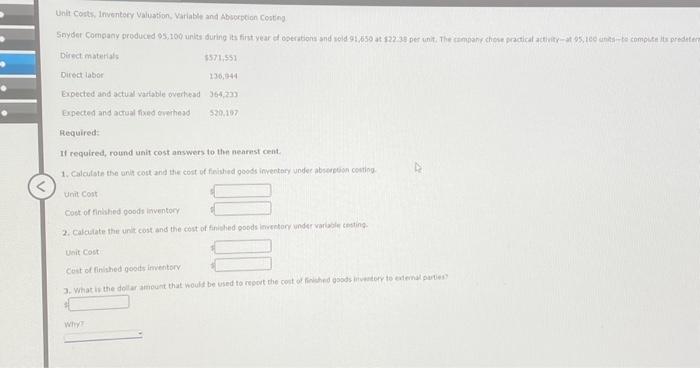

Question: Unit Costs, Inventory Valuation, Variable and Absorption Costing Snyder Company produced 95,100 units during its first year of operations and sold 91,650 at $22.38 per

Unit Costs, Inventory Valuation, Variable and Absorption Costing Snyder Company produced 95,100 units during its first year of operations and sold 91,650 at $22.38 per unit. The company chose practical activity-at 95,100 units-to compute its predeterm Direct materials Direct labor Expected and actual variable overhead Expected and actual fixed overhead Required: Unit Cost $571,551 Unit Cost 136,944 If required, round unit cost answers to the nearest cent. 1. Calculate the unit cost and the cost of finished goods inventory under absorption costing. 364,233 Why? 520,197 Cost of finished goods inventory 2. Calculate the unit cost and the cost of finished goods inventory under variable costing. Cost of finished goods inventory 3. What is the dollar amount that would be used to report the cost of finished goods inventory to external parties?

Unit Costi, Inventecy Valuation, Varlable and Absocption costing: Required: If reguired, round unit cost answers to then nearest cent. 2. Calosate the unit cost and the cost of finibhed goods imeseton under varibble cesting Whir

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock