Question: Upon graduating, you are a process engineer at ABC Biologics INC start up. As the engineer in process design, you are asked to determine if

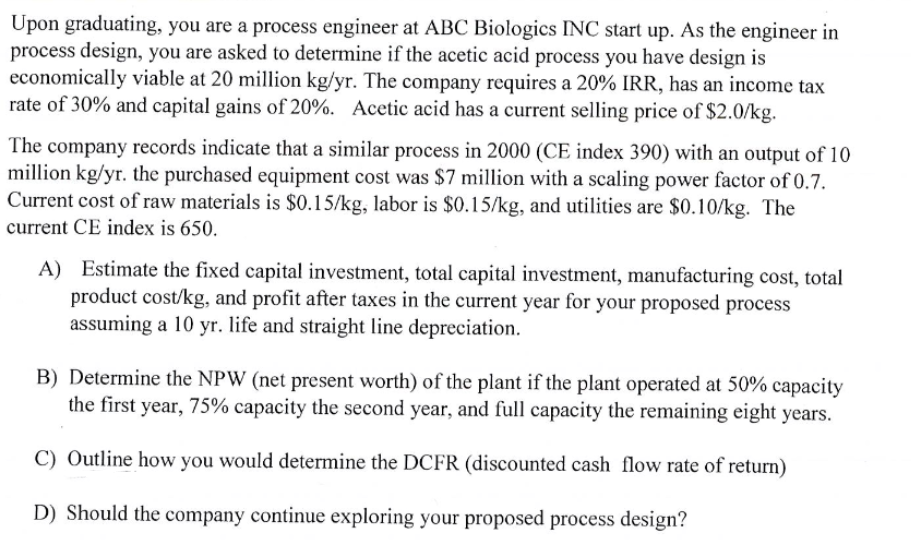

Upon graduating, you are a process engineer at ABC Biologics INC start up. As the engineer in process design, you are asked to determine if the acetic acid process you have design is economically viable at 20 million kg/yr. The company requires a 20% IRR, has an income tax rate of 30% and capital gains of 20%. Acetic acid has a current selling price of $2.0/kg. The company records indicate that a similar process in 2000 (CE index 390) with an output of 10 million kg/yr. the purchased equipment cost was S7 million with a scaling power factor of 0.7 Current cost of raw materials is $0.15/kg, labor is $0.15/kg, and utilities are $0.10/kg. The current CE index is 650. Estimate the fixed capital investment, total capital investment, manufacturing cost, total product cost/kg, and profit after taxes in the current year for your proposed process assuming a 10 yr. life and straight line depreciation A) B) Determine the NPW (net present worth) of the plant if the plant operated at 50% capacity the first year, 75% capacity the second year, and full capacity the remaining eight years. C) Outline how you would determine the DCFR (discounted cash flow rate of return) D) Should the company continue exploring your proposed process design? Upon graduating, you are a process engineer at ABC Biologics INC start up. As the engineer in process design, you are asked to determine if the acetic acid process you have design is economically viable at 20 million kg/yr. The company requires a 20% IRR, has an income tax rate of 30% and capital gains of 20%. Acetic acid has a current selling price of $2.0/kg. The company records indicate that a similar process in 2000 (CE index 390) with an output of 10 million kg/yr. the purchased equipment cost was S7 million with a scaling power factor of 0.7 Current cost of raw materials is $0.15/kg, labor is $0.15/kg, and utilities are $0.10/kg. The current CE index is 650. Estimate the fixed capital investment, total capital investment, manufacturing cost, total product cost/kg, and profit after taxes in the current year for your proposed process assuming a 10 yr. life and straight line depreciation A) B) Determine the NPW (net present worth) of the plant if the plant operated at 50% capacity the first year, 75% capacity the second year, and full capacity the remaining eight years. C) Outline how you would determine the DCFR (discounted cash flow rate of return) D) Should the company continue exploring your proposed process design

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts