Question: Unreadable part : how does the variance arise? Case: Top managers of Marshall Industries predicted annual sales of 23,600 units of its Product at a

Unreadable part : how does the variance arise?

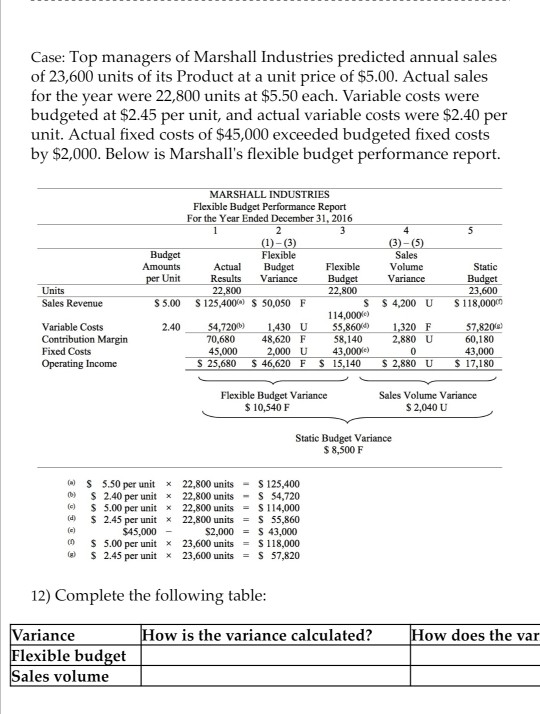

Case: Top managers of Marshall Industries predicted annual sales of 23,600 units of its Product at a unit price of $5.00. Actual sales for the year were 22,800 units at $5.50 each. Variable costs were budgeted at $2.45 per unit, and actual variable costs were $2.40 per unit. Actual fixed costs of $45,000 exceeded budgeted fixed costs by $2,000. Below is Marshall's flexible budget performance report. 5 MARSHALL INDUSTRIES Flexible Budget Performance Report For the Year Ended December 31, 2016 2 3 4 (1)-(3) (3)-(5) Budget Flexible Sales Amounts Actual Budget Flexible Volume Results Variance Budget Variance 22,800 22,800 S 5.00 S 125,400 $ 50,050 F S $4,200 U 114.000) 2.40 54,7200 1,430 U 55,860% 1,320 F 70,680 48,620 F 58,140 2,880 U 45,000 2,000 U 43,000) 0 S 25,680 $ 46,620 F $ 15,140 $ 2,880 U per Unit Units Sales Revenue Static Budget 23,600 S 118,0000 Variable Costs Contribution Margin Fixed Costs Operating Income 57,820 60,180 43,000 $ 17,180 Flexible Budget Variance $ 10,540 F Sales Volume Variance $ 2,040 U Static Budget Variance $ 8,500 F ( S 5.50 per unit x 22,800 units S 125,400 $ 2.40 per unit x 22,800 units S 54,720 $ 5.00 per unit x 22,800 units = $ 114,000 (d) $ 2.45 per unit x 22,800 units = $ 55,860 $45,000 - $2,000 = $ 43,000 $5.00 per unit x 23,600 units = $ 118,000 ) $ 2.45 per unit * 23,600 units = S 57,820 12) Complete the following table: How is the variance calculated? How does the var Variance Flexible budget Sales volume

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts