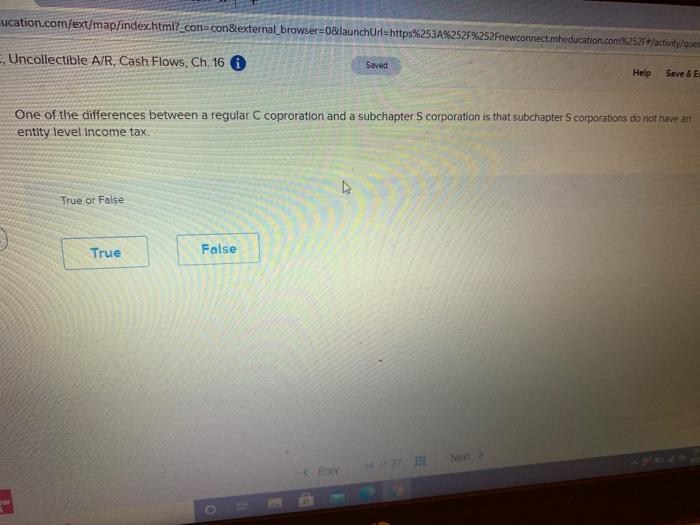

Question: urgent answer please ucation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A9 newconnect.mheducation.com%252Ft/activity ques - Uncollectible A/R, Cash Flows, Ch.16 Saved Help Save & E One of the differences between a regular C

ucation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A9 newconnect.mheducation.com%252Ft/activity ques - Uncollectible A/R, Cash Flows, Ch.16 Saved Help Save & E One of the differences between a regular C coproration and a subchapter Scorporation is that subchapter 5 corporations do not have an entity level income tax. True or False True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts