Question: Unless otherwise instructed, use two (2) decimal places for both percentages and dollar amounts. This is enforced, like in Connect If you need to enter

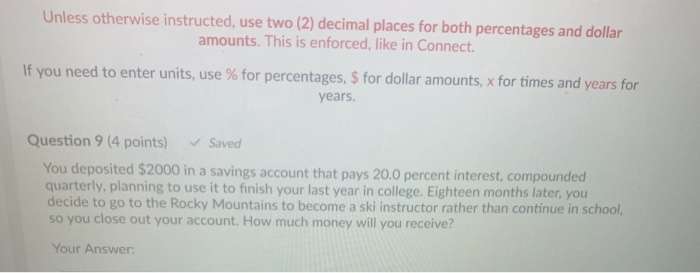

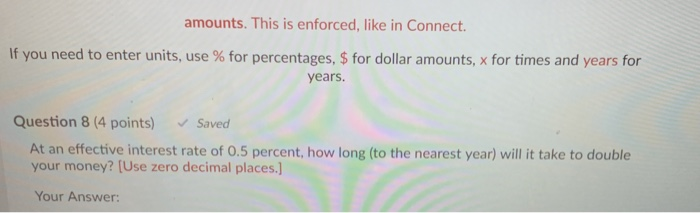

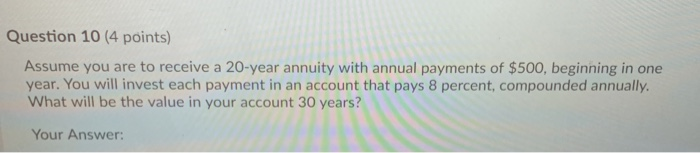

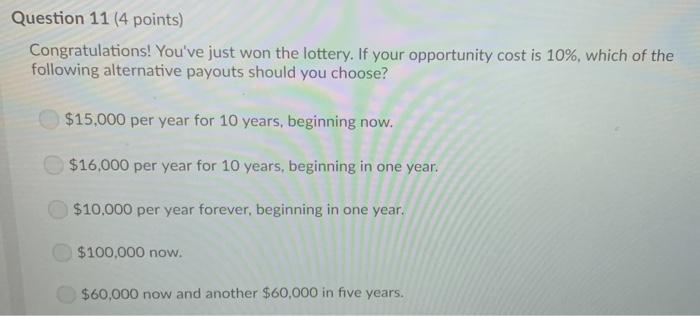

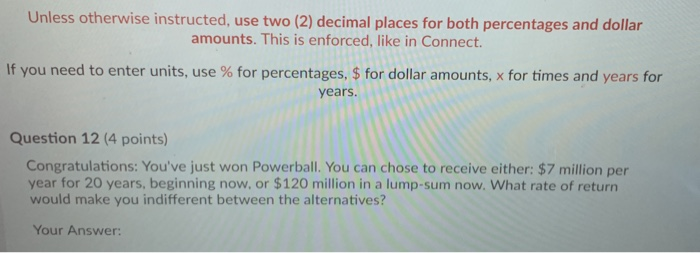

Unless otherwise instructed, use two (2) decimal places for both percentages and dollar amounts. This is enforced, like in Connect If you need to enter units, use % for percentages, $ for dollar amounts, x for times and years for years. Question 9 (4 points) Saved You deposited $2000 in a savings account that pays 20.0 percent interest, compounded quarterly, planning to use it to finish your last year in college. Eighteen months later, you decide to go to the Rocky Mountains to become a ski instructor rather than continue in school, so you close out your account. How much money will you receive? Your Answer: amounts. This is enforced, like in Connect If you need to enter units, use % for percentages, $ for dollar amounts, x for times and years for years Question 8 (4 points Saved At an effective interest rate of 0.5 percent, how long (to the nearest year) will it take to double your money? [Use zero decimal places.] Your Answer: Question 10 (4 points) Assume you are to receive a 20-year annuity with annual payments of $500, beginning in one year. You will invest each payment in an account that pays 8 percent, compounded annually What will be the value in your account 30 years? Your Answer: Question 11 (4 points) Congratulations! You've just won the lottery. If your opportunity cost is 10%, which of the following alternative payouts should you choose? $15,000 per year for 10 years, beginning now. $16,000 per year for 10 years, beginning in one year. $10,000 per year forever, beginning in one year. $100,000 now. $60,000 now and another $60,000 in five years. Unless otherwise instructed, use two (2) decimal places for both percentages and dollar amounts. This is enforced, like in Connect. If you need to enter units, use % for percentages, $ for dollar amounts, x for times and years for years. Question 12 (4 points) Congratulations: You've just won Powerball. You can chose to receive either: $7 million per year for 20 years, beginning now, or $120 million in a lump-sum now. What rate of return would make you indifferent between the alternatives? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts