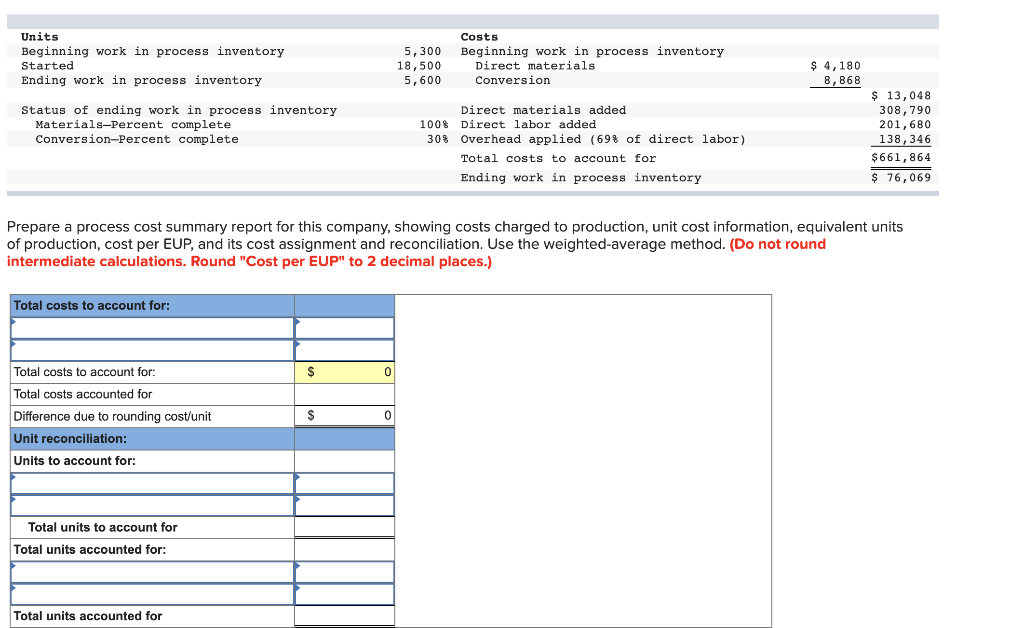

Question: Units Beginning work in process inventory Started Ending work in process inventory 5,300 18,500 5,600 Costs Beginning work in process inventory Direct materials Conversion $

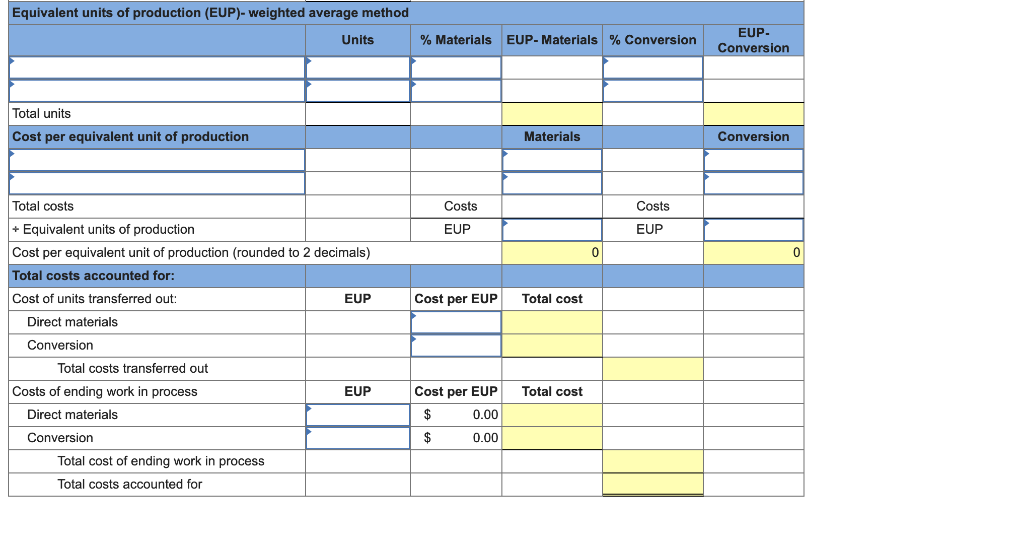

Units Beginning work in process inventory Started Ending work in process inventory 5,300 18,500 5,600 Costs Beginning work in process inventory Direct materials Conversion $ 4,180 8,868 Status of ending work in process inventory Materials-Percent complete Conversion-Percent complete Direct materials added 100% Direct labor added 30% Overhead applied (69% of direct labor) Total costs to account for Ending work in process inventory $ 13,048 308, 790 201,680 138, 346 $661,864 $ 76,069 Prepare a process cost summary report for this company, showing costs charged to production, unit cost information, equivalent units of production, cost per EUP, and its cost assignment and reconciliation. Use the weighted average method. (Do not round intermediate calculations. Round "Cost per EUP" to 2 decimal places.) Total costs to account for: $ 0 Total costs to account for: Total costs accounted for Difference due to rounding cost/unit Unit reconciliation: Units to account for: $ 0 Total units to account for Total units accounted for: Total units accounted for Equivalent units of production (EUP)- weighted average method Units % Materials EUP-Materials % Conversion EUP Conversion Total units Cost per equivalent unit of production Materials Conversion Total costs Costs EUP Costs EUP 0 0 Cost per EUP Total cost + Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total costs accounted for: Cost of units transferred out: EUP Direct materials Conversion Total costs transferred out Costs of ending work in process EUP Direct materials Total cost Cost per EUP $ 0.00 $ 0.00 Conversion Total cost of ending work in proces Total costs accounted for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts