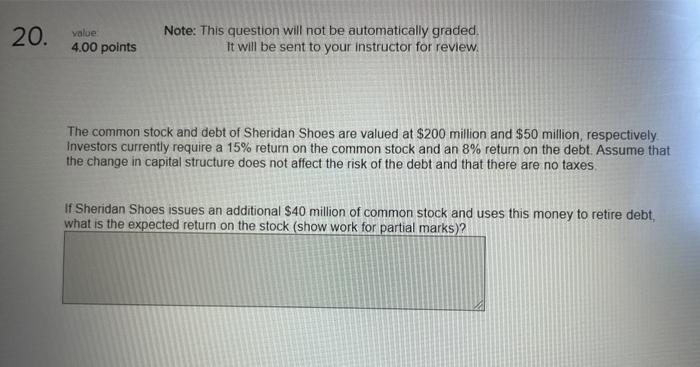

Question: URGENT!! 20. value 4.00 points Note: This question will not be automatically graded It will be sent to your instructor for review The common stock

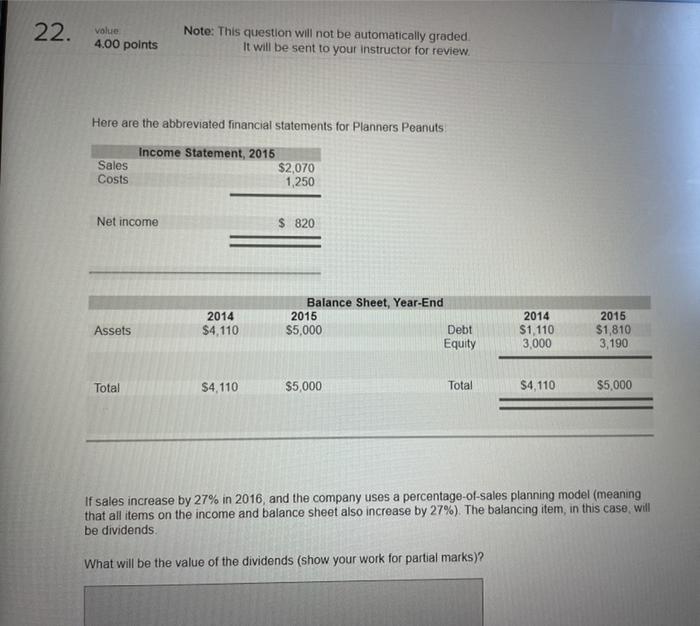

20. value 4.00 points Note: This question will not be automatically graded It will be sent to your instructor for review The common stock and debt of Sheridan Shoes are valued at $200 million and $50 million, respectively Investors currently require a 15% return on the common stock and an 8% return on the debt. Assume that the change in capital structure does not affect the risk of the debt and that there are no taxes If Sheridan Shoes issues an additional $40 million of common stock and uses this money to retire debt, what is the expected return on the stock (show work for partial marks)? 22. volue 4.00 points Note: This question will not be automatically graded. It will be sent to your instructor for review. Here are the abbreviated financial statements for Planners Peanuts Sales Costs Income Statement, 2015 $2,070 1,250 Net income $ 820 Balance Sheet, Year-End 2015 $5,000 Debt Equity 2014 $4,110 Assets 2014 $1,110 3,000 2015 $1,810 3,190 Total $4, 110 $5,000 Total $4.110 $5,000 If sales increase by 27% in 2016, and the company uses a percentage-of-sales planning model (meaning that all items on the income and balance sheet also increase by 27%). The balancing item in this case will be dividends. What will be the value of the dividends (show your work for partial marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts