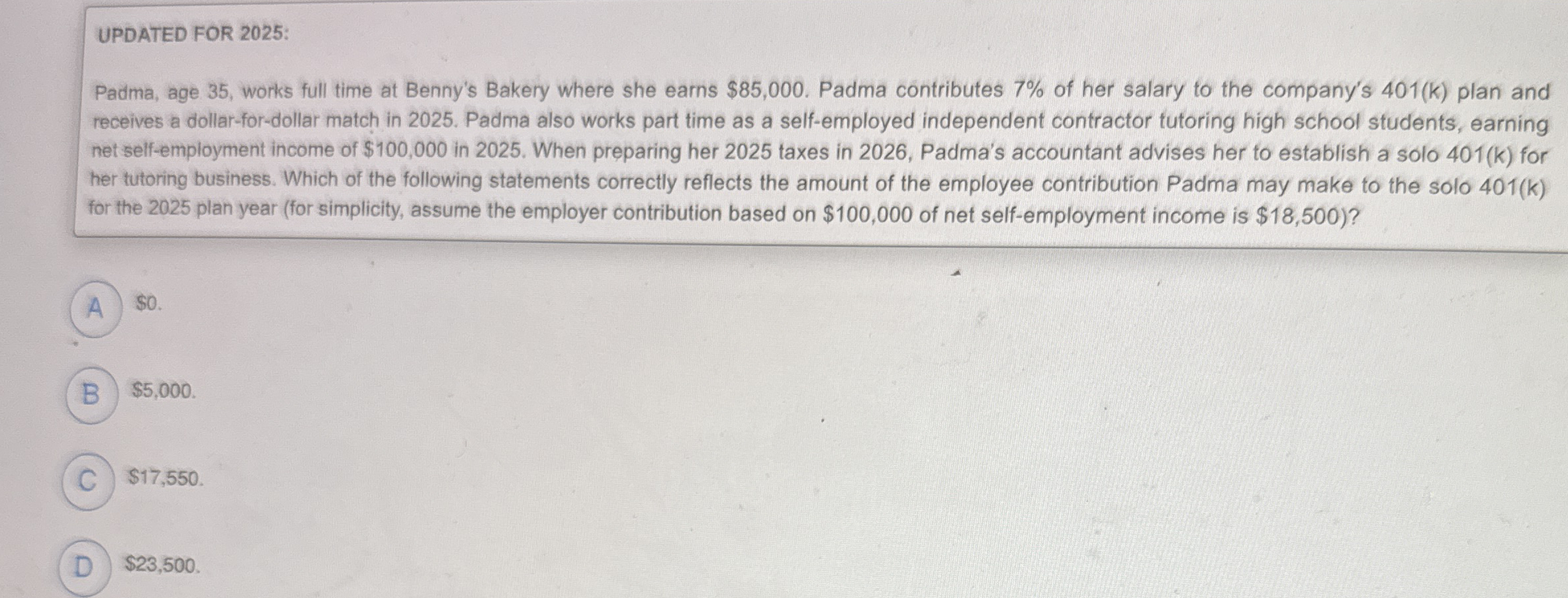

Question: UPDATED FOR 2 0 2 5 : Padma, age 3 5 , works full time at Benny's Bakery where she earns $ 8 5 ,

UPDATED FOR :

Padma, age works full time at Benny's Bakery where she earns $ Padma contributes of her salary to the company's plan and receives a dollarfordollar match in Padma also works part time as a selfemployed independent contractor futoring high school students, earning net selfemployment income of $ in When preparing her taxes in Padma's accountant advises her to establish a solo for her tutoring business. Which of the following statements correctly reflects the amount of the employee contribution Padma may make to the solo for the plan year for simplicity, assume the employer contribution based on $ of net selfemployment income is $

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock