Question: Units 1. Lambda Company uses the periodic inventory method and had the following inventory information available: Unit Cost Total Cost 1/1 Beginning Inventory 100

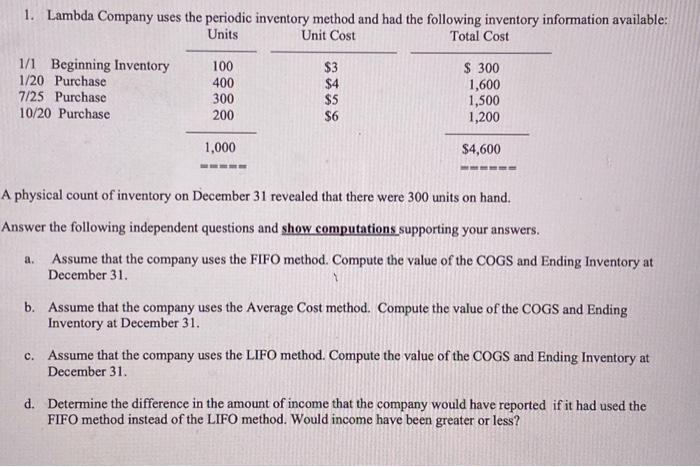

Units 1. Lambda Company uses the periodic inventory method and had the following inventory information available: Unit Cost Total Cost 1/1 Beginning Inventory 100 $3 $ 300 1/20 Purchase 400 $4 1,600 7/25 Purchase 300 $5 1,500 10/20 Purchase 200 $6 1,200 1,000 $4,600 A physical count of inventory on December 31 revealed that there were 300 units on hand. Answer the following independent questions and show computations supporting your answers. a. Assume that the company uses the FIFO method. Compute the value of the COGS and Ending Inventory at December 31. b. Assume that the company uses the Average Cost method. Compute the value of the COGS and Ending Inventory at December 31. c. Assume that the company uses the LIFO method. Compute the value of the COGS and Ending Inventory at December 31. d. Determine the difference in the amount of income that the company would have reported if it had used the FIFO method instead of the LIFO method. Would income have been greater or less?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts