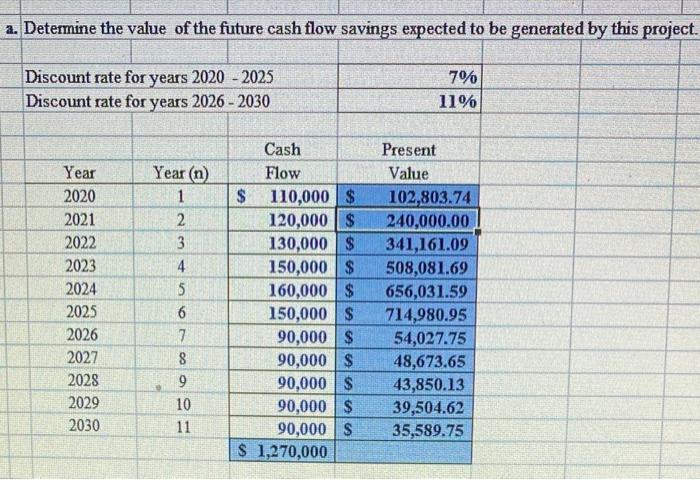

Question: Unsure if my present values are even correct a. Determine the value of the future cash flow savings expected to be generated by this project.

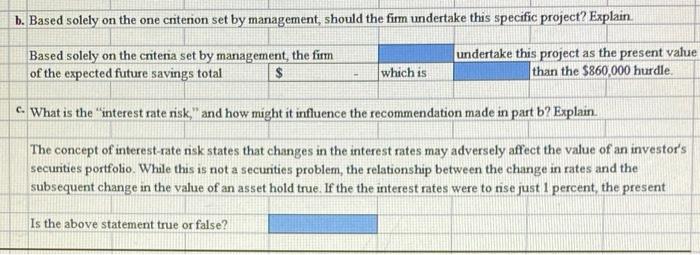

a. Determine the value of the future cash flow savings expected to be generated by this project. Discount rate for years 2020 - 2025 Discount rate for years 2026 - 2030 7% 11% Year (n) Year 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 1 2 3 4 5 6 7 8 9 10 11 Cash Flow $ 110,000 $ 120,000 $ 130,000 $ 150,000 $ 160,000 $ 150,000 $ 90,000 $ 90,000 $ 90,000 $ 90,000 $ 90,000 $ $ 1,270,000 Present Value 102,803.74 240,000.00 341,161.09 508,081.69 656,031.59 714,980.95 54,027.75 48,673.65 43,850.13 39,504.62 35,589.75 b. Based solely on the one critenon set by management should the firm undertake this specific project? Explain Based solely on the critena set by management, the firm of the expected future savings total $ undertake this project as the present value than the $860,000 hurdle. which is C. What is the interest rate risk," and how might it influence the recommendation made in part b? Explain The concept of interest-rate risk states that changes in the interest rates may adversely affect the value of an investor's securities portfolio While this is not a securities problem, the relationship between the change in rates and the subsequent change in the value of an asset hold true. If the the interest rates were to rise just 1 percent, the present Is the above statement true or false

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts