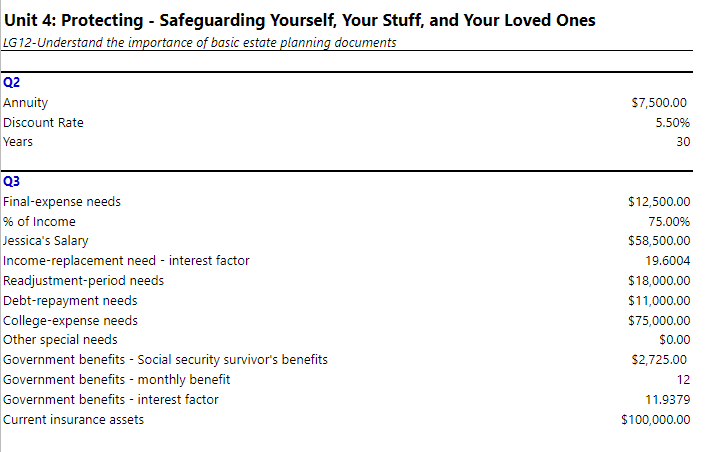

Question: Unit 4: Protecting - Safeguarding Yourself, Your Stuff, and Your Loved Ones LG 12-Understand the importance of basic estate planning documents Q2 Annuity Discount Rate

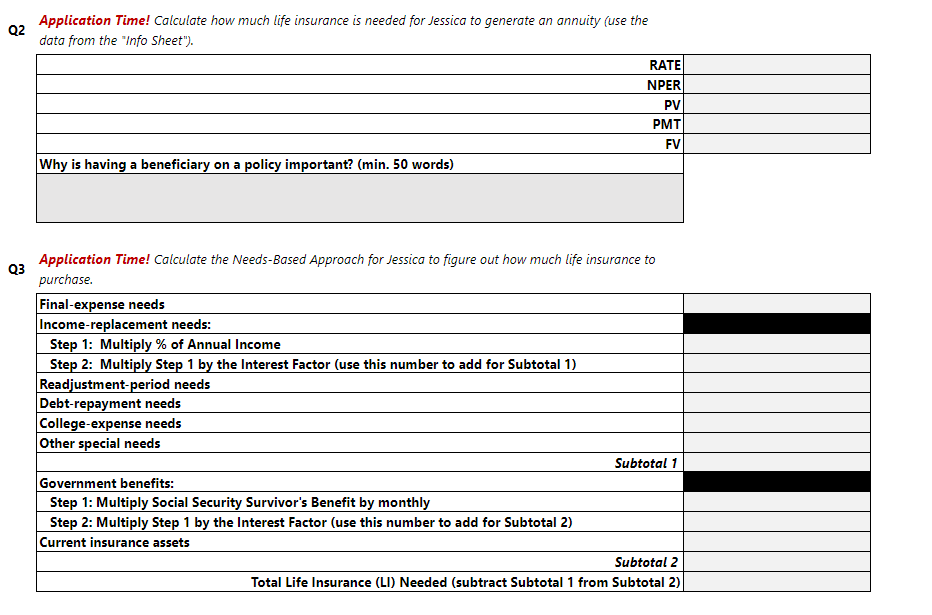

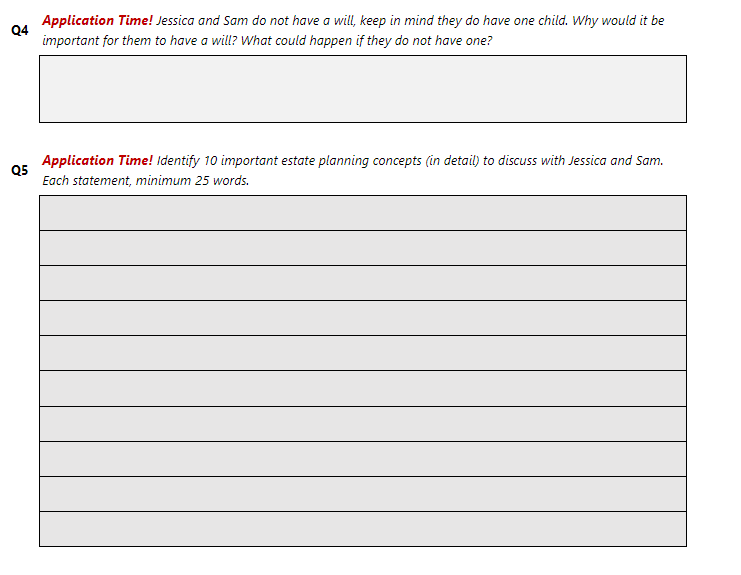

Unit 4: Protecting - Safeguarding Yourself, Your Stuff, and Your Loved Ones LG 12-Understand the importance of basic estate planning documents Q2 Annuity Discount Rate Years $7,500.00 5.50% 30 - Q3 Final-expense needs % of Income Jessica's Salary Income-replacement need - interest factor Readjustment-period needs Debt-repayment needs College-expense needs Other special needs Government benefits - Social security survivor's benefits Government benefits - monthly benefit Government benefits - interest factor Current insurance assets $12,500.00 75.00% $58,500.00 19.6004 $18,000.00 $11,000.00 $75,000.00 $0.00 $2,725.00 12 11.9379 $100,000.00 Q2 Application Time! Calculate how much life insurance is needed for Jessica to generate an annuity (use the data from the "Info Sheet"). RATE NPER PV PMT FV Why is having a beneficiary on a policy important? (min. 50 words) Q3 Application Time! Calculate the Needs-Based Approach for Jessica to figure out how much life insurance to purchase. Final-expense needs Income-replacement needs: Step 1: Multiply % of Annual Income Step 2: Multiply Step 1 by the Interest Factor (use this number to add for Subtotal 1) Readjustment period needs Debt-repayment needs College-expense needs Other special needs Subtotal 1 Government benefits: Step 1: Multiply Social Security Survivor's Benefit by monthly Step 2: Multiply Step 1 by the Interest Factor (use this number to add for Subtotal 2) Current insurance assets Subtotal 2 Total Life Insurance (LI) Needed (subtract Subtotal 1 from Subtotal 2) Q4 Application Time! Jessica and Sam do not have a will, keep in mind they do have one child. Why would it be important for them to have a will? What could happen if they do not have one? Q5 Application Time! Identify 10 important estate planning concepts (in detail) to discuss with Jessica and Sam. Each statement, minimum 25 words. Unit 4: Protecting - Safeguarding Yourself, Your Stuff, and Your Loved Ones LG 12-Understand the importance of basic estate planning documents Q2 Annuity Discount Rate Years $7,500.00 5.50% 30 - Q3 Final-expense needs % of Income Jessica's Salary Income-replacement need - interest factor Readjustment-period needs Debt-repayment needs College-expense needs Other special needs Government benefits - Social security survivor's benefits Government benefits - monthly benefit Government benefits - interest factor Current insurance assets $12,500.00 75.00% $58,500.00 19.6004 $18,000.00 $11,000.00 $75,000.00 $0.00 $2,725.00 12 11.9379 $100,000.00 Q2 Application Time! Calculate how much life insurance is needed for Jessica to generate an annuity (use the data from the "Info Sheet"). RATE NPER PV PMT FV Why is having a beneficiary on a policy important? (min. 50 words) Q3 Application Time! Calculate the Needs-Based Approach for Jessica to figure out how much life insurance to purchase. Final-expense needs Income-replacement needs: Step 1: Multiply % of Annual Income Step 2: Multiply Step 1 by the Interest Factor (use this number to add for Subtotal 1) Readjustment period needs Debt-repayment needs College-expense needs Other special needs Subtotal 1 Government benefits: Step 1: Multiply Social Security Survivor's Benefit by monthly Step 2: Multiply Step 1 by the Interest Factor (use this number to add for Subtotal 2) Current insurance assets Subtotal 2 Total Life Insurance (LI) Needed (subtract Subtotal 1 from Subtotal 2) Q4 Application Time! Jessica and Sam do not have a will, keep in mind they do have one child. Why would it be important for them to have a will? What could happen if they do not have one? Q5 Application Time! Identify 10 important estate planning concepts (in detail) to discuss with Jessica and Sam. Each statement, minimum 25 words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts