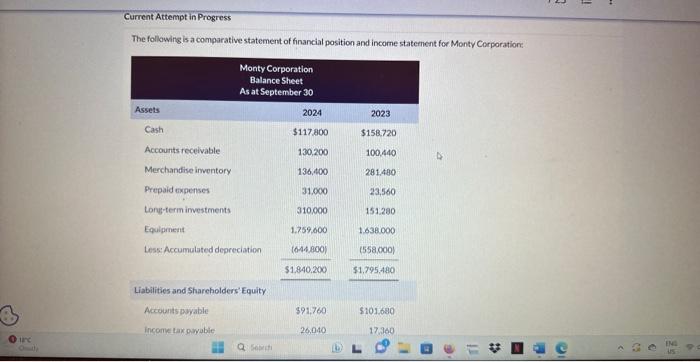

Question: urc Omalle Current Attempt in Progress The following is a comparative statement of financial position and income statement for Monty Corporation: Assets Cash Accounts

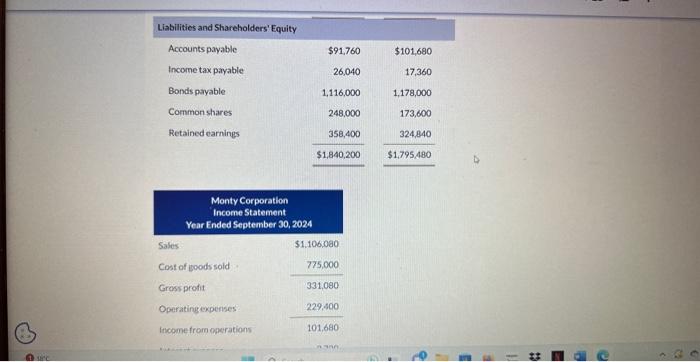

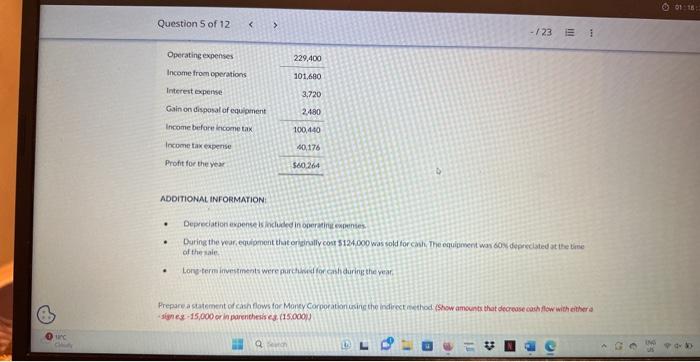

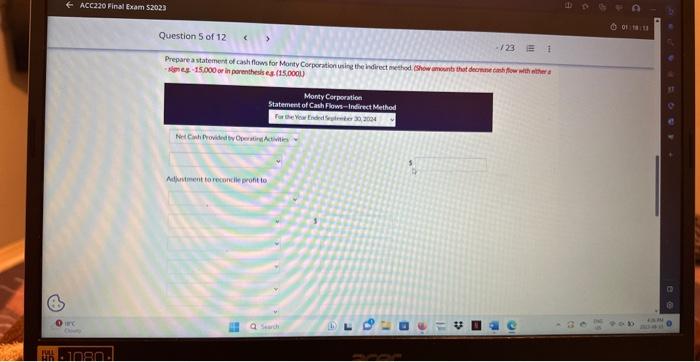

urc Omalle Current Attempt in Progress The following is a comparative statement of financial position and income statement for Monty Corporation: Assets Cash Accounts receivable Merchandise inventory Prepaid expenses Long-term investments Equipment Monty Corporation Balance Sheet As at September 30 Less: Accumulated depreciation Liabilities and Shareholders' Equity Accounts payable income tax payable. Q Search 2024 $117,800 130,200 136,400 31,000 310,000 1,759,600 (644,800) $1,840.200 $91,760 26,040 2023 $158.720 100,440 281,480 23,560 151.280 1.638.000 (558,000) $1,795.480 $101.680 17,360 DL G 11 # 49 C 1 ENG US src Liabilities and Shareholders' Equity Accounts payable Income tax payable Bonds payable Common shares Retained earnings Monty Corporation Income Statement Year Ended September 30, 2024 Sales Cost of goods sold Gross profit Operating expenses Income from operations $91,760 26,040 1,116,000 248,000 358,400 $1,840,200 $1,106,080 775,000 331,080 229,400 101.680 On 300, $101,680 17,360 1,178,000 173,600 324,840 $1,795,480 [ (1 # E P e c Chin Question 5 of 12 Operating expenses Income from operations Interest expense Gain on disposal of equipment Income before income tax Income tax expense Profit for the year < > ADDITIONAL INFORMATION: . . 229,400 101,680 3,720 2,480 100,440 40,176 $60,264 Qe -/23 E 1 Depreciation expense is included in operating expenses During the year, equipment that originally cost $124,000 was sold for cash. The equipment was 60% depreciated at the time of the sale. Long-term investments were purchived for cash during the year, Prepare a statement of cash flows for Monty Corporation using the indirect method (Show amounts that decrease cash flow with either a sign eg-15,000 or in parenthesis ea. (15.000)) B ACC220 Final Exam $2023 urc Chery FULL tin 1080 Question 5 of 12 Prepare a statement of cash flows for Monty Corporation using the indirect method Show amounts that decreme cash flow with other sign eg-15,000 or in parenthesise (15,0001) Monty Corporation Statement of Cash Flows-Indirect Method For the Year Ended Sep 30, 2004 Net Cash Provided by Operating Activities Adjustment to reconcile profit to Search 123 1 C 01:18:18 POD 162 204 D O ACC220 Final Exam 52023 HD-1080- Question 5 of 12 ( > Qe acer -/23 1 G 01:18:05 42 13 B IPE Date HD 1080- Question 5 of 12 Qed acer -1231 01:17:53 WITH It the ACC220 Final Exam 52023 C Opty HD-1080- Question 5 of 12 Save for Later < > acer -/23 1 Attempts: 0 of 1 used 01:17:47 904 AUT Ba O

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

CALCULATIONS Operating Activities Net income 60264 Adjustments for noncash items Depreciation expens... View full answer

Get step-by-step solutions from verified subject matter experts