Question: Unit 9 Lab Assignmen X WP NWP Assessment Pla X AC114 - Unit 9 Lab.do x S Document Upload | St x Course Hero X

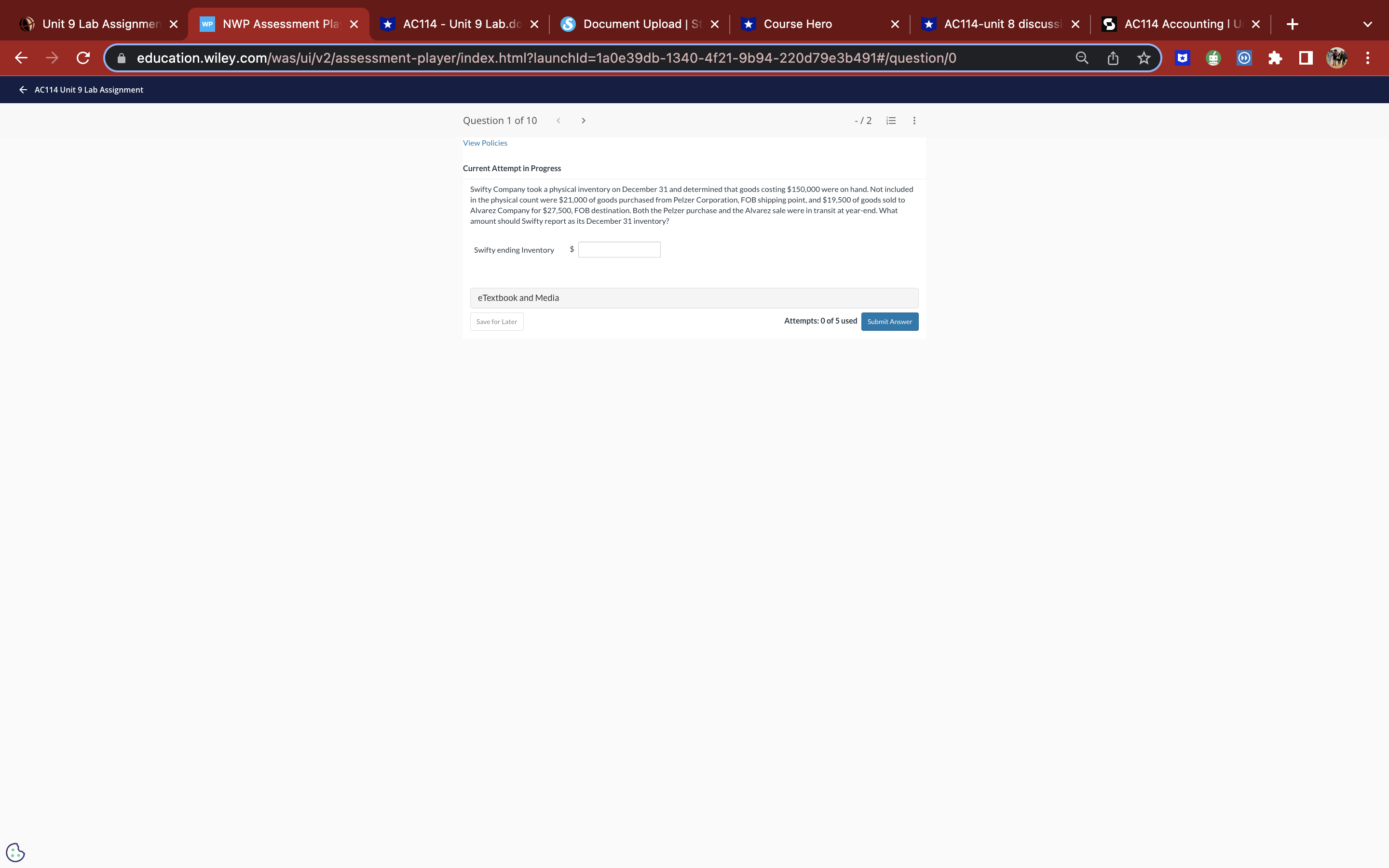

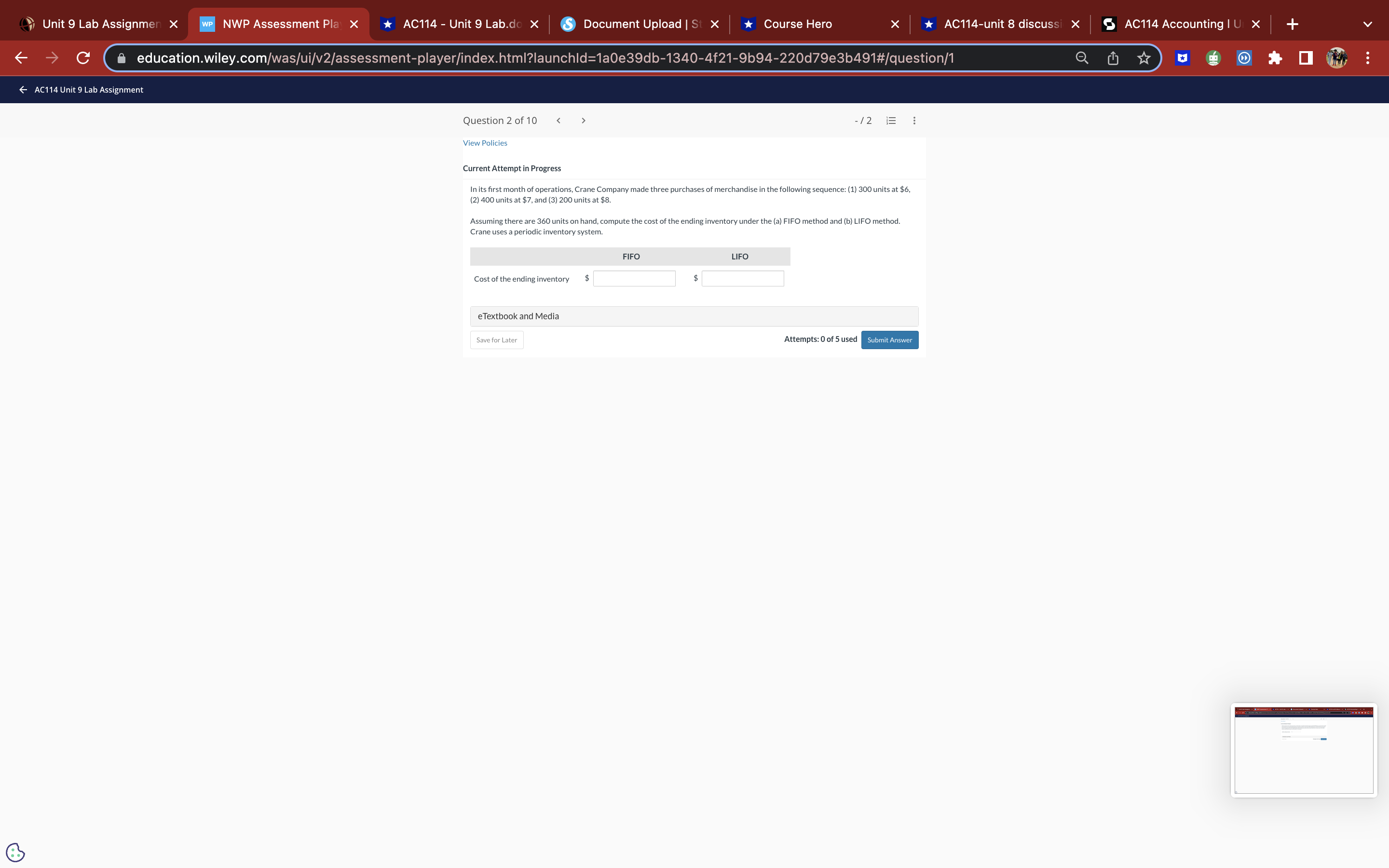

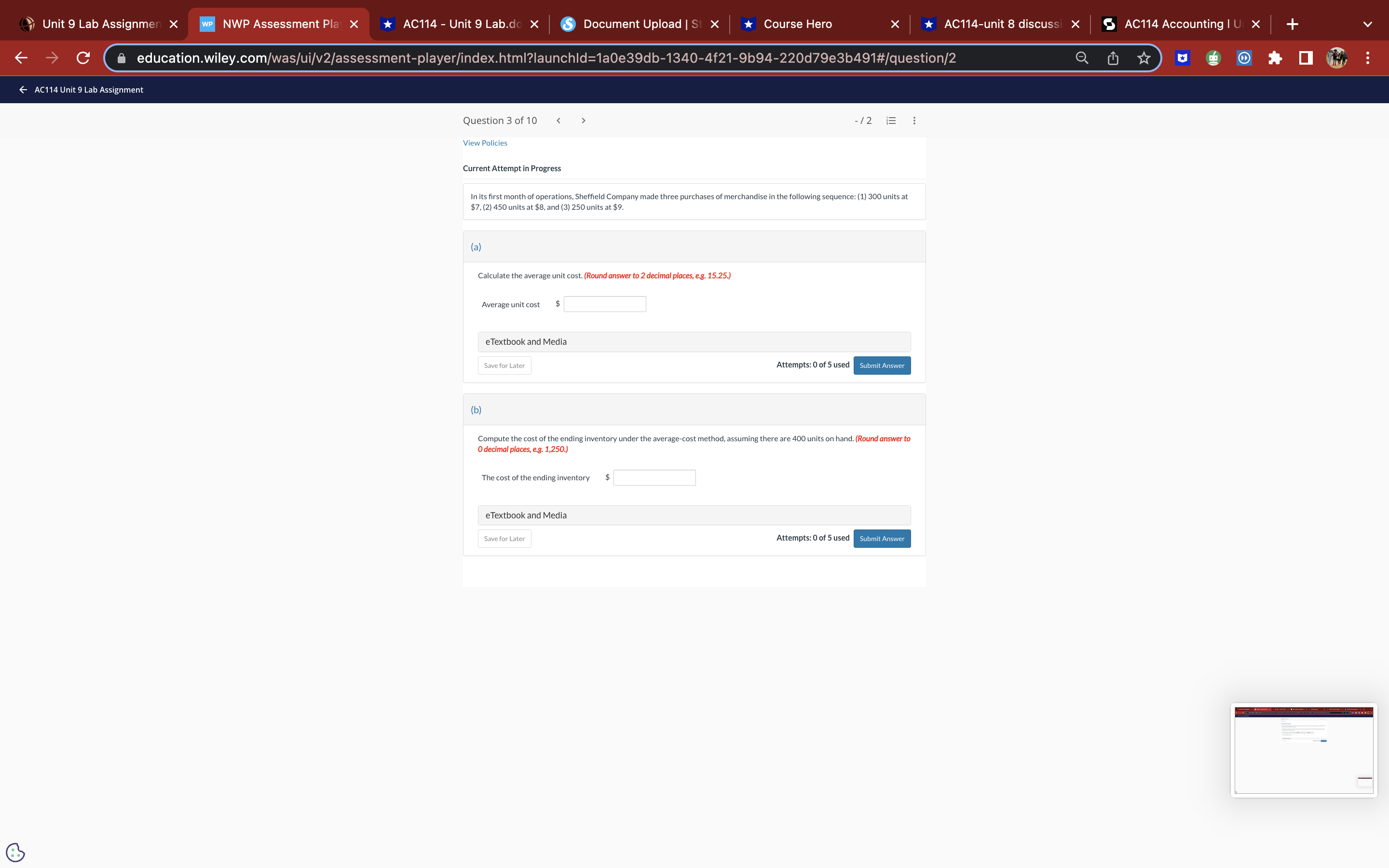

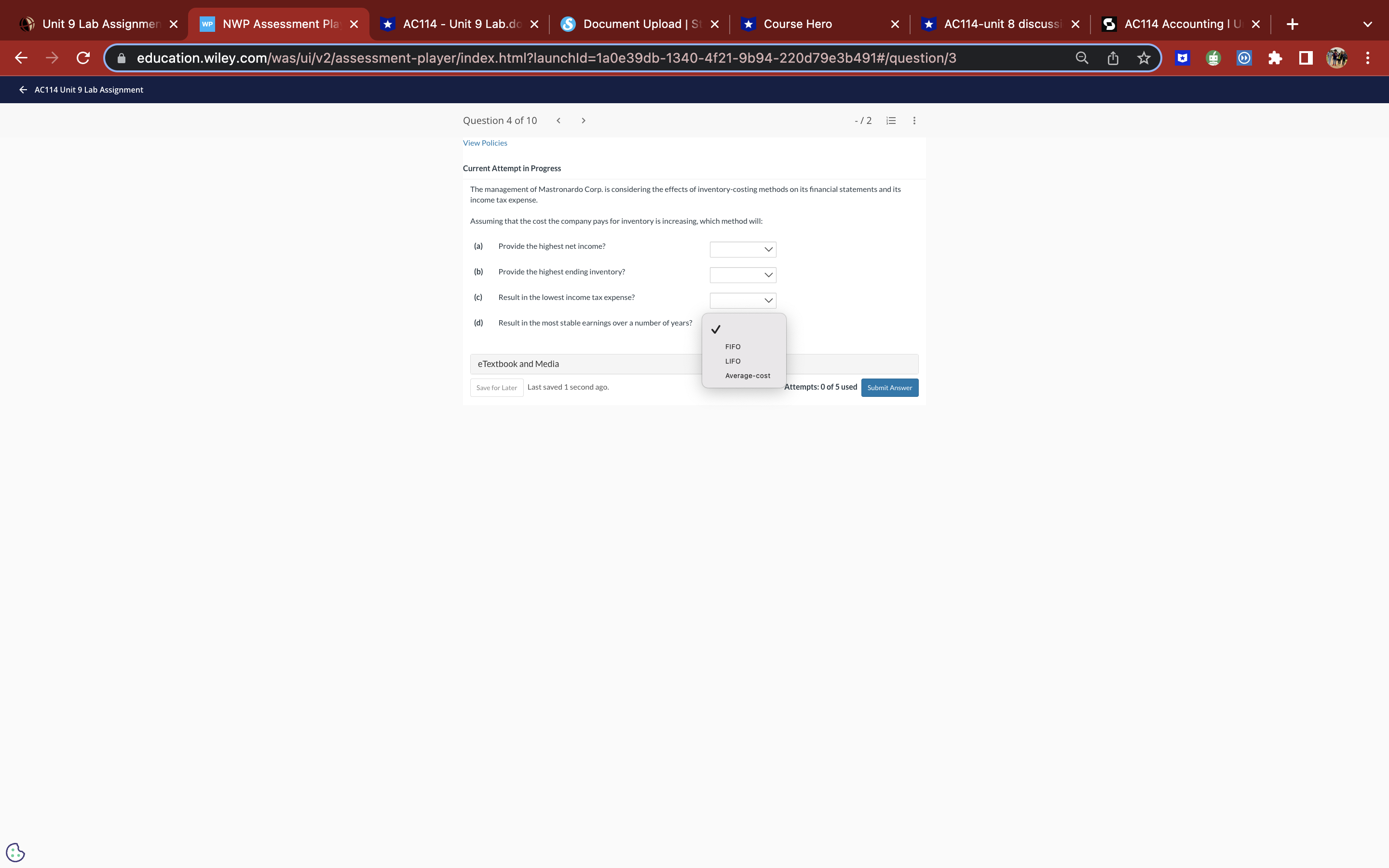

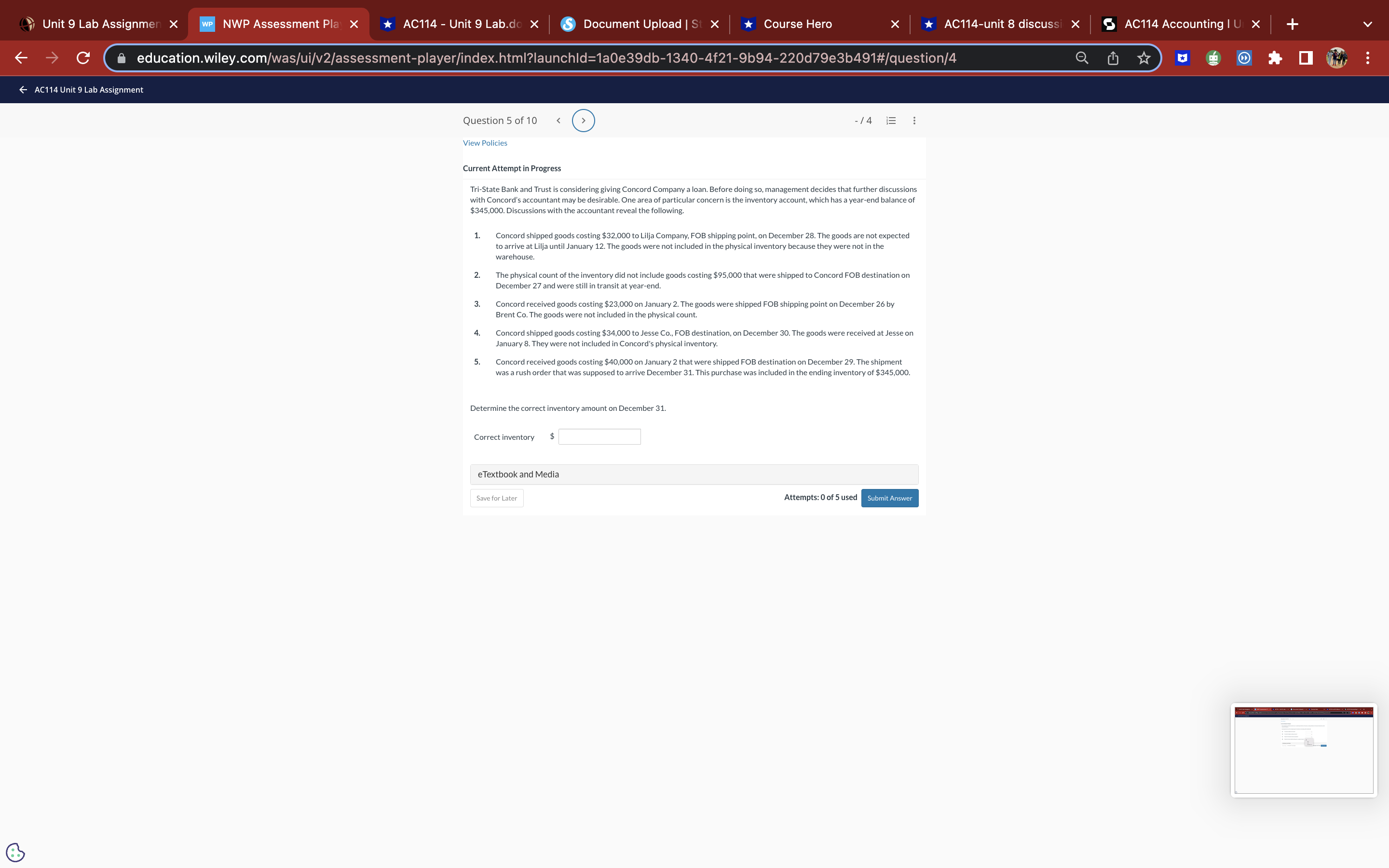

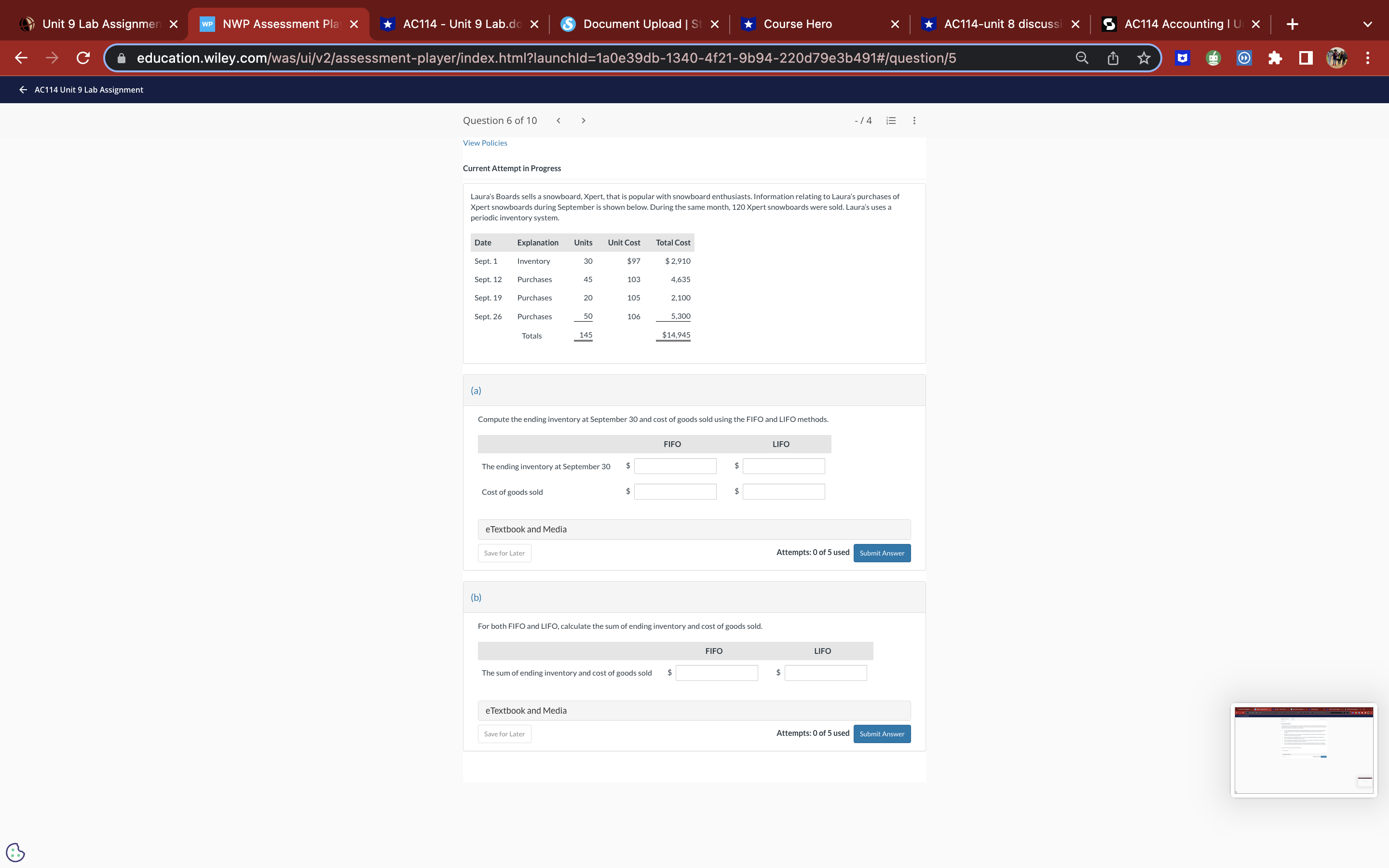

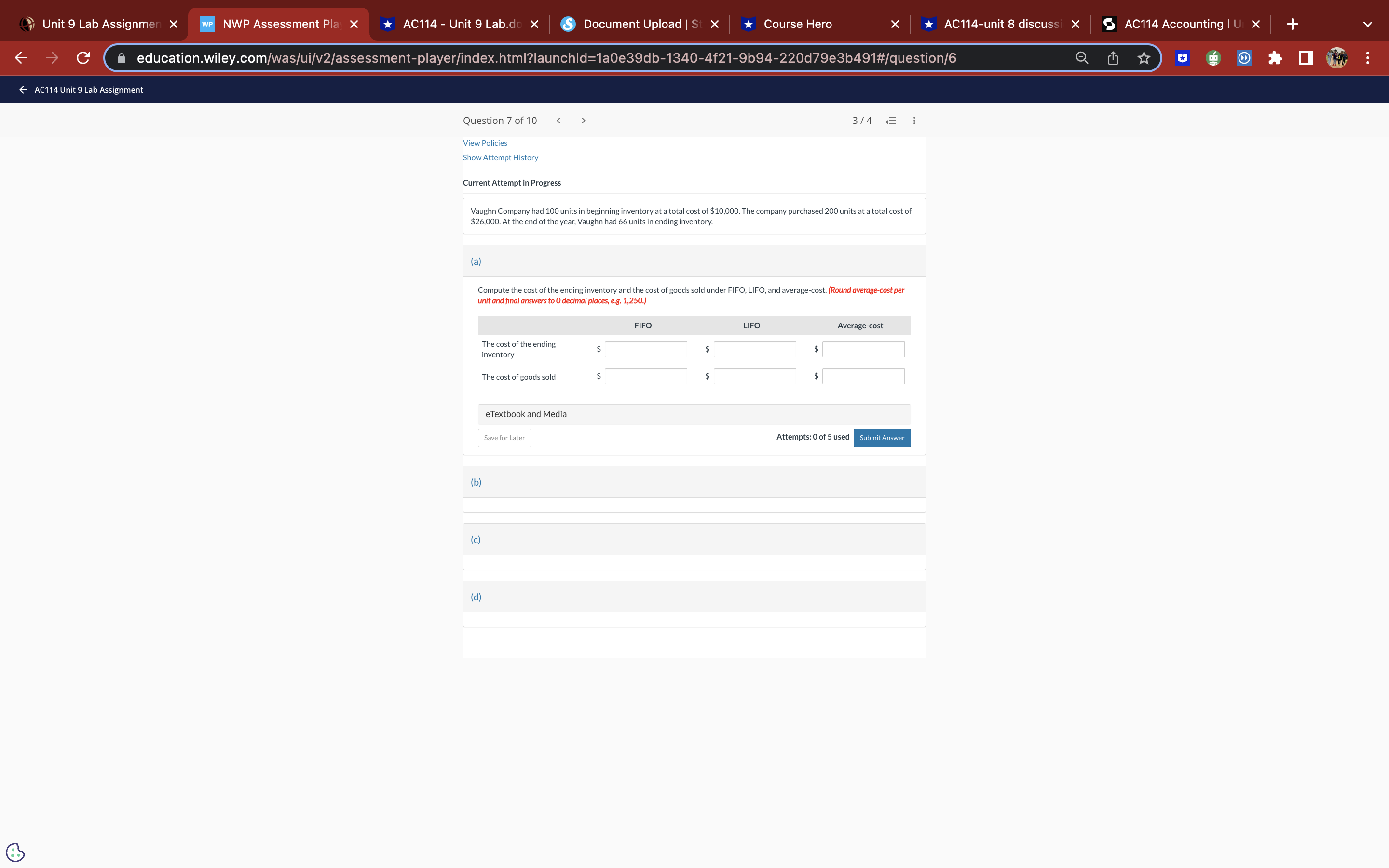

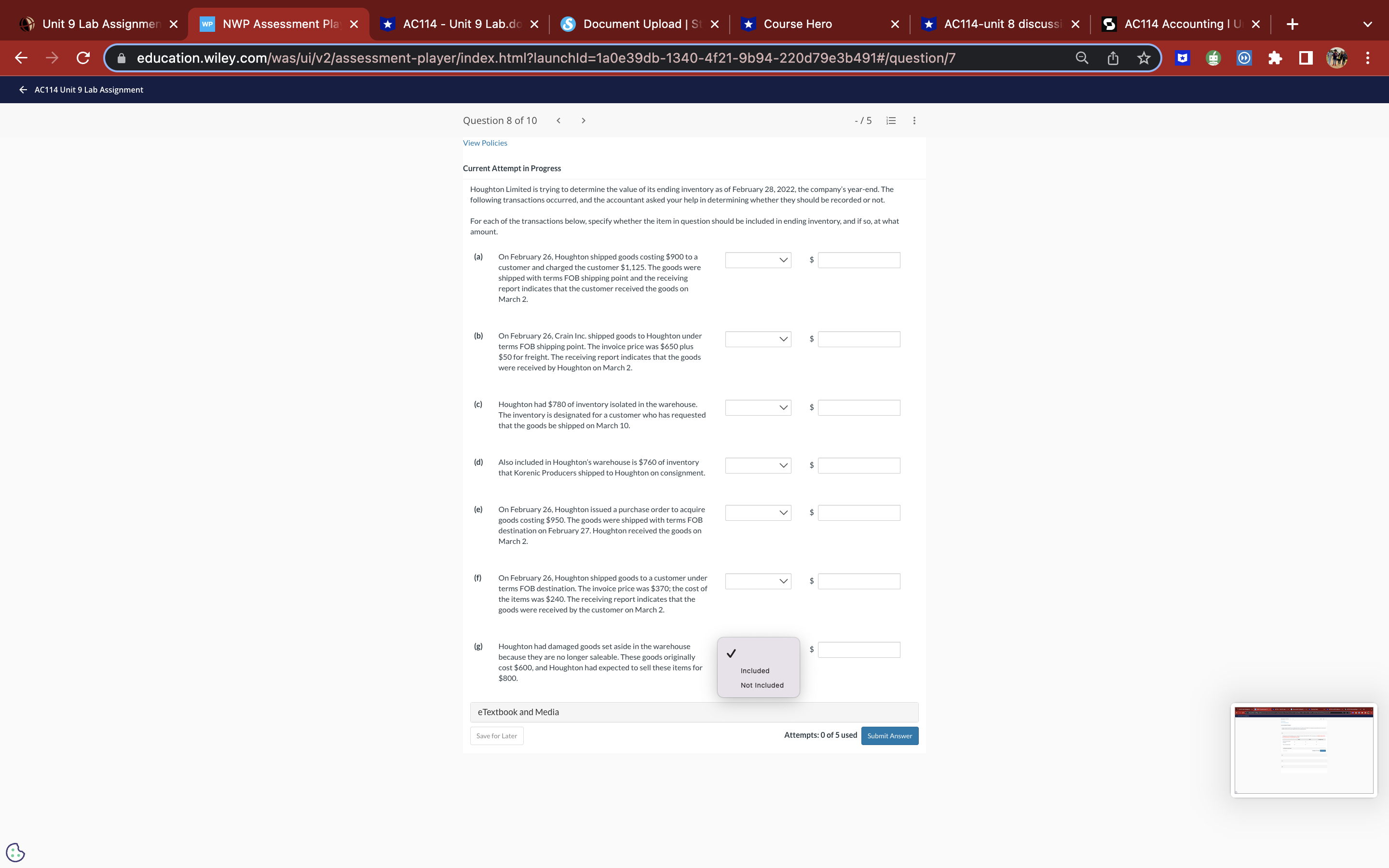

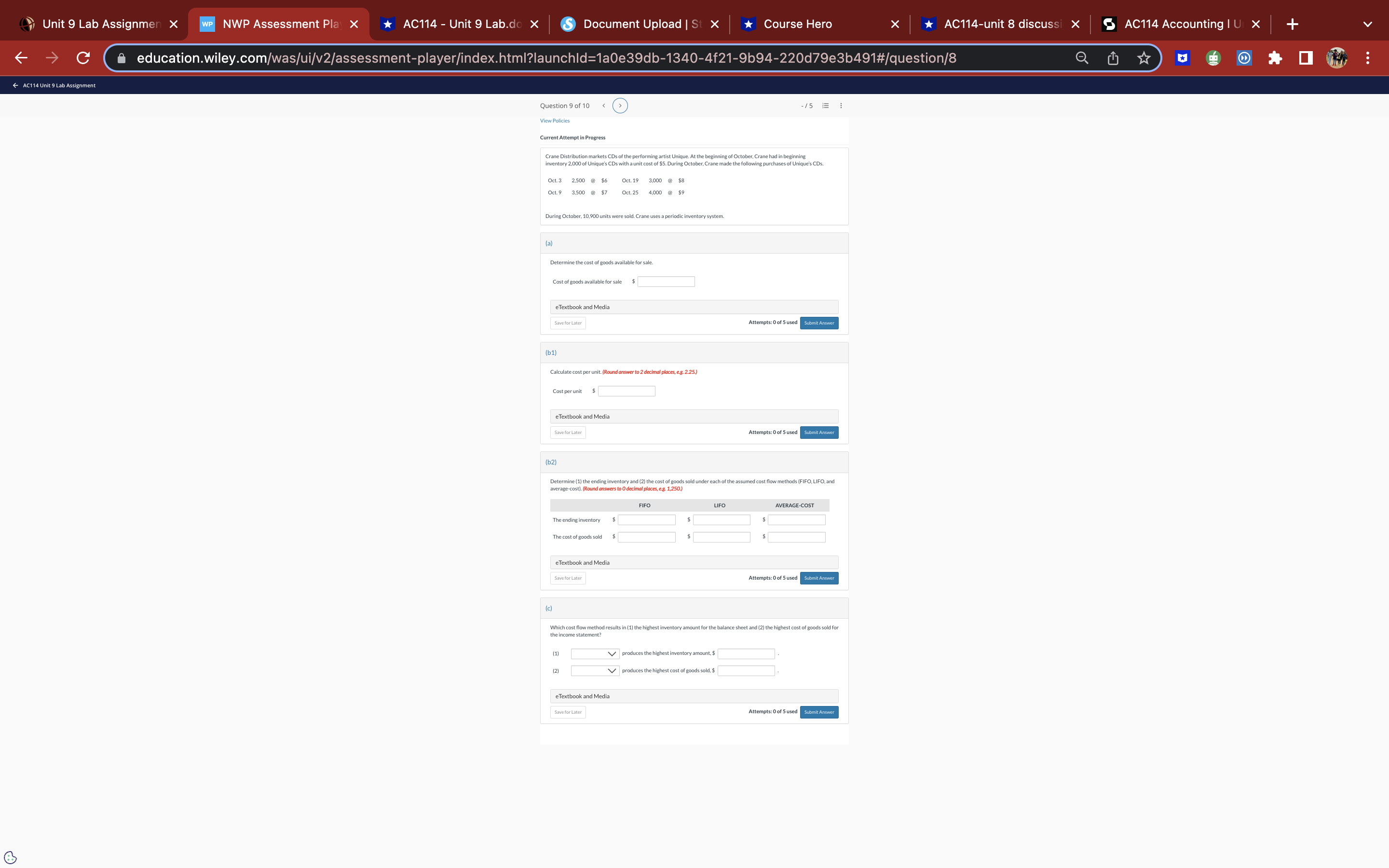

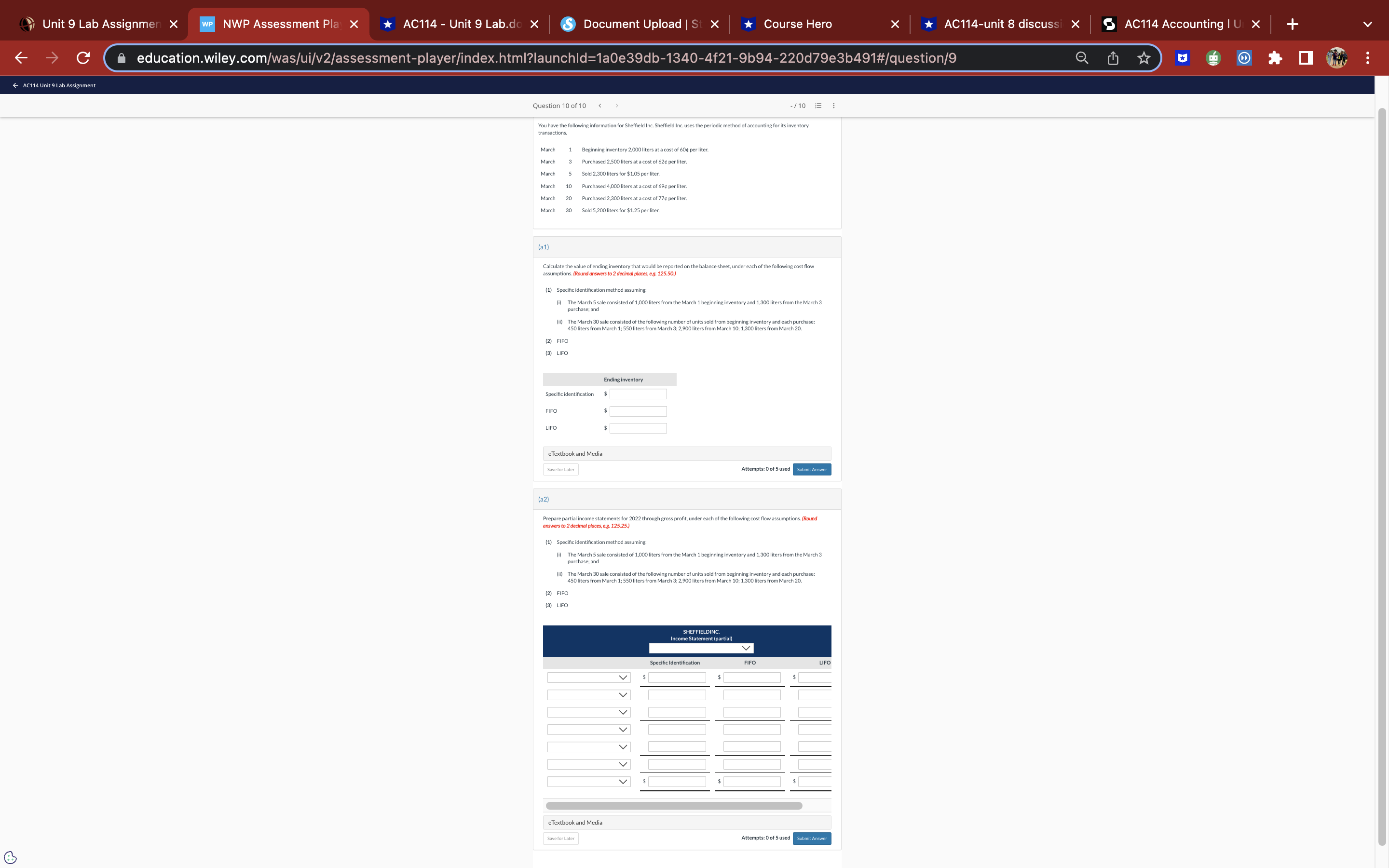

Unit 9 Lab Assignmen X WP NWP Assessment Pla X AC114 - Unit 9 Lab.do x S Document Upload | St x Course Hero X AC114-unit 8 discussi x AC114 Accounting | U X + C education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=1a0e39db-1340-4f21-9694-220d79e3b491#/question/0 * 0 # AC114 Unit 9 Lab Assignment Question 1 of 10 - 12 3 : View Policies Current Attempt in Progress Swifty Company took a physical inventory on December 31 and determined that goods costing $ 150,000 were on hand. Not included in the physical count were $21,000 of goods purchased from Pelzer Corporation, FOB shipping point, and $19,500 of goods sold to Alvarez Company for $27,500, FOB destination. Both the Pelzer purchase and the Alvarez sale were in transit at year-end. What amount should Swifty report as its December 31 inventory? Swifty ending Inventory eTextbook and Media Save for Later Attempts: 0 of 5 used Submit AnswerUnit 9 Lab Assignmen X WP NWP Assessment Pla X AC114 - Unit 9 Lab.do x S Document Upload | St x Course Hero X AC114-unit 8 discussi x AC114 Accounting | U X + C education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=1a0e39db-1340-4f21-9694-220d79e3b491#/question/1 * 0 # AC114 Unit 9 Lab Assignment Question 2 of 10 - 12 3 : View Policies Current Attempt in Progress In its first month of operations, Crane Company made three purchases of merchandise in the following sequence: (1) 300 units at $6, 2) 400 units at $7, and (3) 200 units at $8. Assuming there are 360 units on hand, compute the cost of the ending inventory under the (a) FIFO method and (b) LIFO method. Crane uses a periodic inventory system. FIFO LIFO Cost of the ending inventory e Textbook and Media Save for Later Attempts: 0 of 5 used Submit AnswerUnit 9 Lab Assignmen X WP NWP Assessment Pla X AC114 - Unit 9 Lab.do x S Document Upload | St x Course Hero X AC114-unit 8 discussi x AC114 Accounting | U X + C education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=1a0e39db-1340-4f21-9694-220d79e3b491#/question/2 * 0 # AC114 Unit 9 Lab Assignment Question 3 of 10 - 12 3 : View Policies Current Attempt in Progress In its first month of operations, Sheffield Company made three purchases of merchandise in the following sequence: (1) 300 units at $7, (2) 450 units at $8, and (3) 250 units at $9. (a Calculate the average unit cost. (Round answer to 2 decimal places, e.g. 15.25.) Average unit cost e Textbook and Media Save for Later Attempts: 0 of 5 used Submit Answer b Compute the cost of the ending inventory under the average-cost method, assuming there are 400 units on hand. (Round answer to O decimal places, e.g. 1,250.) The cost of the ending inventory e Textbook and Media Save for Later Attempts: 0 of 5 used Submit AnswerUnit 9 Lab Assignmen X WP NWP Assessment Pla X AC114 - Unit 9 Lab.do x S Document Upload | St x Course Hero X AC114-unit 8 discussi x AC114 Accounting | U X + C education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=1a0e39db-1340-4f21-9694-220d79e3b491#/question/3 * 0 # AC114 Unit 9 Lab Assignment Question 4 of 10 View Policies Current Attempt in Progress The management of Mastronardo Corp. is considering the effects of inventory-costing methods on its financial statements and its income tax expense Assuming that the cost the company pays for inventory is increasing, which method will: (a) Provide the highest net income? (b) Provide the highest ending inventory? (c) Result in the lowest income tax expense? V (d) Result in the most stable earnings over a number of years? FIFO e Textbook and Media LIFO Average-cost Save for Later Last saved 1 second ago. Attempts: 0 of 5 used Submit AnswerUnit 9 Lab Assignmen X WP NWP Assessment Pla X AC114 - Unit 9 Lab.do x S Document Upload | St x Course Hero X AC114-unit 8 discussi x AC114 Accounting | U X + C education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=1a0e39db-1340-4f21-9694-220d79e3b491#/question/4 * 0 # AC114 Unit 9 Lab Assignment Question 5 of 10 - 14 : View Policies Current Attempt in Progress Tri-State Bank and Trust is considering giving Concord Company a loan. Before doing so, management decides that further discussions with Concord's accountant may be desirable. One area of particular concern is the inventory account, which has a year-end balance of $345,000. Discussions with the accountant reveal the following. 1. Concord shipped goods costing $32,000 to Lilja Company, FOB shipping point, on December 28. The goods are not expected to arrive at Lilja until January 12. The goods were not included in the physical inventory because they were not in the warehouse. 2. The physical count of the inventory did not include goods costing $95,000 that were shipped to Concord FOB destination on December 27 and were still in transit at year-end. 3. Concord received goods costing $23,000 on January 2. The goods were shipped FOB shipping point on December 26 by Brent Co. The goods were not included in the physical count. 4. Concord shipped goods costing $34,000 to Jesse Co., FOB destination, on December 30. The goods were received at Jesse on anuary 8. They were not included in Concord's physical inventory. 5. Concord received goods costing $40,000 on January 2 that were shipped FOB destination on December 29. The shipment was a rush order that was supposed to arrive December 31. This purchase was included in the ending inventory of $345,000. Determine the correct inventory amount on December 31. Correct inventory $ e Textbook and Media Save for Later Attempts: 0 of 5 used Submit AnswerUnit 9 Lab Assignmen X WP NWP Assessment Pla X AC114 - Unit 9 Lab.do x S Document Upload | St x Course Hero X AC114-unit 8 discussi x AC114 Accounting | U X + C education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=1a0e39db-1340-4f21-9694-220d79e3b491#/question/5 * 0 # AC114 Unit 9 Lab Assignment Question 6 of 10 - 14 : View Policies Current Attempt in Progress Laura's Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Laura's purchases of Xpert snowboards during September is shown below. During the same month, 120 Xpert snowboards were sold. Laura's uses a periodic inventory system. Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 30 $97 $ 2,910 Sept. 12 Purchases 45 103 4.635 Sept. 19 Purchases 20 105 2,100 Sept. 26 Purchases 50 106 5,300 Total 145 $14,945 (a) Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods. FIFO LIFO The ending inventory at September 30 $ Cost of goods sold $ $ e Textbook and Media Save for Later Attempts: 0 of 5 used Submit Answer (b For both FIFO and LIFO, calculate the sum of ending inventory and cost of goods sold. FIFO LIFO The sum of ending inventory and cost of goods sold eTextbook and Media Save for Later Attempts: 0 of 5 used Submit AnswerUnit 9 Lab Assignmen X WP NWP Assessment Pla X AC114 - Unit 9 Lab.do x S Document Upload | St x Course Hero X AC114-unit 8 discussi x AC114 Accounting | U X + C education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=1a0e39db-1340-4f21-9694-220d79e3b491#/question/6 * 0 # AC114 Unit 9 Lab Assignment Question 7 of 10 3/4 3 : View Policies Show Attempt History Current Attempt in Progress Vaughn Company had 100 units in beginning inventory at a total cost of $10,000. The company purchased 200 units at a total cost of $26,000. At the end of the year, Vaughn had 66 units in ending inventory. (a Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round average-cost per unit and final answers to O decimal places, eg. 1,250.) FIFO LIFO Average-cost The cost of the ending inventory The cost of goods sold e Textbook and Media Save for Later Attempts: 0 of 5 used Submit Answer (b (c) (d)Unit 9 Lab Assignmen X WP NWP Assessment Pla X AC114 - Unit 9 Lab.do x S Document Upload | St x Course Hero X AC114-unit 8 discussi x AC114 Accounting | U X + C education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=1a0e39db-1340-4f21-9694-220d79e3b491#/question/7 * 0 # AC114 Unit 9 Lab Assignment Question 8 of 10 - 15 3 : View Policies Current Attempt in Progress Houghton Limited is trying to determine the value of its ending inventory as of February 28, 2022, the company's year-end. The following transactions occurred, and the accountant asked your help in determining whether they should be recorded or not. For each of the transactions below, specify whether the item in question should be included in ending inventory, and if so, at what amount. (a) On February 26, Houghton shipped goods costing $900 to a customer and charged the customer $1,125. The goods were shipped with terms FOB shipping point and the receiving report indicates that the customer received the goods on March 2. b) On February 26, Crain Inc. shipped goods to Houghton under terms FOB shipping point. The invoice price was $650 plus $50 for freight. The receiving report indicates that the goods were received by Houghton on March 2. (c) Houghton had $780 of inventory isolated in the warehouse. The inventory is designated for a customer who has requested that the goods be shipped on March 10 d) Also included in Houghton's warehouse is $760 of inventory that Korenic Producers shipped to Houghton on consignment e) On February 26, Houghton issued a purchase order to acquire goods costing $950. The goods were shipped with terms FOB destination on February 27. Houghton received the goods on March 2. (f) On February 26, Houghton shipped goods to a customer under v terms FOB destination. The invoice price was $370; the cost of the items was $240. The receiving report indicates that the goods were received by the customer on March 2. (g) Houghton had damaged goods set aside in the warehouse because they are no longer saleable. These goods originally cost $600, and Houghton had expected to sell these items for Included $800. Not Included e Textbook and Media Save for Later Attempts: 0 of 5 used Submit AnswerUnit 9 Lab Assignmen X WP NWP Assessment Pla X AC114 - Unit 9 Lab.do x S Document Upload | St x Course Hero X AC114-unit 8 discussi x AC114 Accounting | U X -> C education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=1a0e39db-1340-4f21-9694-220d79e3b491#/question/8 AC1 14 Unit 9 Lab Assignment Question 9 of 10 - 15 2 1 View Policies Current Attempt in Progress Crane Distribution markets CDs of the performing artist Unique. At the beg ing of October, Crane had in beginning nventory 2,000 of Unique's CDs with a unit cost of $5. During October, Crane made the following purchases of Unique's CDs Oct. 3 2.500 @ $6 Oct. 19 3,000 @ $8 Oct. 9 3.500 @ $7 Oct. 25 4,000 @ $9 During October, 10,900 units were sold. uses a periodic inventory system. (a) Determine the cost of goods available for sale. Cost of goods available for sale e Textbook and Media Save for Later Attempts: 0 of 5 used Submit Answer (b1) Calculate cost per unit. (Round answer to 2 decimal places, e.g. 2.25.) Cost per unit $ eTextbook and Media Save for Later Attempts: 0 of S used Submit Answer (b2) Determine (1) the ending inventory and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and verage-cost). (Round answers to O decimal places, e.g. 1,250.) FIFO LIFO AVERAGE-COST The ending inventory The cost of goods sold e Textbook and Media Save for Later Attempts: 0 of 5 used Submit Answer (c) Which cost flow method results in (1) the highest invent and (2) the highest cost of goods sold for he income statement? (1) V produces the highest inventory amount. $ 21 V produces the highest cost of goods sold. $ eTextbook and Media Save for Later Attempts: 0 of 5 used Submit AnswerUnit 9 Lab Assignmen X WP NWP Assessment Pla X AC114 - Unit 9 Lab.do x S Document Upload | St x Course Hero X AC114-unit 8 discussi x AC114 Accounting | U X + C education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=1a0e39db-1340-4f21-9694-220d79e3b491#/question/9 : AC114 Unit 9 Lab Assignment Question 10 of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts