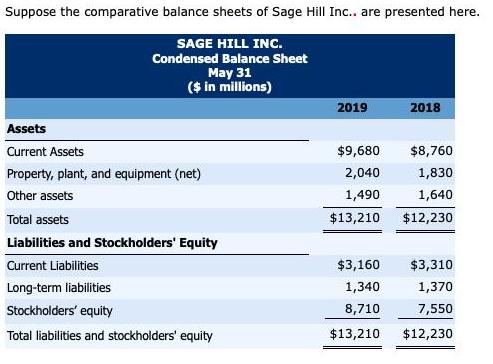

Suppose the comparative balance sheets of Sage Hill Inc.. are presented here. SAGE HILL INC. Condensed...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

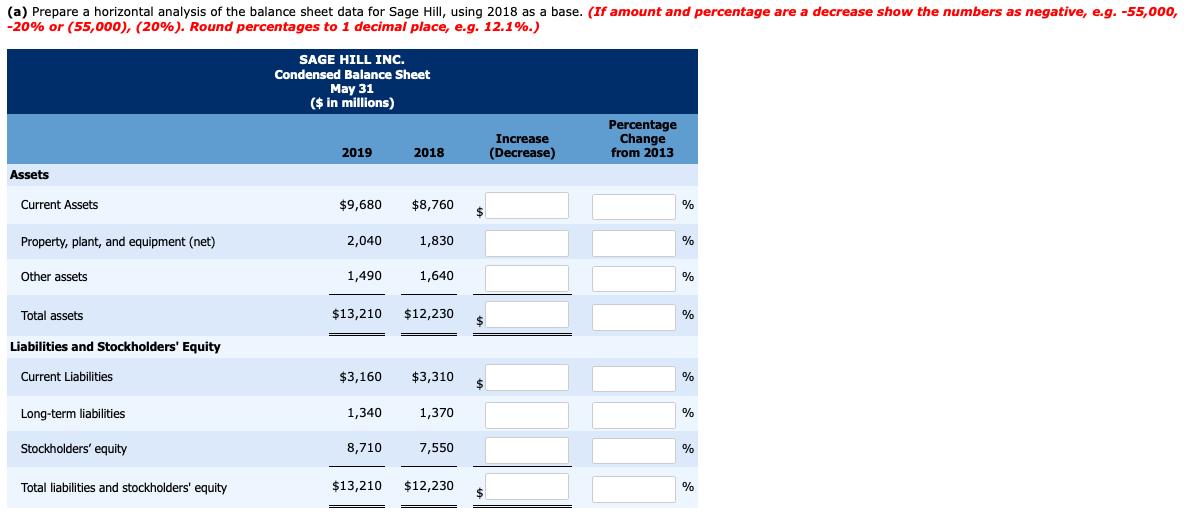

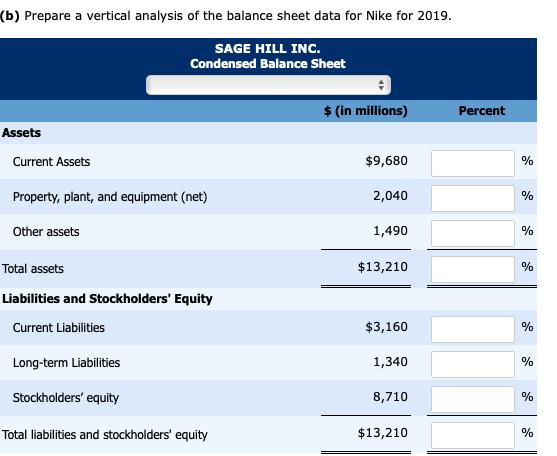

Suppose the comparative balance sheets of Sage Hill Inc.. are presented here. SAGE HILL INC. Condensed Balance Sheet May 31 ($ in millions) 2019 2018 Assets Current Assets $9,680 $8,760 Property, plant, and equipment (net) 2,040 1,830 Other assets 1,490 1,640 Total assets $13,210 $12,230 Liabilities and Stockholders' Equity Current Liabilities $3,160 $3,310 Long-term liabilities 1,340 1,370 Stockholders' equity 8,710 7,550 Total liabilities and stockholders' equity $13,210 $12,230 (a) Prepare a horizontal analysis of the balance sheet data for Sage Hill, using 2018 as a base. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.1%.) SAGE HILL INC. Condensed Balance Sheet May 31 ($ in millions) Percentage Change from 2013 Increase 2019 2018 (Decrease) Assets Current Assets $9,680 $8,760 % Property, plant, and equipment (net) 2,040 1,830 % Other assets 1,490 1,640 % Total assets $13,210 $12,230 % Liabilities and Stockholders' Equity Current Liabilities $3,160 $3,310 % Long-term liabilities 1,340 1,370 Stockholders' equity 8,710 7,550 % Total liabilities and stockholders' equity $13,210 $12,230 (b) Prepare a vertical analysis of the balance sheet data for Nike for 2019. SAGE HILL INC. Condensed Balance Sheet $ (in millions) Percent Assets Current Assets $9,680 Property, plant, and equipment (net) 2,040 % Other assets 1,490 % Total assets $13,210 % Liabilities and Stockholders' Equity Current Liabilities $3,160 % Long-term Liabilities 1,340 % Stockholders' equity 8,710 % Total liabilities and stockholders' equity $13,210 % Suppose the comparative balance sheets of Sage Hill Inc.. are presented here. SAGE HILL INC. Condensed Balance Sheet May 31 ($ in millions) 2019 2018 Assets Current Assets $9,680 $8,760 Property, plant, and equipment (net) 2,040 1,830 Other assets 1,490 1,640 Total assets $13,210 $12,230 Liabilities and Stockholders' Equity Current Liabilities $3,160 $3,310 Long-term liabilities 1,340 1,370 Stockholders' equity 8,710 7,550 Total liabilities and stockholders' equity $13,210 $12,230 (a) Prepare a horizontal analysis of the balance sheet data for Sage Hill, using 2018 as a base. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.1%.) SAGE HILL INC. Condensed Balance Sheet May 31 ($ in millions) Percentage Change from 2013 Increase 2019 2018 (Decrease) Assets Current Assets $9,680 $8,760 % Property, plant, and equipment (net) 2,040 1,830 % Other assets 1,490 1,640 % Total assets $13,210 $12,230 % Liabilities and Stockholders' Equity Current Liabilities $3,160 $3,310 % Long-term liabilities 1,340 1,370 Stockholders' equity 8,710 7,550 % Total liabilities and stockholders' equity $13,210 $12,230 (b) Prepare a vertical analysis of the balance sheet data for Nike for 2019. SAGE HILL INC. Condensed Balance Sheet $ (in millions) Percent Assets Current Assets $9,680 Property, plant, and equipment (net) 2,040 % Other assets 1,490 % Total assets $13,210 % Liabilities and Stockholders' Equity Current Liabilities $3,160 % Long-term Liabilities 1,340 % Stockholders' equity 8,710 % Total liabilities and stockholders' equity $13,210 %

Expert Answer:

Related Book For

Intermediate Accounting

ISBN: 978-1118147290

15th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield

Posted Date:

Students also viewed these accounting questions

-

The comparative balance sheets of Fain, Inc. are presented here. FAIN INC. Comparative Balance Sheets May 3l (S in millions) 2009 2008 Assets Current assets Property, plant, and equipment (net) Other...

-

The comparative balance sheets of Maynard Movie Theater Company at June 30, 2010 and 2009, reported the following: Maynard Movie Theater s transactions during the year ended June 30, 2010, included...

-

The comparative balance sheets of Medford Movie Theater Company at June 30, 2010 and 2009, reported the following: Medfords transactions during the year ended June 30, 2010, included the following:...

-

For each of the following tests, identify two different samples of people who would have the expertise to serve as subject matter experts (SMEs) for providing judgments regarding the content validity...

-

The balances for the accounts listed below appear in the Adjusted Trial Balance columns of the end-of-period spreadsheet (work sheet). Indicate whether each balance should be extended to (a) An...

-

This problem explores the effect of interchanging the order of two operations on a signal, namely, sampling and performing a memoryless nonlinear operation. (a) Consider the two signal-processing...

-

Estimate the cost of activities

-

Presented below is the comparative balance sheet for Diatessaron Inc., a private company reporting under ASPE, at December 31, 2017 and 2016: Additional information: 1. Cash dividends of $15,000 were...

-

El Grupo Basu readquiri 4 millones de sus acciones a 64 dlares por accin como acciones propias. El ao pasado, por primera vez, Basu vendi 2 millones de acciones propias a 65 dlares por accin. Si Basu...

-

Pauley, Inc., pays its employees' weekly wages in cash. A supplementary payroll sheet that lists the employees' names and their earnings for a certain week is shown below. Complete the payroll sheet...

-

The accompanying file contains four observations with four categorical variables, x1,x2,x3, and x4. x1 x2 x3 x4 Round Wood Large With handle Square Metal Small With handle Triangle Metal Small...

-

Solve xy' - 2y = x.

-

Vanishing Games Corporation (VGC) operates a massively multiplayer online game, charging players a monthly subscription of $15. At the start of January 2021, VGC's income statement accounts had zero...

-

Financial data, medical service data, and staffing data are best defined as what type of data

-

. What is meant by the term "foreign exchange rate"? In general, what causes foreign exchange rates to vary over time? . Do changes in foreign exchange rates benefit or hurt U.S. companies that are...

-

Primare Corporation has provided the following data concerning last month's manufacturing operations. Purchases of raw materials Indirect materials used in production Direct labor Manufacturing...

-

Yosko Company budgeted direct materials purchases of $191,640 in January and $139,360 in February. Assume Yosko pays for direct materials purchases 70% in the month of purchase and 30% in the month...

-

Maria Castigliani is head of the purchasing department of Ambrosiana Merceti, a medium-sized construction company. One morning she walked into the office and said, The main problem in this office is...

-

When salaries and wages expense for the year is computed, why are beginning accrued salaries and wages subtracted from, and ending accrued salaries and wages added to, salaries and wages paid during...

-

Bagwell Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $2,500,000 on January 1, 2012. Bagwell expected to complete the...

-

Venzuela Company's net income for 2014 is $50,000. The only potentially dilutive securities outstanding were 1,000 options issued during 2013, each exercisable for one share at $6. None has been...

-

Identify one country in Europe and one in Asia. Using the measures for the key drivers of e-commerce, compare the degree of advancement of e-commerce in each of the two countries. LO.1

-

Which activities are least likely to be affected by e-commerce? LO.1

-

In an earlier chapters exercise, you ran a regression model using the ANES knowledge index as your dependent variable and the four media variables as your independent variables. Now, after reading...

Study smarter with the SolutionInn App