Question: Unit# 6 - Problem 10-27 - Part F Hamilton and Battles, Ltd. produces and sells two productsguitar cases and violin cases. Each of these products

Unit# 6 - Problem 10-27 - Part F

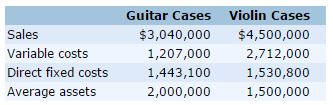

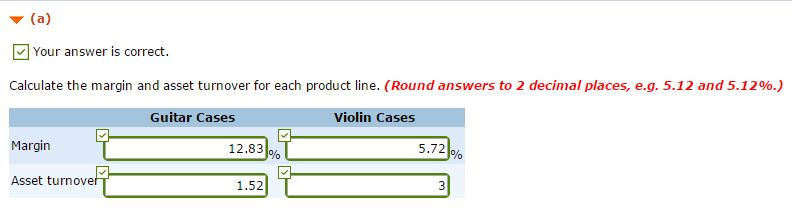

Hamilton and Battles, Ltd. produces and sells two productsguitar cases and violin cases. Each of these products is made in a dedicated manufacturing facility, and the product line managers are evaluated based on the product lines return on investment. The following data is from the most recent year of operations.

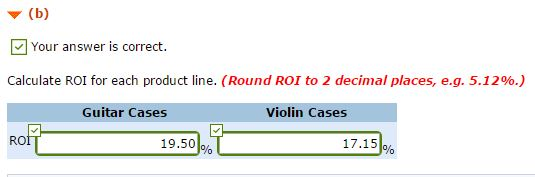

C - Both product line managers would like to improve their respective returns on investment, and each manager has a different idea about how to accomplish this. If the guitar case product line manager was able to increase sales volume such that the new asset turnover was 1.75 times. What would be the new operating income? (Round variable cost ratio to 2 decimal places, e.g. 5.25 and final answers to 0 decimal places, e.g. 12,500.)

D - If the guitar case product line manager was able to increase sales volume such that the new asset turnover was 1.75 times, what would be the new return on investment? (Round ROI to 2 decimal places, e.g. 5.12%.)

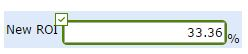

E - Both product line managers would like to improve their respective returns on investment, and each manager has a different idea about how to accomplish this. If the violin case product manager was able to reduce variable costs by 5%, what would be the new operating income? (Round Operating income to 0 decimal places, e.g. 12,500.)

Please answer - F - If the violin case product manager was able to reduce variable costs by 5%, what would be the new return on investment? (Round ROI to 2 decimal places, e.g. 5.12%.)

Guitar Cases Violin Cases Sales $3,040,000 $4,500,000 Variable costs 1,207,000 2,712,000 Direct fixed costs 1,443,100 1,530,800 2,000,000 1,500,000 Average assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts