Question: Unlike bond pricing, Excel does not have built-in functions for stock pricing, so we need to create our own equations. We will begin with constant

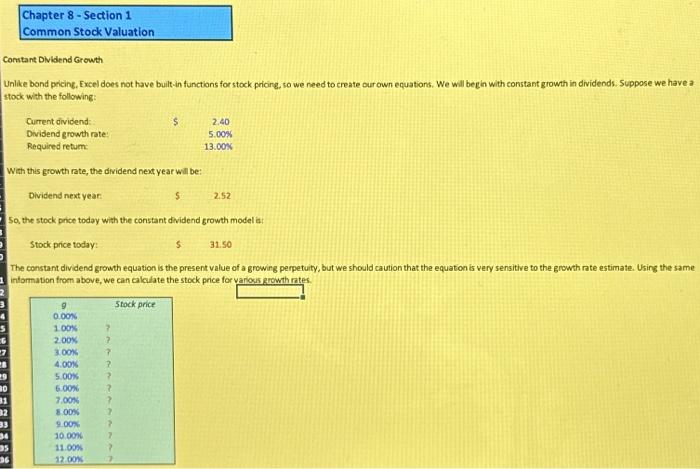

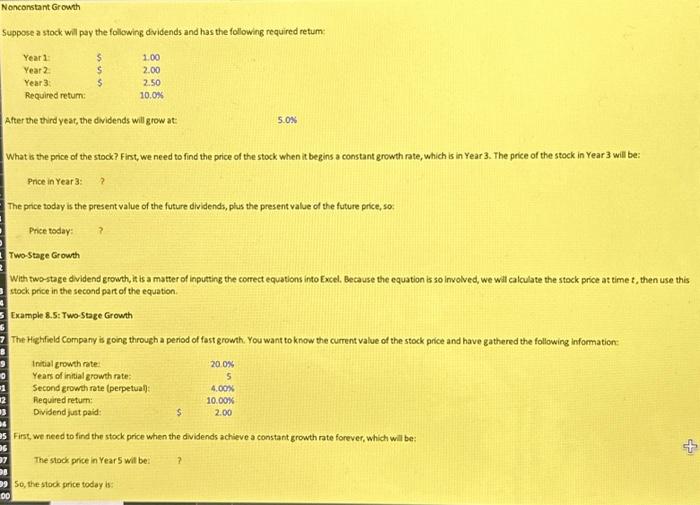

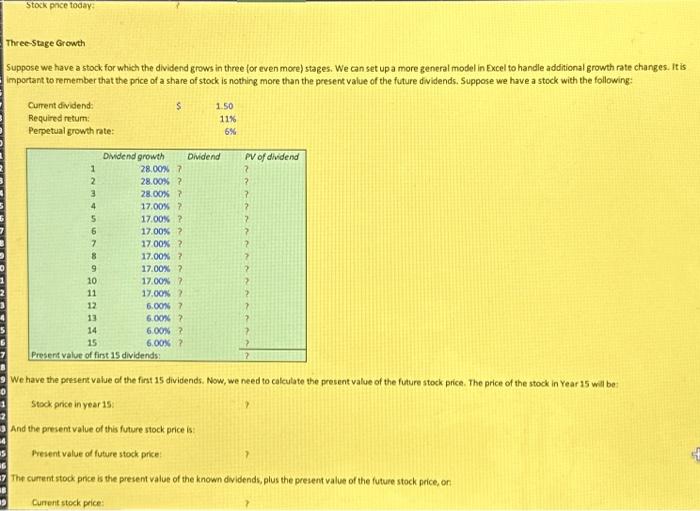

Unlike bond pricing, Excel does not have built-in functions for stock pricing, so we need to create our own equations. We will begin with constant growth in dividends. Suppose we have a stock with the following: With this growth rate, the dividend next year will be: So, the stock price today with the constant dividend growth model is: Suppose a stock will pay the following dividends and has the following required retum: After the third yeat, the dividends will grow at: 5.0s What is the price of the stock? Finst, we need to find the price of the stock when it begins a constant growth rate, which is in Year 3 . The price of the stock in Year 3 will be: Pnce in Year 3: ? The price today is the present value of the future dividends, plus the present value of the future price, so: Price today: ? Two-Stage Growth With two-stage dividend growth, it is a matter of inputing the correct equations into Excel, Beca use the equation is so involved, we wil calculate the stock price at time t, then use this stock price in the second part of the equation. Example 8.5: Two-Stage Growth The Highfield Company is going through a period of fast growth. You want to know the current value of the stock price and have gathered the following information: First, we need to find the stock price when the dividends achieve a constant growth rate forever, which will be: The stock prise in Year 5 wit be: So, the stock grice today is: Suppose we have a stock for which the dividend grows in three for even more) stages. We can set up a more zeneral model in Excel to handle additional growth rate changes. It is important to remember that the price of a share of stock is nothing more than the present value of the future dividends. Suppose we have a stock with the following: We have the peesent value of the first 15 dividends. Now, we need to calculate the present value of the future stock price. The price of the stock in Year 15 will be- Stock price in year 15 And the present value of this future stock price is Present value of future stock price: The curtent stock pnce is the presemt value of the known dividends, plus the present value of the future stock price, or Cunent stock price Unlike bond pricing, Excel does not have built-in functions for stock pricing, so we need to create our own equations. We will begin with constant growth in dividends. Suppose we have a stock with the following: With this growth rate, the dividend next year will be: So, the stock price today with the constant dividend growth model is: Suppose a stock will pay the following dividends and has the following required retum: After the third yeat, the dividends will grow at: 5.0s What is the price of the stock? Finst, we need to find the price of the stock when it begins a constant growth rate, which is in Year 3 . The price of the stock in Year 3 will be: Pnce in Year 3: ? The price today is the present value of the future dividends, plus the present value of the future price, so: Price today: ? Two-Stage Growth With two-stage dividend growth, it is a matter of inputing the correct equations into Excel, Beca use the equation is so involved, we wil calculate the stock price at time t, then use this stock price in the second part of the equation. Example 8.5: Two-Stage Growth The Highfield Company is going through a period of fast growth. You want to know the current value of the stock price and have gathered the following information: First, we need to find the stock price when the dividends achieve a constant growth rate forever, which will be: The stock prise in Year 5 wit be: So, the stock grice today is: Suppose we have a stock for which the dividend grows in three for even more) stages. We can set up a more zeneral model in Excel to handle additional growth rate changes. It is important to remember that the price of a share of stock is nothing more than the present value of the future dividends. Suppose we have a stock with the following: We have the peesent value of the first 15 dividends. Now, we need to calculate the present value of the future stock price. The price of the stock in Year 15 will be- Stock price in year 15 And the present value of this future stock price is Present value of future stock price: The curtent stock pnce is the presemt value of the known dividends, plus the present value of the future stock price, or Cunent stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts