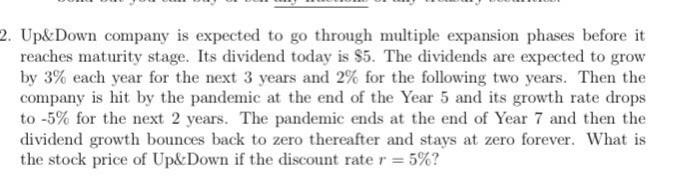

Question: Up&Down company is expected to go through multiple expansion phases before it reaches maturity stage. Its dividend today is $5. The dividends are expected to

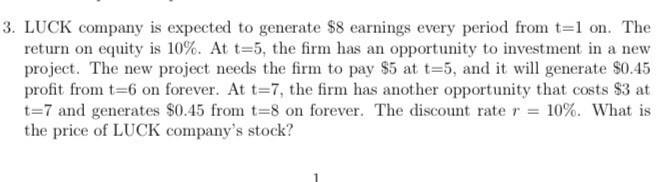

Up\&Down company is expected to go through multiple expansion phases before it reaches maturity stage. Its dividend today is $5. The dividends are expected to grow by 3% each year for the next 3 years and 2% for the following two years. Then the company is hit by the pandemic at the end of the Year 5 and its growth rate drops to 5% for the next 2 years. The pandemic ends at the end of Year 7 and then the dividend growth bounces back to zero thereafter and stays at zero forever. What is the stock price of Up\&Down if the discount rate r=5% ? LUCK company is expected to generate $8 earnings every period from t=1 on. The return on equity is 10%. At t=5, the firm has an opportunity to investment in a new project. The new project needs the firm to pay $5 at t=5, and it will generate $0.45 profit from t=6 on forever. At t=7, the firm has another opportunity that costs $3 at t=7 and generates $0.45 from t=8 on forever. The discount rate r=10%. What is the price of LUCK company's stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts