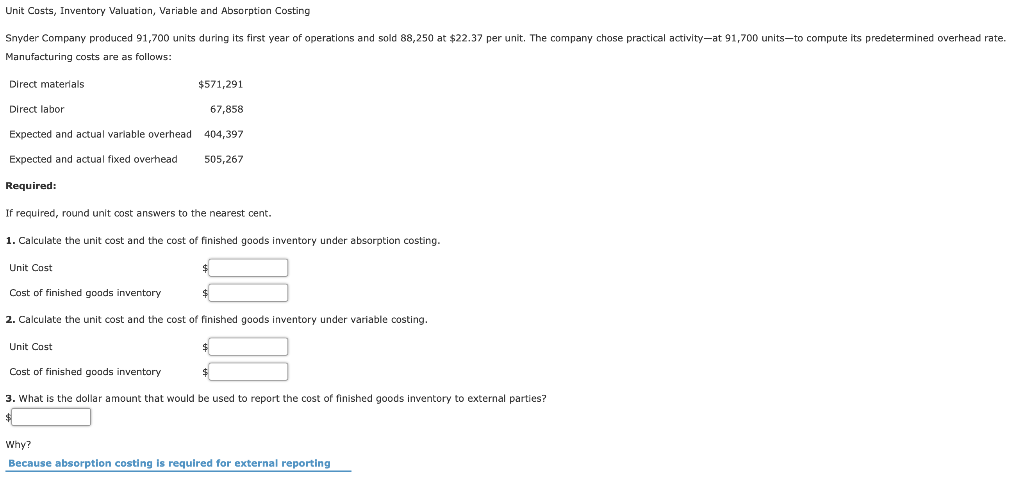

Question: Unit Costs, Inventory Valuation, Variable and Absorption Costing operations and sold 88,250 at $22.37 per unit. The company chose practical activity-at 91,700 units,to compute its

Unit Costs, Inventory Valuation, Variable and Absorption Costing operations and sold 88,250 at $22.37 per unit. The company chose practical activity-at 91,700 units,to compute its predetermined overhead rate. Snyder Company produced 91,700 units during its first year Manufacturing costs are as follows: Direct materials $571,291 Direct labor 67,858 Expected and actual variable overhead 404,397 Expected and actual fixed overhead 505,267 Required: If required, round unit cost answers to the nearest cent. 1. Calculate the unit cost and the cost of finished goods inventory under absorption costing. Unit Cost Cost of finished goods inventory $ 2. Calculate the unit cost and the cost f finished goods inventory under variable costing. Unit Cost Cost of finished goods inventory $ 3. What is the dollar amount that would be used to report the cost of finished goods inventory to external parties? Why? Because absorption costing required for external reporting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts