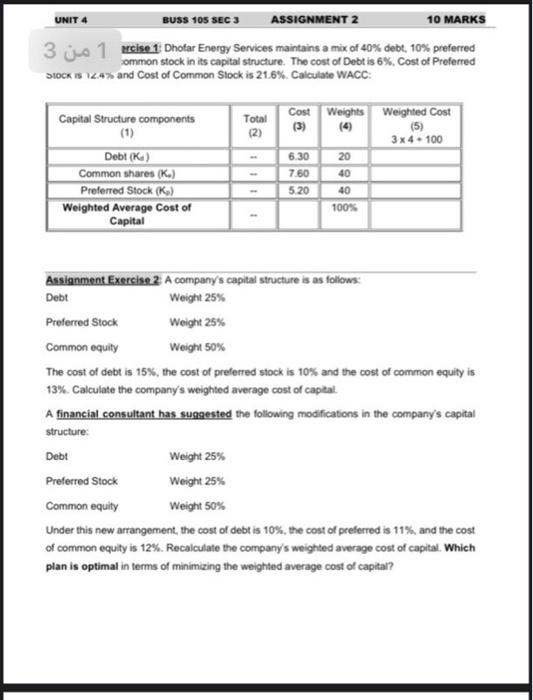

Question: UNIT 4 BUSS 105 SEC 3 ASSIGNMENT 2 10 MARKS 3 ja 1 1 % ommon stock in its capital structure. The cost of Debt

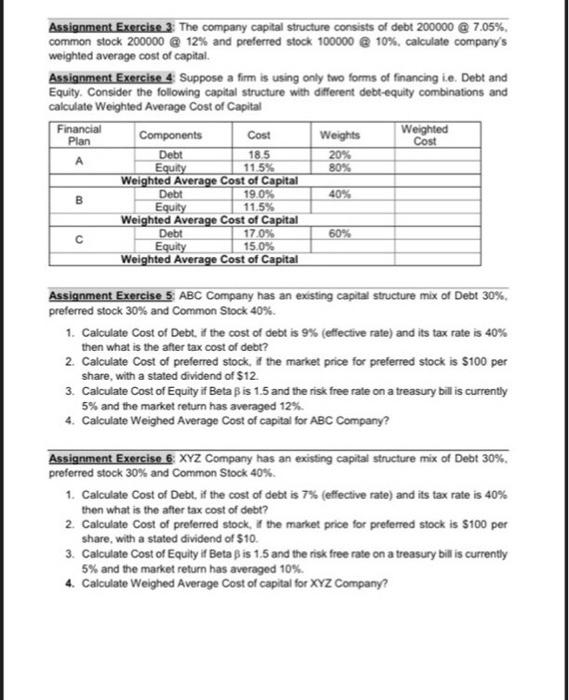

UNIT 4 BUSS 105 SEC 3 ASSIGNMENT 2 10 MARKS 3 ja 1 1 % ommon stock in its capital structure. The cost of Debt is 6%, Cost of Preferred STOCKiS 12.4% and Cost of Common Stock is 216%. Calculate WACC: Capital Structure components Total (2) Cost Weights Weighted Cost (3) (5) 3 x 4.100 6.30 7.60 40 5.20 40 100% Debt (K) Common shares (K) Preferred Stock (K) Weighted Average Cost of Capital 20 Assignment Exercise 2 A company's capital structure is as follows: Debt Weight 25% Preferred Stock Weight 25% Common equity Weight 50% The cost of debt is 15%, the cost of preferred stock is 10% and the cost of common equity is 13%. Calculate the company's weighted average cost of capital A financial consultant has suggested the following modifications in the company's capital structure: Debt Weight 25% Preferred Stock Weight 25% Common equity Weight 50% Under this new arrangement, the cost of debt is 10%, the cost of preferred is 11%, and the cost of common equity is 12%. Recalculate the company's weighted average cost of capital. Which plan is optimal in terms of minimizing the weighted average cost of capital? Assignment Exercise 3 The company capital structure consists of debt 200000 @ 7.05%. common stock 200000 @ 12% and preferred stock 100000 @ 10%, calculate company's weighted average cost of capital. Assignment Exercise 4 Suppose a firm is using only two forms of financing ie Debt and Equity. Consider the following capital structure with different debt-equity combinations and calculate Weighted Average Costo of Capital Financial Components Cost Weights Weighted Cost Debt 18.5 20% Equity 11.5% Weighted Average Cost of Capital 19.0% 40% Equity 11.5% Weighted Average Cost of Capital Debt 170% 60% Equity 15.0% Weighted Average Cost of Capital Plan 80% Debt B Assignment Exercise 5 ABC Company has an existing capital structure mix of Debt 30%, preferred stock 30% and Common Stock 40%. 1. Calculate Cost of Debt. if the cost of debt is 9% (effective rate) and its tax rate is 40% then what is the after tax cost of debt? 2. Calculate Cost of preferred stock, if the market price for preferred stock is $100 per share, with a stated dividend of $12 3. Calculate Cost of Equity if Beta Bis 1.5 and the risk free rate on a treasury bill is currently 5% and the market return has averaged 12% 4. Calculate Weighed Average cost of capital for ABC Company? Assignment Exercise 6 XYZ Company has an existing capital structure mix of Debt 30%. preferred stock 30% and Common Stock 40% 1. Calculate Cost of Debt, if the cost of debt is 7% (effective rate) and its tax rate is 40% then what is the after tax cost of debt? 2. Calculate Cost of preferred stock, the market price for preferred stock is $100 per share, with a stated dividend of $10. 3. Calculate Cost of Equity if Beta is 1.5 and the risk free rate on a treasury bill is currently 5% and the market return has averaged 10% 4. Calculate Weighed Average cost of capital for XYZ Company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts