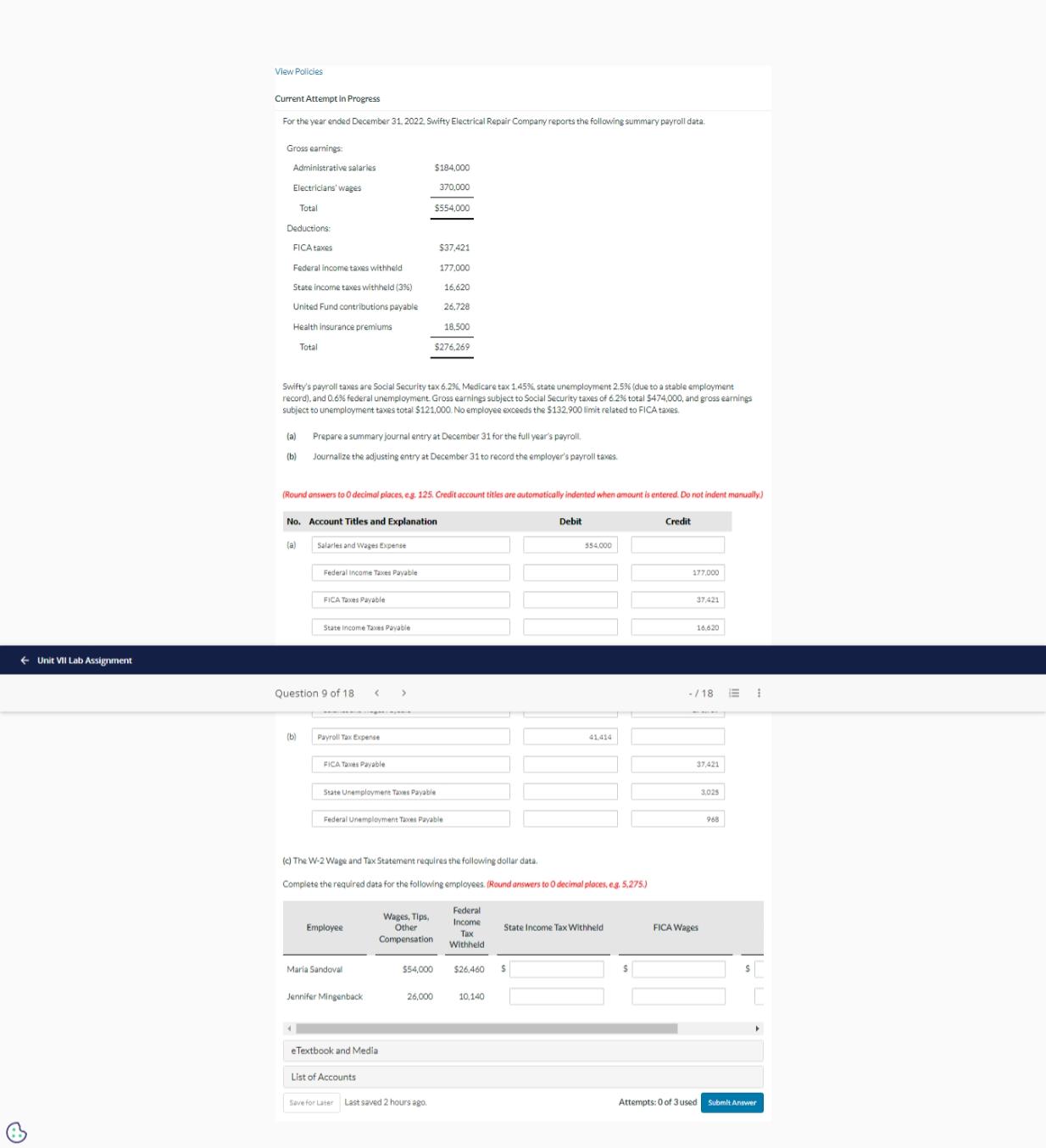

Question: Unit VII Lab Assignment View Policies Current Attempt in Progress For the year ended December 31, 2022. Swifty Electrical Repair Company reports the following

Unit VII Lab Assignment View Policies Current Attempt in Progress For the year ended December 31, 2022. Swifty Electrical Repair Company reports the following summary payroll data: Gross earnings: Administrative salaries Electricians' wages Deductions: FICA taxes Total Federal income taxes withheld State income taxes withheld (3%) United Fund contributions payable Health insurance premiums Total Swifty's payroll taxes are Social Security tax 6.2%, Medicare tax 1,45%, state unemployment 2.5% (due to a stable employment record), and 0.6% federal unemployment. Gross earnings subject to Social Security taxes of 6.2% total $474,000, and gross earnings subject to unemployment taxes total $121,000. No employee exceeds the $132.900 limit related to FICA taxes. (a) (a) Prepare a summary journal entry at December 31 for the full year's payroll, (b) Journalize the adjusting entry at December 31 to record the employer's payroll taxes. (Round answers to O decimal places, eg. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually) (b) No. Account Titles and Explanation Salarles and Wages Expense Federal Income Taxes Payable 4 FICA Taxes Payable Question 9 of 18. < State Income Taxes Payable Payroll Tax Expense FICA Taxes Payable Employee Maria Sandoval State Unemployment Taxes Payable Jennifer Mingenback > Federal Unemployment Taxes Payable $184,000 370,000 $37,421 177,000 16,620 26,728 18,500 $276,269 eTextbook and Media $554,000 List of Accounts (c) The W-2 Wage and Tax Statement requires the following dollar data. Complete the required data for the following employees. (Round answers to O decimal places, e.g. 5,275.) Wages, Tips, Other Compensation $54,000 26,000 Save for Later Last saved 2 hours ago. Federal Income Tax Withheld $26.460 10,140 Debit 554,000 S 41,414 State Income Tax Withheld S Credit 177,000 37,421 16.620 -/18 E1 37,421 FICA Wages 3,025 968 Attempts: 0 of 3 used Submit Answer

Step by Step Solution

3.48 Rating (171 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts