Question: UPDATED QUESTION with columns: I will attach 4 photos with the excel information, if I could attach an excel I would, but chegg won't allow

UPDATED QUESTION with columns:

I will attach 4 photos with the excel information, if I could attach an excel I would, but chegg won't allow it. I need this assignment to graduate so please help thank you so much.

The question also has information with it below:

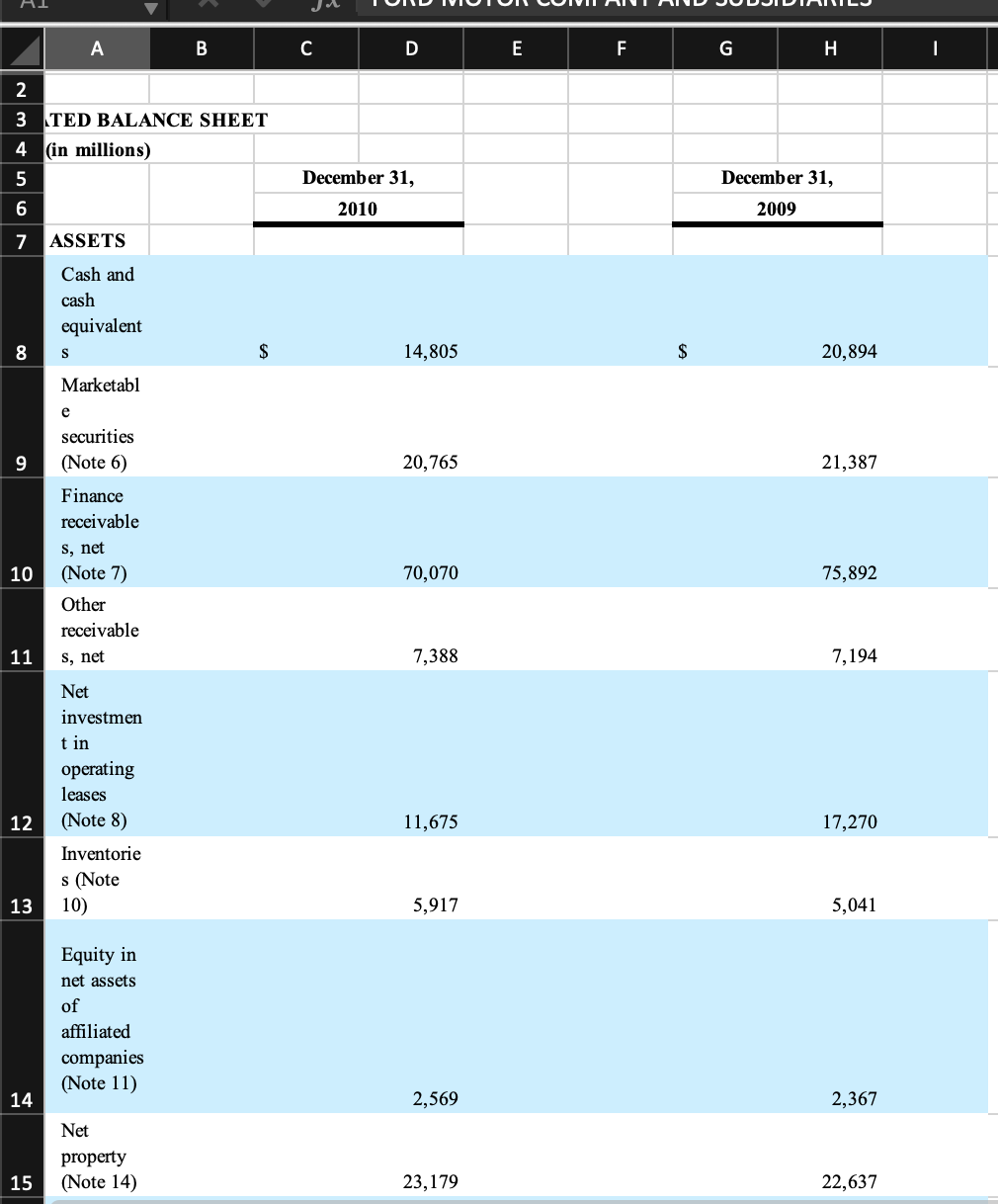

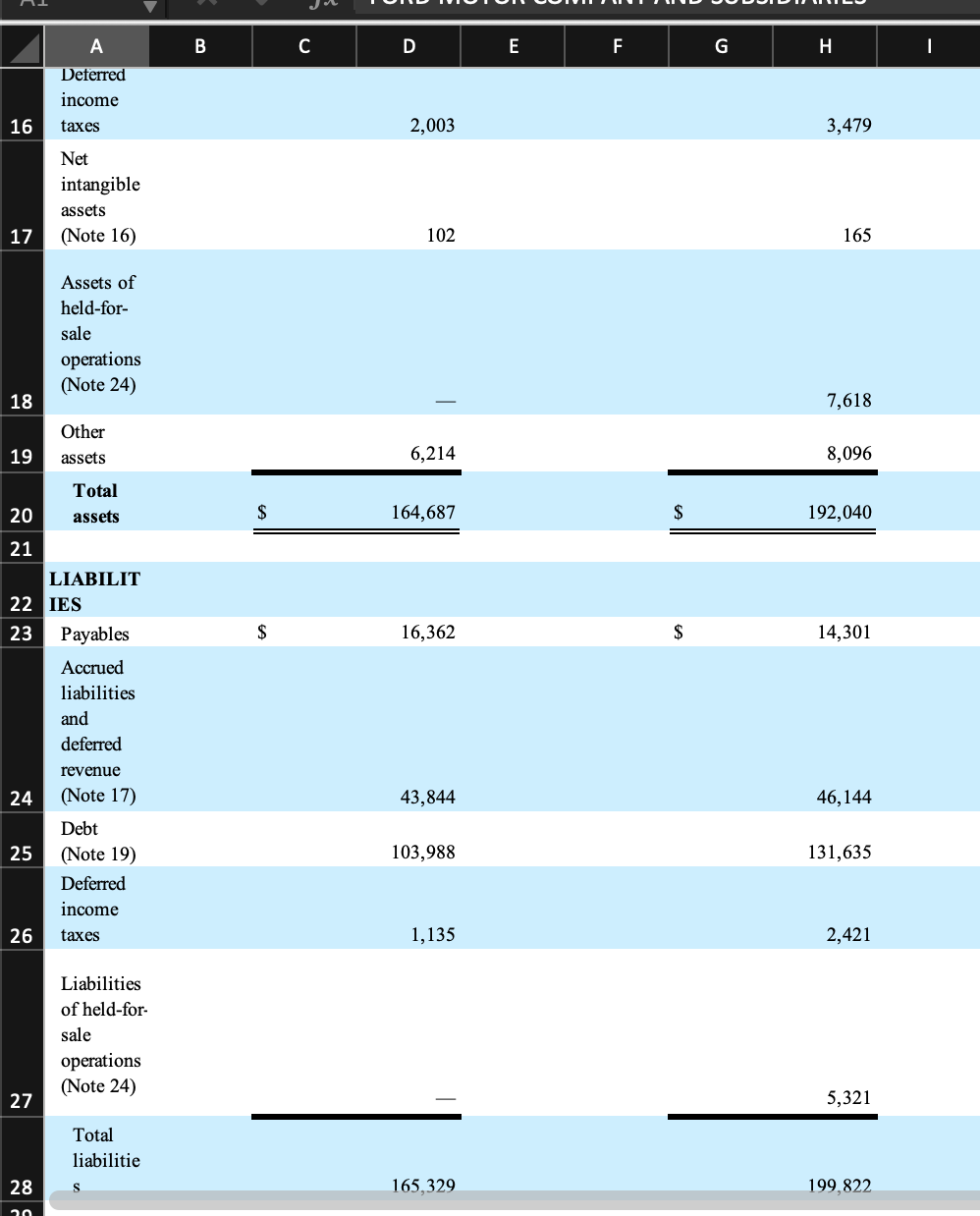

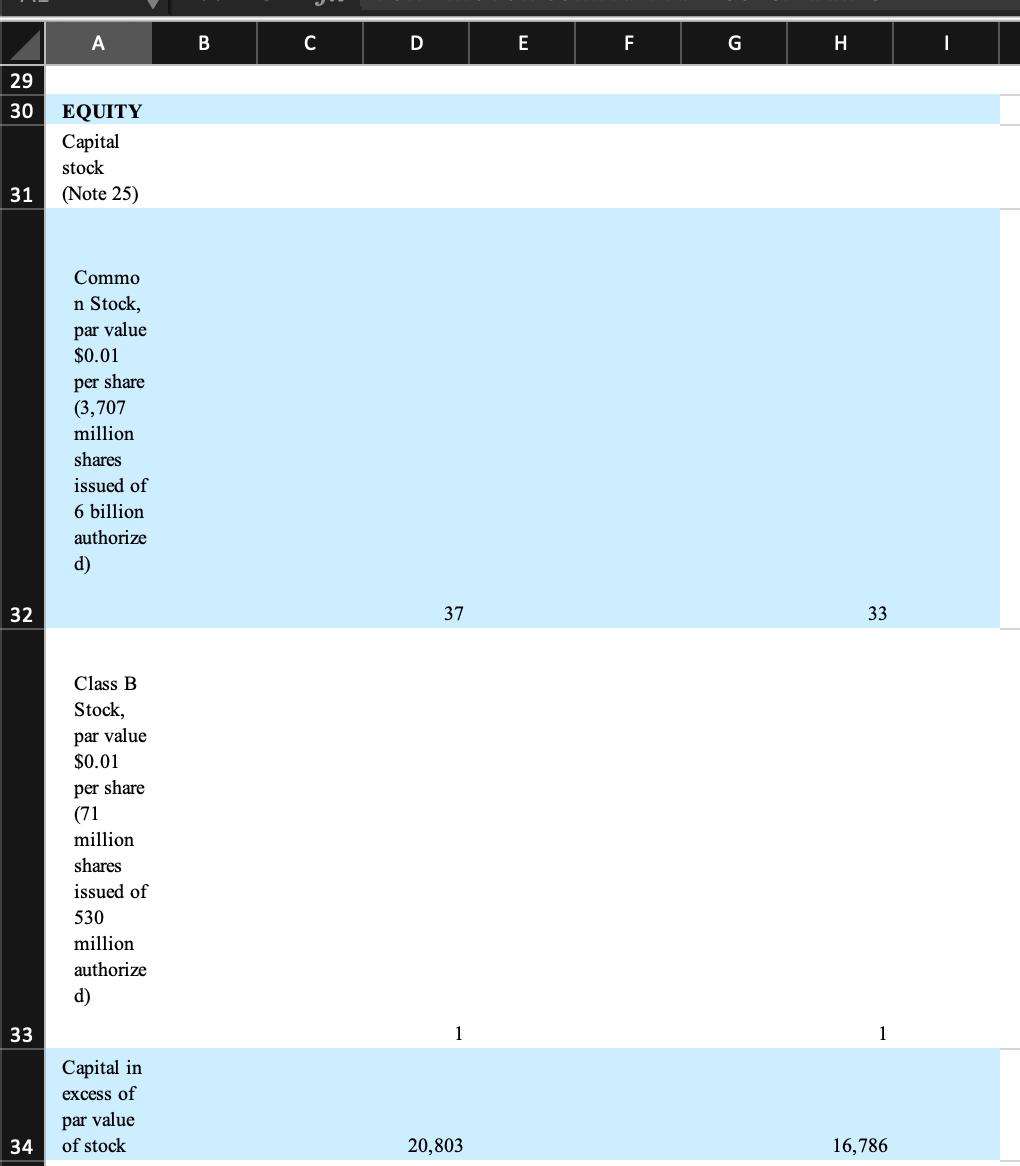

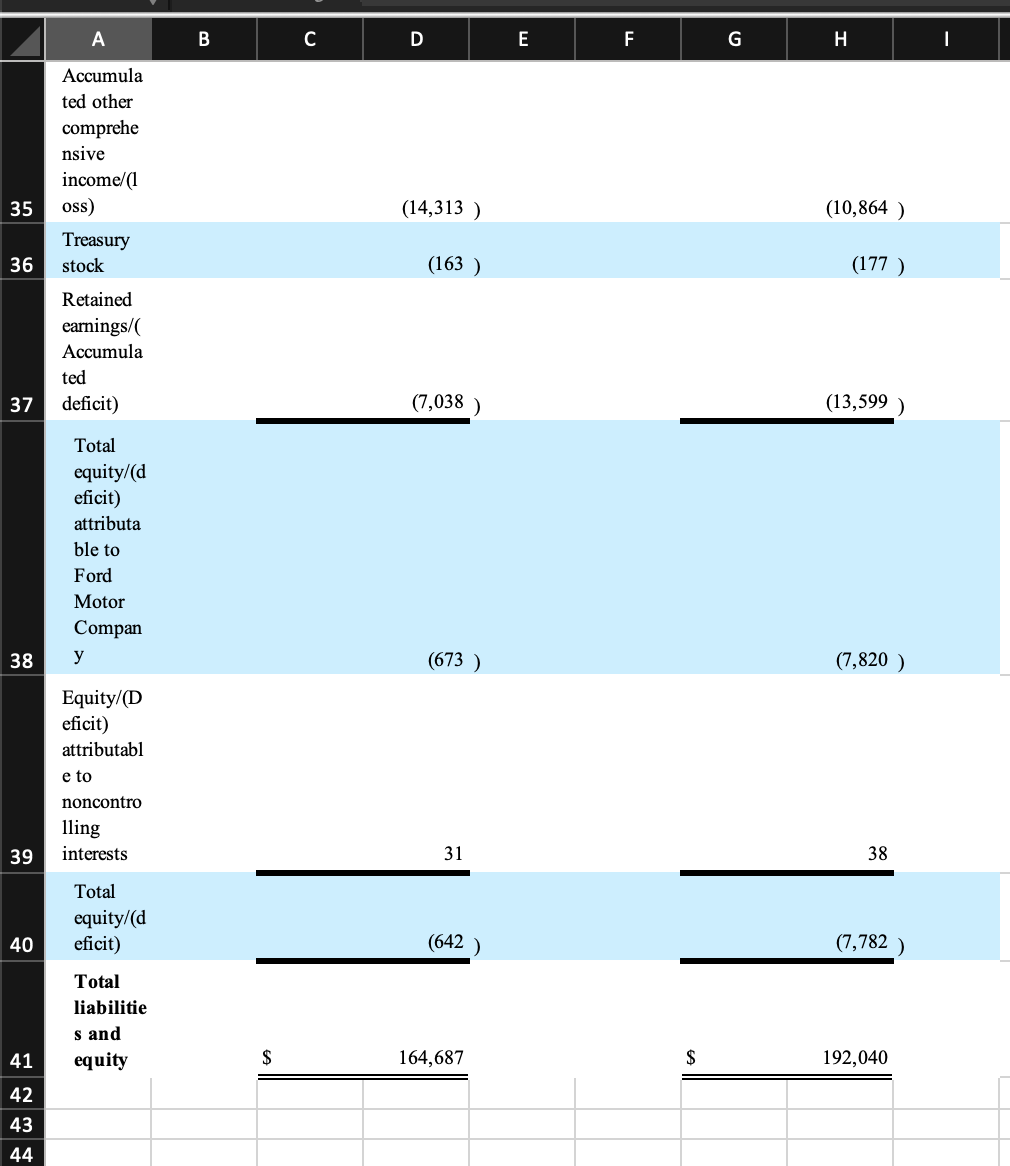

The file is a Balance Sheet for The Ford Motor Company.

You need to format the file for the CEO to read, using the following guidelines (whether it follows what you learned in the module or not!):

1. All the data needs to remain within the rows that it exists in now.

2. Your 2010 numbers need to end up in column D, and your 2009 figures in column G.

3. Replace the figures in rows 20, 28, 38, 40 and 41 with formulas to insure that if the data is changed then the figures will calculate the correct totals.

4. Use what you learned from the practice file to format the Assessment file. Use critical thinking skills to create a professional document.

5. Answer the assessment questions based on the file you create. When asked for a figure, enter exactly what is in the cells on your file.

With all this information the actual question I am getting asked is:

Question: What do you have in cell D32 of your file?

A B C D E F G H I 29 30 EQUITY Capital stock 31 (Note 25) Commo n Stock, par value $0.01 per share (3,707 million shares issued of 6 billion authorize d) 32 37 33 Class B Stock, par value $0.01 per share (71 million shares issued of 530 million authorize d) 33 1 1 Capital in excess of par value 34 of stock 20,803 16,786 A B C D E F G H Accumula ted other comprehe nsive income/(1 35 oss) (14,313) (10,864) Treasury 36 stock (163) (177) Retained earnings/( Accumula ted 37 deficit) (7,038) (13,599) Total equity/(d eficit) attributa ble to Ford Motor Compan 38y (673) (7,820) Equity/(D eficit) attributabl e to noncontro lling 39 interests 31 38 Total equity/(d 40 eficit) (642) (7,782) Total liabilitie s and 41 equity $164,687 $192,040 42 43 44 A B C D E F G H I 29 30 EQUITY Capital stock 31 (Note 25) Commo n Stock, par value $0.01 per share (3,707 million shares issued of 6 billion authorize d) 32 37 33 Class B Stock, par value $0.01 per share (71 million shares issued of 530 million authorize d) 33 1 1 Capital in excess of par value 34 of stock 20,803 16,786 A B C D E F G H Accumula ted other comprehe nsive income/(1 35 oss) (14,313) (10,864) Treasury 36 stock (163) (177) Retained earnings/( Accumula ted 37 deficit) (7,038) (13,599) Total equity/(d eficit) attributa ble to Ford Motor Compan 38y (673) (7,820) Equity/(D eficit) attributabl e to noncontro lling 39 interests 31 38 Total equity/(d 40 eficit) (642) (7,782) Total liabilitie s and 41 equity $164,687 $192,040 42 43 44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts