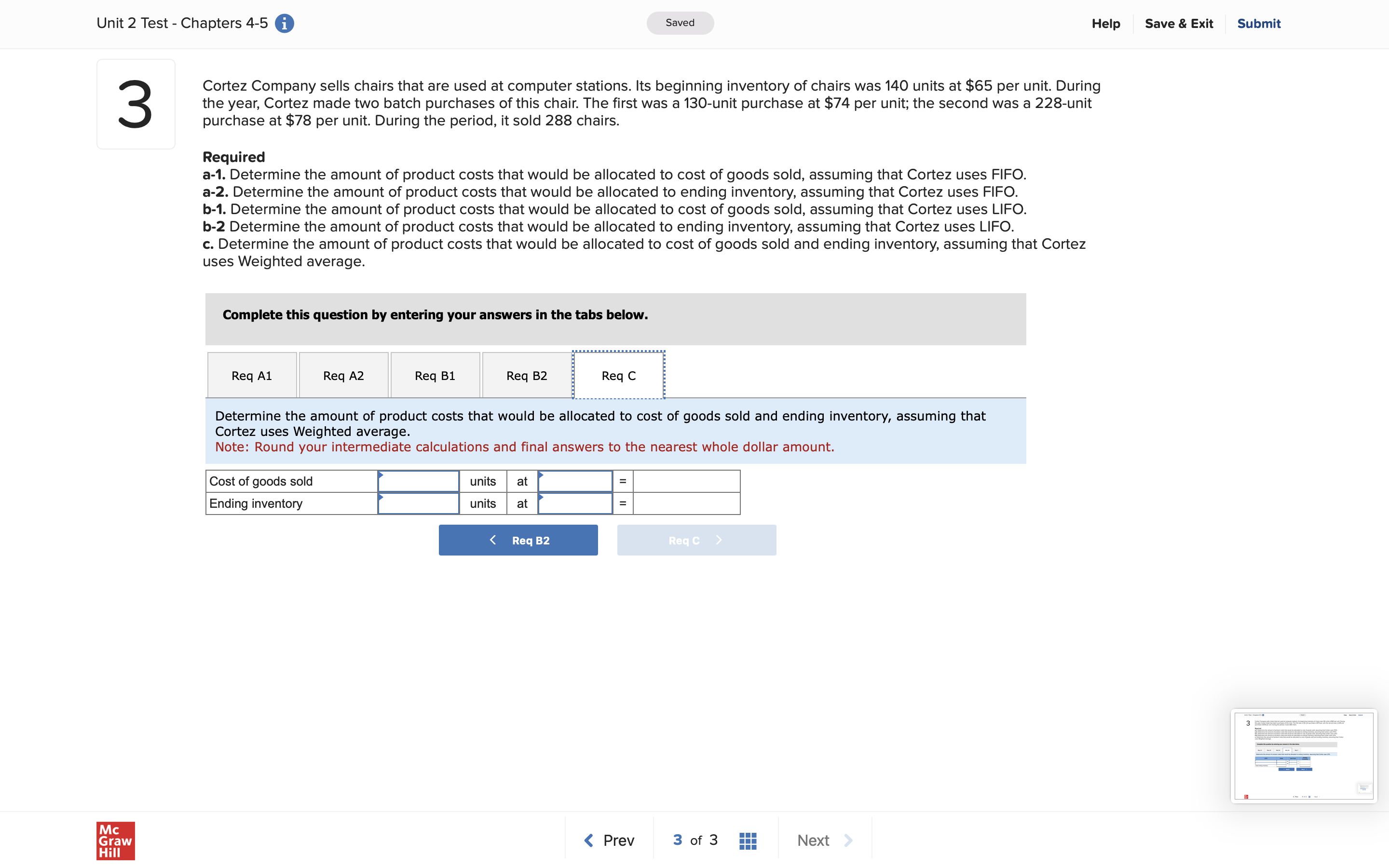

Unit 2 Test - Chapters 4-5 i Saved Help Save & Exit Submit 3 Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 140 units at $65 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 130-unit purchase at $74 per unit; the second was a 228-unit purchase at $78 per unit. During the period, it sold 288 chairs. Required a-1. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses FIFO. a-2. Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses FIFO. b-1. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses LIFO. b-2 Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses LIFO. c. Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses Weighted average. Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B1 Req B2 Req C Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses FIFO. FIFO Cost of Goods Units Unit Cost Sold at = at 11 11 at Tota HillUnit 2 Test - Chapters 4-5 i Saved Help Save & Exit Submit 3 Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 140 units at $65 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 130-unit purchase at $74 per unit; the second was a 228-unit purchase at $78 per unit. During the period, it sold 288 chairs. Required a-1. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses FIFO. a-2. Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses FIFO. b-1. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses LIFO. b-2 Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses LIFO. c. Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses Weighted average. Complete this question by entering your answers in the tabs below. Req Al Req A2 Req B1 Req B2 Req C Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses FIFO. FIFO Units Unit Cost Ending Inventory at = Req B1 > Mc Graw HillUnit 2 Test - Chapters 4-5 i Saved Help Save & Exit Submit 3 Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 140 units at $65 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 130-unit purchase at $74 per unit; the second was a 228-unit purchase at $78 per unit. During the period, it sold 288 chairs. Required a-1. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses FIFO. a-2. Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses FIFO. b-1. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses LIFO. b-2 Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses LIFO. c. Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses Weighted average. Complete this question by entering your answers in the tabs below. Req Al Req A2 Req B1 Req B2 Req C Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses LIFO. LIFO Units Unit Cost Cost of Goods Sold at = at Total Req B2 > Mc Graw HillUnit 2 Test - Chapters 45 0 Saved He", 3 Cortez Company sells chairs that are used at computer stations' Its beginning inventory of chairs was 140 units at $65 per unit. During the year, Cortez made two batch purchases of this chair. The rst was a 130-unit purchase at $74 per unit; the second was a 228-unit purchase at $78 per unit. During the period, it sold 288 chairs. Required a-1. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses FIFO. 8-2. Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses FIFO. b-1. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses LIFO. b-2 Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses LIFOt c. Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses Weighted average. Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req Bl Req B2 Req c Total ending inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts