Question: Urban's, which is currently operating at full capacity has current assets of $6,500, net fixed assets of $85,500, current liabilities of $7,250, no long-term debt

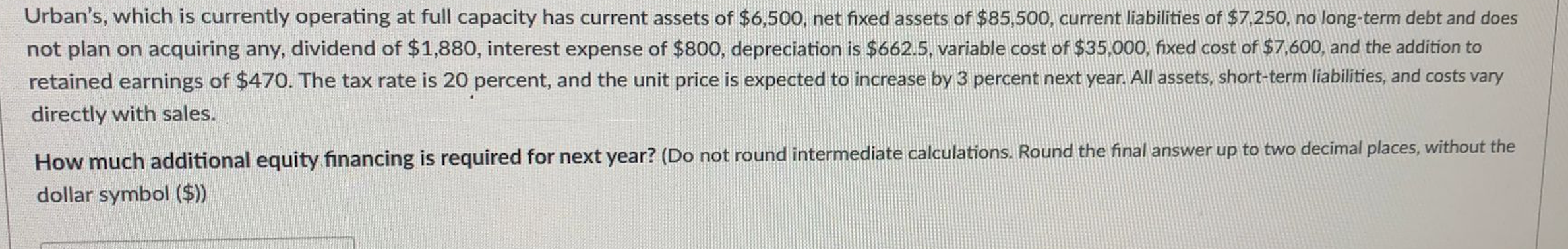

Urban's, which is currently operating at full capacity has current assets of $6,500, net fixed assets of $85,500, current liabilities of $7,250, no long-term debt and does not plan on acquiring any, dividend of $1,880, interest expense of $800, depreciation is $662.5, variable cost of $35,000, fixed cost of $7,600, and the addition to retained earnings of $470. The tax rate is 20 percent, and the unit price is expected to increase by 3 percent next year. All assets, short-term liabilities, and costs vary directly with sales. How much additional equity financing is required for next year? (Do not round intermediate calculations. Round the final answer up to two decimal places, without the dollar symbol ($))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts