Question: Units Sold to Break Even, Unit Variable Cost, Unit Manufacturing Cost, Units to Earn Target Income Belham Company produces and sells disposable foil baking pans

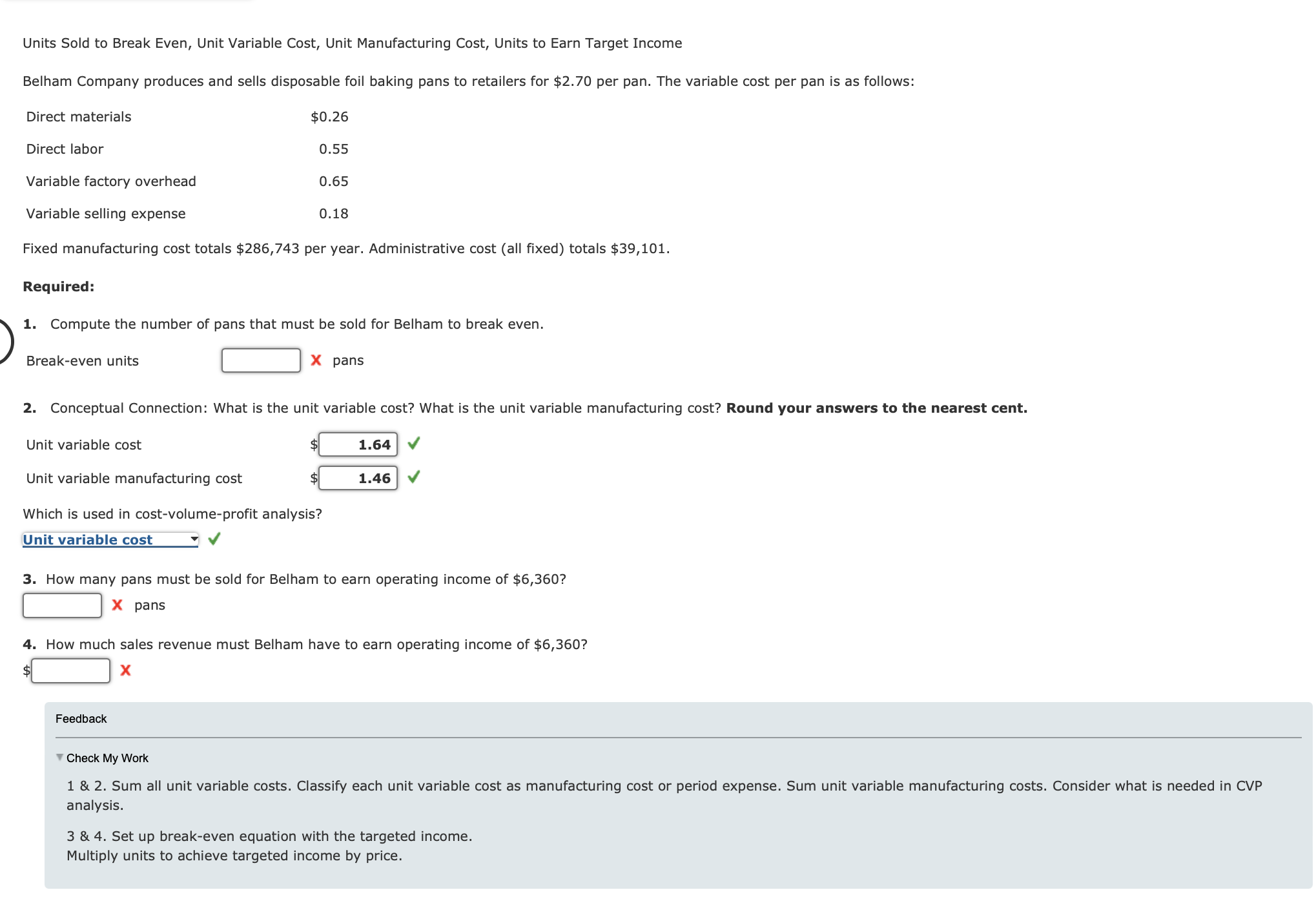

Units Sold to Break Even, Unit Variable Cost, Unit Manufacturing Cost, Units to Earn Target Income Belham Company produces and sells disposable foil baking pans to retailers for $2.70 per pan. The variable cost per pan is as follows: Fixed manufacturing cost totals $286,743 per year. Administrative cost (all fixed) totals $39,101. Required: 1. Compute the number of pans that must be sold for Belham to break even. Break-even units X pans 2. Conceptual Connection: What is the unit variable cost? What is the unit variable manufacturing cost? Round your answers to the nearest cent. Which is used in cost-volume-profit analysis? 3. How many pans must be sold for Belham to earn operating income of $6,360 ? X pans 4. How much sales revenue must Belham have to earn operating income of $6,360 ? $ x Feedback Theck My Work analysis. 3 \& 4. Set up break-even equation with the targeted income. Multiply units to achieve targeted income by price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts