Question: uppose the risky asset A with expected return equal to 11.4% and variance equal to 0.04 can be nixed with the risk-free asset that offers

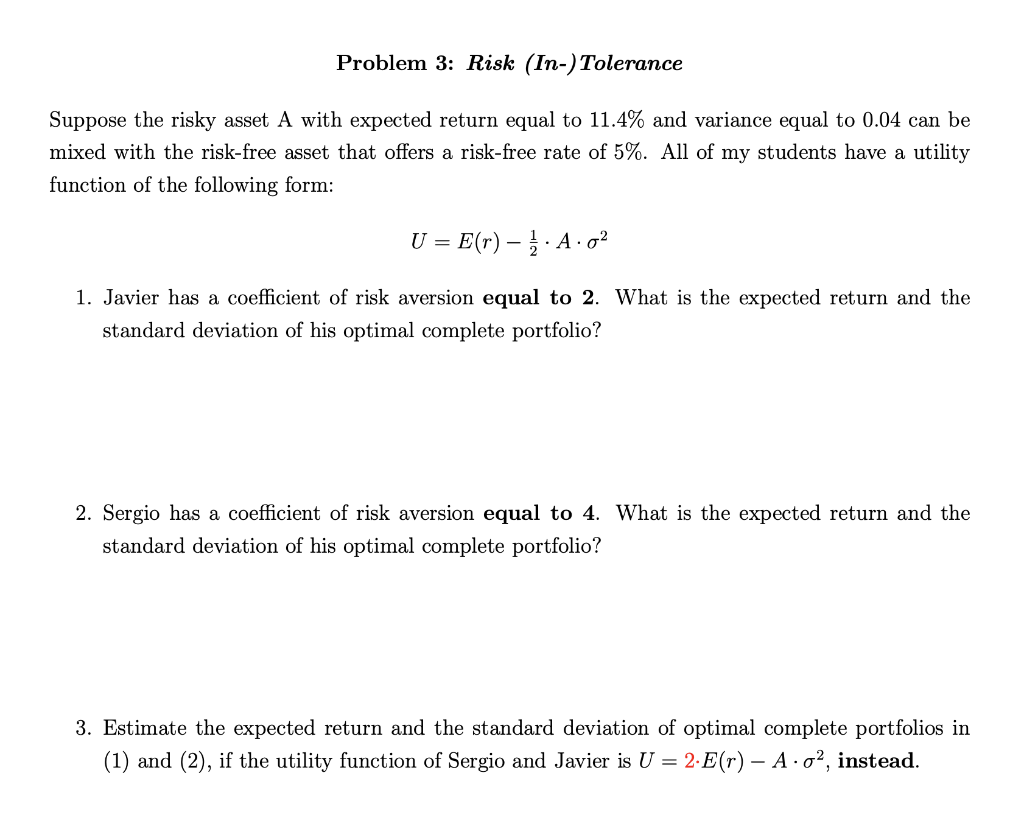

uppose the risky asset A with expected return equal to 11.4% and variance equal to 0.04 can be nixed with the risk-free asset that offers a risk-free rate of 5%. All of my students have a utility anction of the following form: U=E(r)21A2 1. Javier has a coefficient of risk aversion equal to 2. What is the expected return and the standard deviation of his optimal complete portfolio? 2. Sergio has a coefficient of risk aversion equal to 4 . What is the expected return and the standard deviation of his optimal complete portfolio? 3. Estimate the expected return and the standard deviation of optimal complete portfolios in (1) and (2), if the utility function of Sergio and Javier is U=2E(r)A2, instead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts