Question: | Unit - 3 Assignment Chapter 5 ( Introduction to Valuation: The TVM ) Answer all questions: 1 . Suppose you deposit (

Unit Assignment

Chapter Introduction to Valuation: The TVM

Answer all questions:

Suppose you deposit $ today t in a bank account that pays an interest rate of per year. If you keep the account for years before you withdraw all the money, how much will you be able to withdraw after years?

Find the present value of a security that will pay $ in years. The opportunity cost interest rate that you could earn from alternative investments is per year.

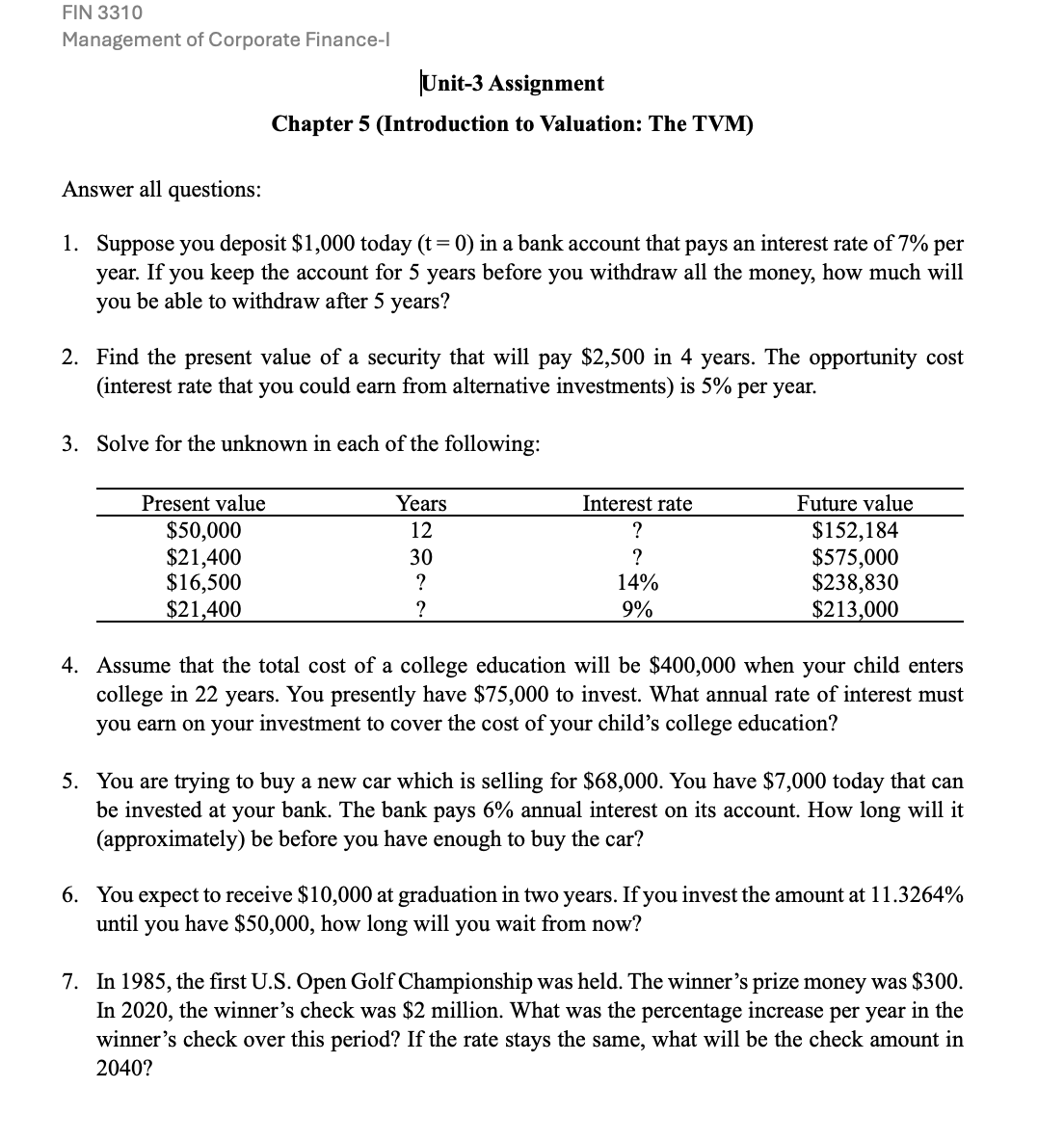

Solve for the unknown in each of the following:

Assume that the total cost of a college education will be $ when your child enters college in years. You presently have $ to invest. What annual rate of interest must you earn on your investment to cover the cost of your child's college education?

You are trying to buy a new car which is selling for $ You have $ today that can be invested at your bank. The bank pays annual interest on its account. How long will it approximately be before you have enough to buy the car?

You expect to receive $ at graduation in two years. If you invest the amount at until you have $ how long will you wait from now?

In the first US Open Golf Championship was held. The winner's prize money was $ In the winner's check was $ million. What was the percentage increase per year in the winner's check over this period? If the rate stays the same, what will be the check amount in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock