Question: (Uploaded completes assignment question. I found answers for question (a) and (b) readily but not for (c) & (d). Kindly review and help me pls.

(Uploaded completes assignment question. I found answers for question (a) and (b) readily but not for (c) & (d). Kindly review and help me pls. Thanks in advance)

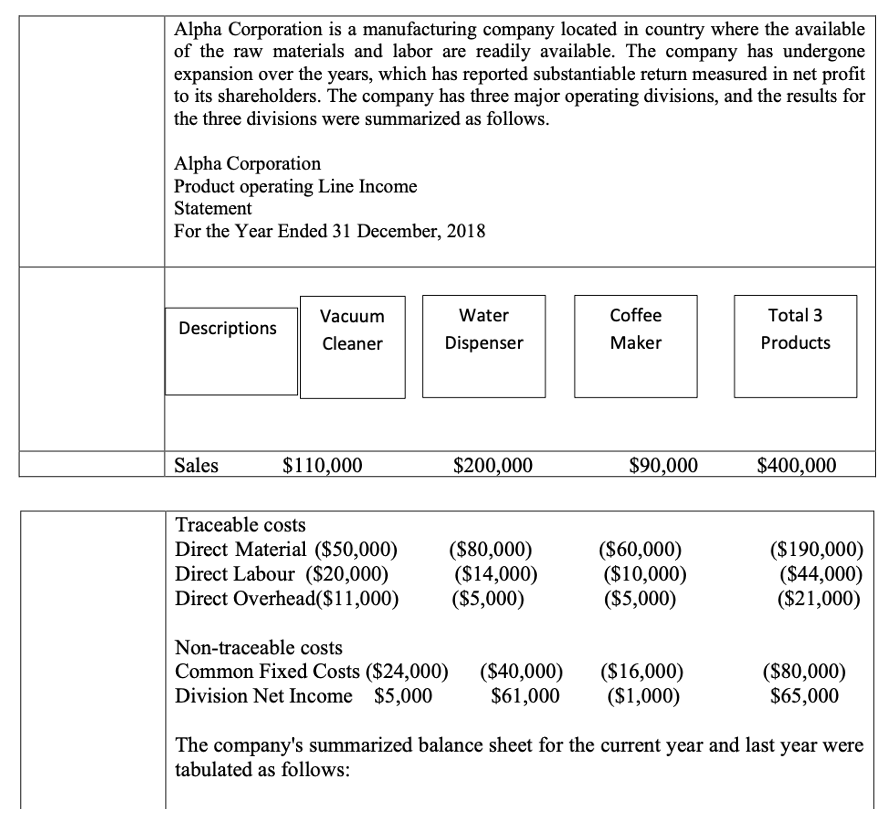

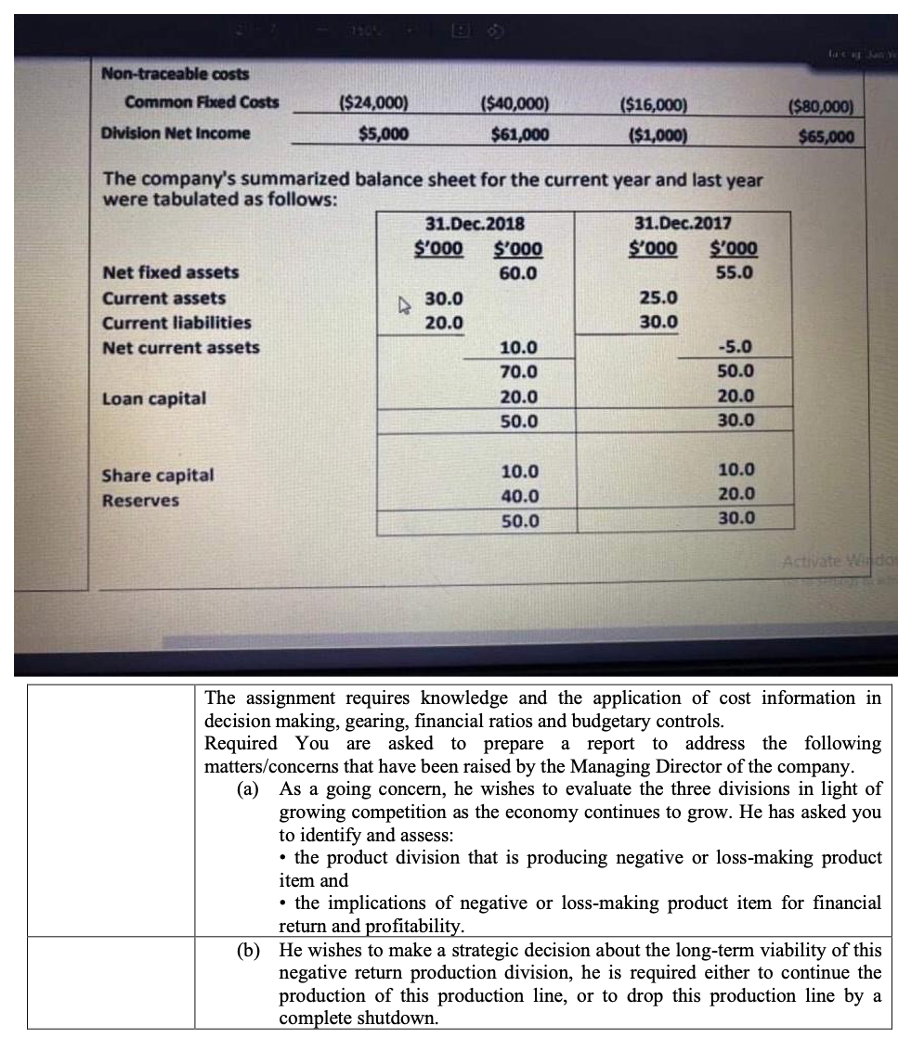

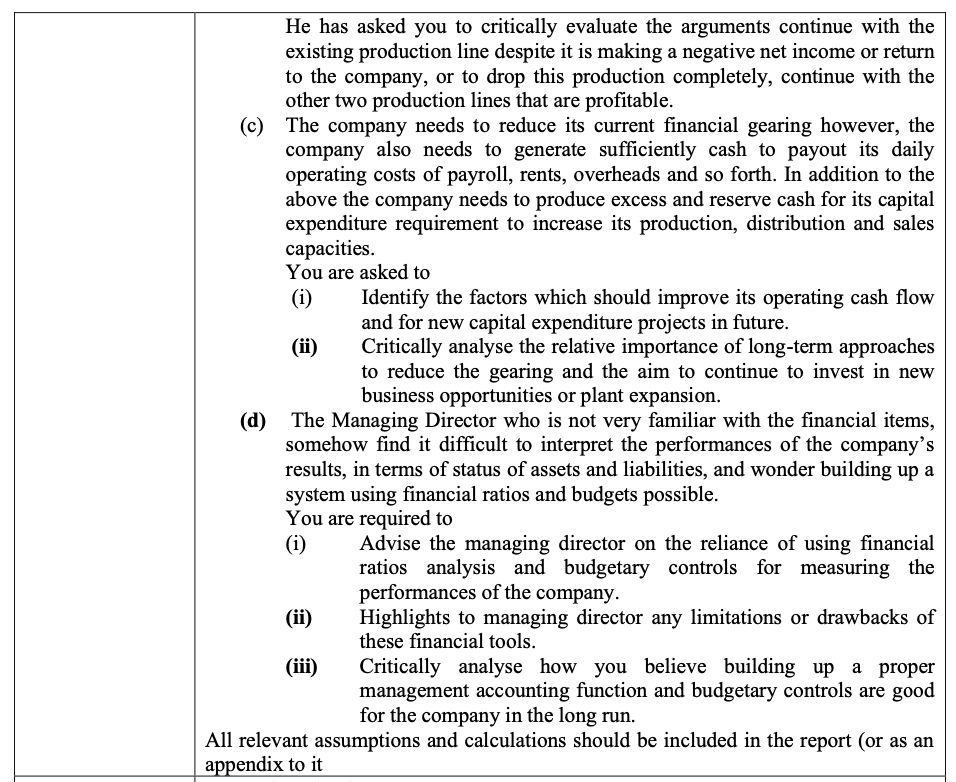

Alpha Corporation is a manufacturing company located in country where the available of the raw materials and labor are readily available. The company has undergone expansion over the years, which has reported substantiable return measured in net profit to its shareholders. The company has three major operating divisions, and the results for the three divisions were summarized as follows. Alpha Corporation Product operating Line Income Statement For the Year Ended 31 December, 2018 Descriptions Vacuum Cleaner Water Dispenser Coffee Maker Total 3 Products Sales $110,000 $200,000 $90,000 $400,000 Traceable costs Direct Material ($50,000) Direct Labour ($20,000) Direct Overhead($11,000) ($80,000) ($14,000) ($5,000) ($60,000) ($10,000) ($5,000) ($190,000) ($44,000) ($21,000) Non-traceable costs Common Fixed Costs ($24,000) Division Net Income $5,000 ($40,000) $61,000 ($16,000) ($1,000) ($80,000) $65,000 The company's summarized balance sheet for the current year and last year were tabulated as follows: let Non-traceable costs Common Fixed Costs ($24,000) $5,000 ($40,000) $61,000 ($16,000) ($1,000) ($80,000) $65,000 Division Net Income The company's summarized balance sheet for the current year and last year were tabulated as follows: 31.Dec.2018 31.Dec.2017 $'000 $'000 $'000 $'000 Net fixed assets 60.0 55.0 Current assets 25.0 Current liabilities 20.0 30.0 Net current assets 10.0 -5.0 70.0 50.0 Loan capital 20.0 20.0 50.0 30.0 A 30.0 Share capital Reserves 10.0 40.0 50.0 10.0 20.0 30.0 Activated The assignment requires knowledge and the application of cost information in decision making, gearing, financial ratios and budgetary controls. Required You are asked to prepare a report to address the following matters/concerns that have been raised by the Managing Director of the company. (a) As a going concern, he wishes to evaluate the three divisions in light of growing competition as the economy continues to grow. He has asked you to identify and assess: the product division that is producing negative or loss-making product item and the implications of negative or loss-making product item for financial return and profitability. (b) He wishes to make a strategic decision about the long-term viability of this negative return production division, he is required either to continue the production of this production line, or to drop this production line by a complete shutdown. He has asked you to critically evaluate the arguments continue with the existing production line despite it is making a negative net income or return to the company, or to drop this production completely, continue with the other two production lines that are profitable. (c) The company needs to reduce its current financial gearing however, the company also needs to generate sufficiently cash to payout its daily operating costs of payroll, rents, overheads and so forth. In addition to the above the company needs to produce excess and reserve cash for its capital expenditure requirement to increase its production, distribution and sales capacities. You are asked to (i) i Identify the factors which should improve its operating cash flow and for new capital expenditure projects in future. (ii) Critically analyse the relative importance of long-term approaches to reduce the gearing and the aim to continue to invest in new business opportunities or plant expansion. (d) The Managing Director who is not very familiar with the financial items, somehow find it difficult to interpret the performances of the company's results, in terms of status of assets and liabilities, and wonder building up a system using financial ratios and budgets possible. You are required to (i) Advise the managing director on the reliance of using financial ratios analysis and budgetary controls for measuring the performances of the company. (ii) Highlights to managing director any limitations or drawbacks of these financial tools. (iii) Critically analyse how you believe building up a proper management accounting function and budgetary controls are good for the company in the long run. All relevant assumptions and calculations should be included in the report (or as an appendix to it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts