Question: UNIT CODE: ACC 3101 UNIT NAME: ADVANCED ACCOUNTING 1 ASSIGNMENT ONE Instructions: Answer the question below Katoo and Shem, who prepare their accounts annually to

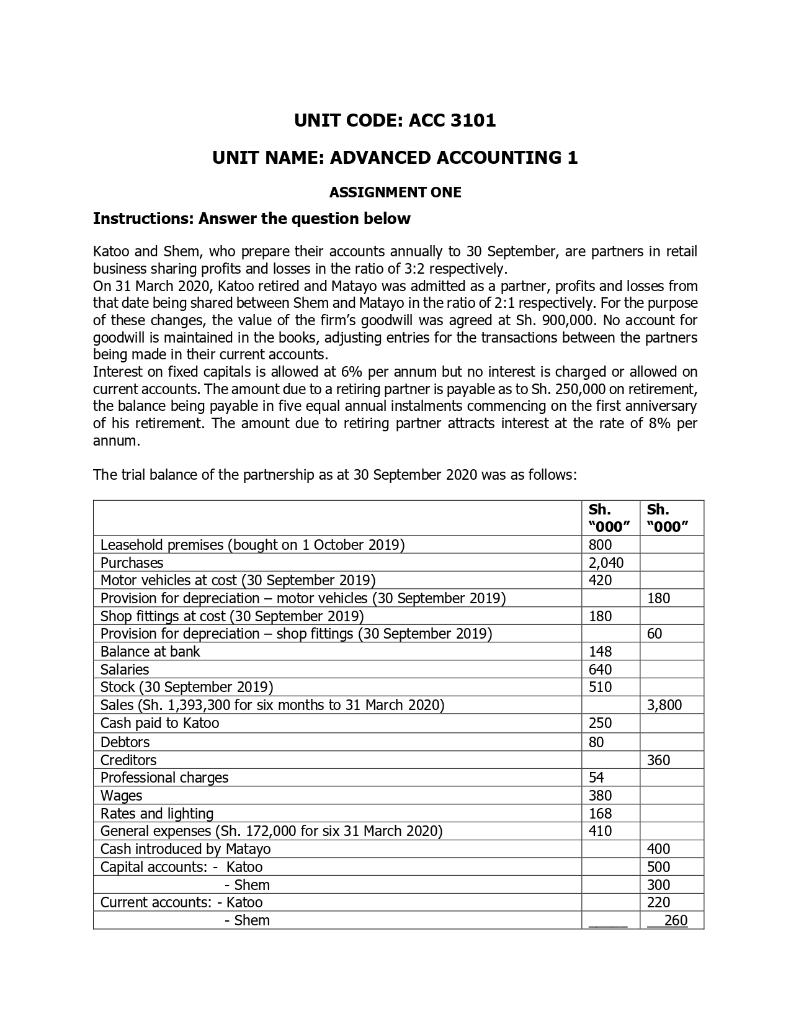

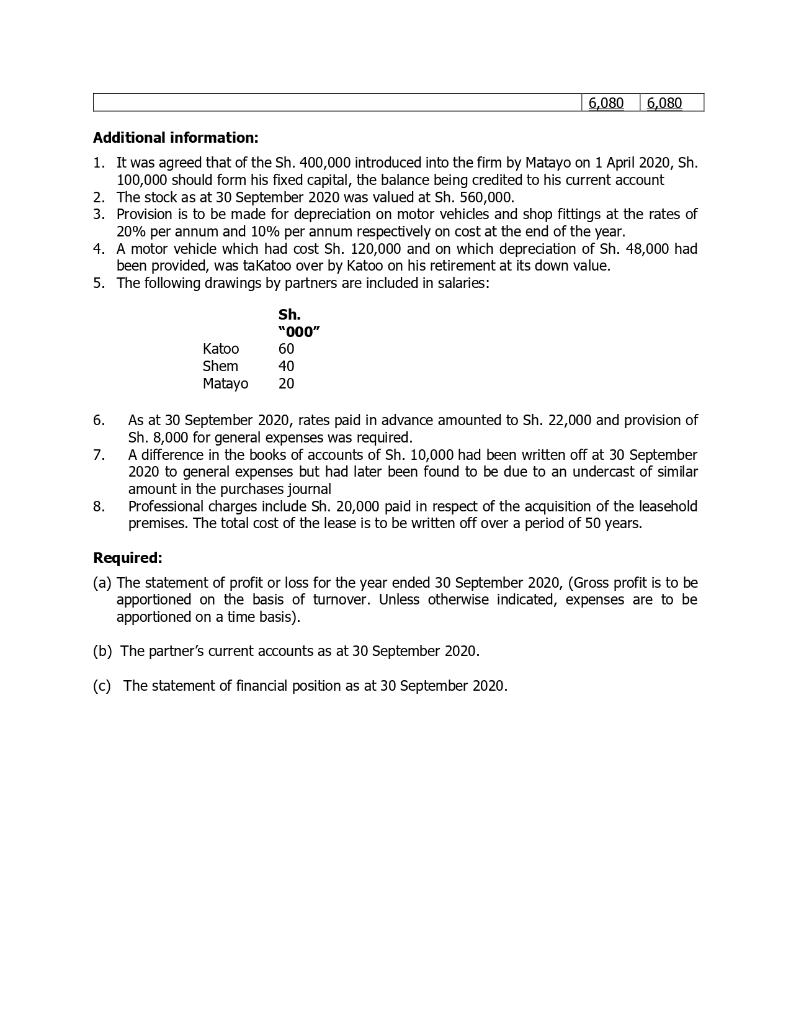

UNIT CODE: ACC 3101 UNIT NAME: ADVANCED ACCOUNTING 1 ASSIGNMENT ONE Instructions: Answer the question below Katoo and Shem, who prepare their accounts annually to 30 September, are partners in retail business sharing profits and losses in the ratio of 3:2 respectively. On 31 March 2020, Katoo retired and Matayo was admitted as a partner, profits and losses from that date being shared between Shem and Matayo in the ratio of 2:1 respectively. For the purpose of these changes, the value of the firm's goodwill was agreed at Sh. 900,000. No account for goodwill is maintained in the books, adjusting entries for the transactions between the partners being made in their current accounts. Interest on fixed capitals is allowed at 6% per annum but no interest is charged or allowed on current accounts. The amount due to a retiring partner is payable as to Sh. 250,000 on retirement, the balance being payable in five equal annual instalments commencing on the first anniversary of his retirement. The amount due to retiring partner attracts interest at the rate of 8% per annum. The trial balance of the partnership as at 30 September 2020 was as follows: Leasehold premises (bought on 1 October 2019) Purchases Motor vehicles at cost (30 September 2019) Provision for depreciation - motor vehicles (30 September 2019) Shop fittings at cost (30 September 2019) Provision for depreciation - shop fittings (30 September 2019) Balance at bank Salaries Stock (30 September 2019) Sales (Sh. 1,393,300 for six months to 31 March 2020) Cash paid to Katoo Debtors Creditors Professional charges Wages Rates and lighting General expenses (Sh. 172,000 for six 31 March 2020) Cash introduced by Matayo Capital accounts: - Katoo Shem Current accounts: - Katoo - Shem Sh. Sh. "000" "000" 800 2,040 420 180 180 60 148 640 510 3,800 250 80 360 54 380 168 410 400 500 300 220 260 6,080 6,080 Additional information: 1. It was agreed that of the Sh. 400,000 introduced into the firm by Matayo on 1 April 2020, Sh. 100,000 should form his fixed capital, the balance being credited to his current account 2. The stock as at 30 September 2020 was valued at Sh. 560,000. 3. Provision is to be made for depreciation on motor vehicles and shop fittings at the rates of 20% per annum and 10% per annum respectively on cost at the end of the year. 4. A motor vehicle which had cost Sh. 120,000 and on which depreciation of Sh. 48,000 had been provided, was takatoo over by Katoo on his retirement at its down value. 5. The following drawings by partners are included in salaries: Katoo Shem Matayo Sh. "000" 60 40 20 6. 7. As at 30 September 2020, rates paid in advance amounted to Sh. 22,000 and provision of Sh. 8,000 for general expenses was required. A difference in the books of accounts of Sh. 10,000 had been written off at 30 September 2020 to general expenses but had later been found to be due to an undercast of similar amount in the purchases journal Professional charges include Sh. 20,000 paid in respect of the acquisition of the leasehold premises. The total cost of the lease is to be written off over a period of 50 years. 8. Required: (a) The statement of profit or loss for the year ended 30 September 2020, (Gross profit is to be apportioned on the basis of turnover. Unless otherwise indicated, expenses are to be apportioned on a time basis). (b) The partner's current accounts as at 30 September 2020. (c) The statement of financial position as at 30 September 2020. UNIT CODE: ACC 3101 UNIT NAME: ADVANCED ACCOUNTING 1 ASSIGNMENT ONE Instructions: Answer the question below Katoo and Shem, who prepare their accounts annually to 30 September, are partners in retail business sharing profits and losses in the ratio of 3:2 respectively. On 31 March 2020, Katoo retired and Matayo was admitted as a partner, profits and losses from that date being shared between Shem and Matayo in the ratio of 2:1 respectively. For the purpose of these changes, the value of the firm's goodwill was agreed at Sh. 900,000. No account for goodwill is maintained in the books, adjusting entries for the transactions between the partners being made in their current accounts. Interest on fixed capitals is allowed at 6% per annum but no interest is charged or allowed on current accounts. The amount due to a retiring partner is payable as to Sh. 250,000 on retirement, the balance being payable in five equal annual instalments commencing on the first anniversary of his retirement. The amount due to retiring partner attracts interest at the rate of 8% per annum. The trial balance of the partnership as at 30 September 2020 was as follows: Leasehold premises (bought on 1 October 2019) Purchases Motor vehicles at cost (30 September 2019) Provision for depreciation - motor vehicles (30 September 2019) Shop fittings at cost (30 September 2019) Provision for depreciation - shop fittings (30 September 2019) Balance at bank Salaries Stock (30 September 2019) Sales (Sh. 1,393,300 for six months to 31 March 2020) Cash paid to Katoo Debtors Creditors Professional charges Wages Rates and lighting General expenses (Sh. 172,000 for six 31 March 2020) Cash introduced by Matayo Capital accounts: - Katoo Shem Current accounts: - Katoo - Shem Sh. Sh. "000" "000" 800 2,040 420 180 180 60 148 640 510 3,800 250 80 360 54 380 168 410 400 500 300 220 260 6,080 6,080 Additional information: 1. It was agreed that of the Sh. 400,000 introduced into the firm by Matayo on 1 April 2020, Sh. 100,000 should form his fixed capital, the balance being credited to his current account 2. The stock as at 30 September 2020 was valued at Sh. 560,000. 3. Provision is to be made for depreciation on motor vehicles and shop fittings at the rates of 20% per annum and 10% per annum respectively on cost at the end of the year. 4. A motor vehicle which had cost Sh. 120,000 and on which depreciation of Sh. 48,000 had been provided, was takatoo over by Katoo on his retirement at its down value. 5. The following drawings by partners are included in salaries: Katoo Shem Matayo Sh. "000" 60 40 20 6. 7. As at 30 September 2020, rates paid in advance amounted to Sh. 22,000 and provision of Sh. 8,000 for general expenses was required. A difference in the books of accounts of Sh. 10,000 had been written off at 30 September 2020 to general expenses but had later been found to be due to an undercast of similar amount in the purchases journal Professional charges include Sh. 20,000 paid in respect of the acquisition of the leasehold premises. The total cost of the lease is to be written off over a period of 50 years. 8. Required: (a) The statement of profit or loss for the year ended 30 September 2020, (Gross profit is to be apportioned on the basis of turnover. Unless otherwise indicated, expenses are to be apportioned on a time basis). (b) The partner's current accounts as at 30 September 2020. (c) The statement of financial position as at 30 September 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts