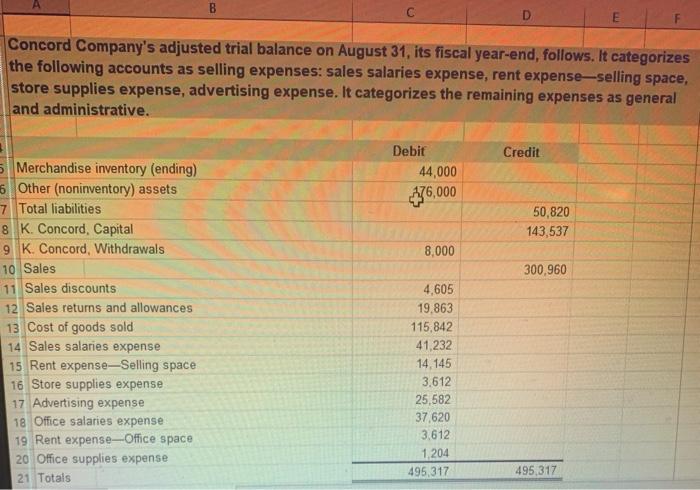

Question: unit 5 E Concord Company's adjusted trial balance on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries

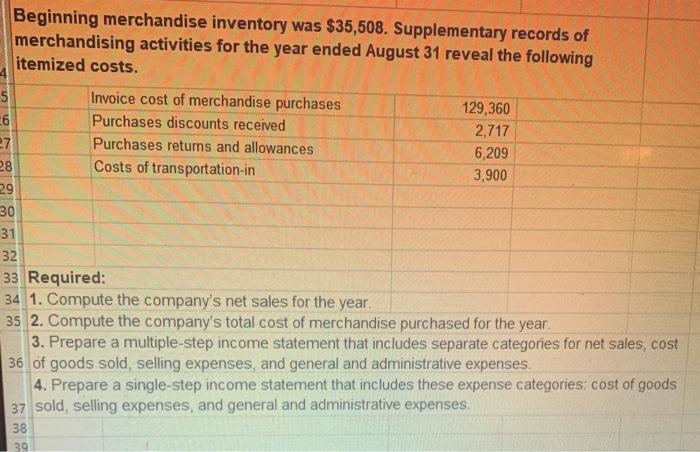

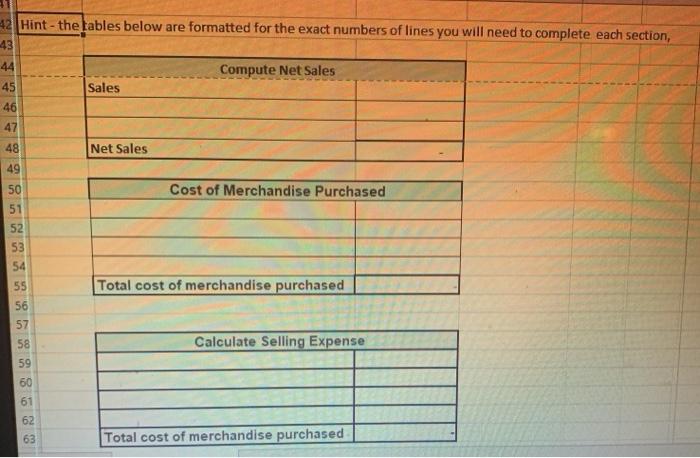

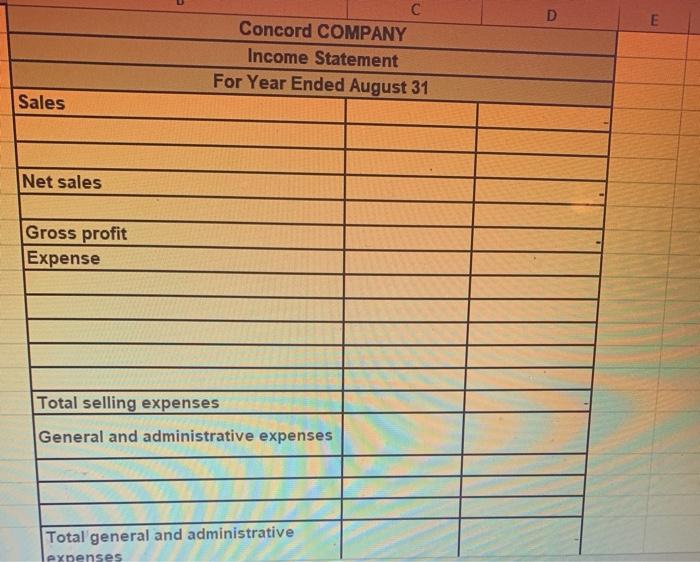

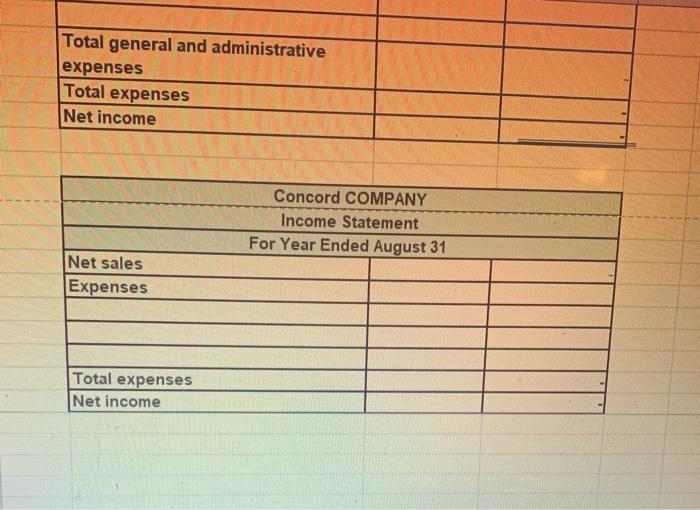

E Concord Company's adjusted trial balance on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, advertising expense. It categorizes the remaining expenses as general and administrative. Credit Debit 44,000 476,000 50,820 143,537 8,000 300,960 5 Merchandise inventory (ending) 6 Other (noninventory) assets 7 Total liabilities 8 K. Concord, Capital 9 K. Concord, Withdrawals 10 Sales 11 Sales discounts 12 Sales returns and allowances 13 Cost of goods sold 14 Sales salaries expense 15 Rent expense-Selling space 16 Store supplies expense 17 Advertising expense 18 Office salaries expense 19 Rent expense-Office space 20 Office supplies expense 21 Totals 4,605 19,863 115,842 41,232 14 145 3,612 25,582 37,620 3.612 1204 495, 317 495,317 Beginning merchandise inventory was $35,508. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. 5 Invoice cost of merchandise purchases 129,360 6 Purchases discounts received 2,717 27 Purchases returns and allowances 6,209 28 Costs of transportation-in 3,900 29 30 31 32 33 Required: 34 1. Compute the company's net sales for the year. 35 2. Compute the company's total cost of merchandise purchased for the year 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost 36 of goods sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods 37 sold, selling expenses, and general and administrative expenses 38 39 42 Hint - the tables below are formatted for the exact numbers of lines you will need to complete each section, 43 44 Compute Net Sales 45 Sales 46 47 48 Net Sales 49 50 Cost of Merchandise Purchased 51 52 53 54 Total cost of merchandise purchased 55 56 57 58 59 Calculate Selling Expense 60 61 62 63 Total cost of merchandise purchased D E C Concord COMPANY Income Statement For Year Ended August 31 Sales Net sales Gross profit Expense Total selling expenses General and administrative expenses Total general and administrative expenses Total general and administrative expenses Total expenses Net income Concord COMPANY Income Statement For Year Ended August 31 Net sales Expenses Total expenses Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts